The current stock market volatility is really not about interest rate ticks in the federal funds market. It’s actually about the fact that the entire post-crisis bull market is a monumental house of cards built on a historically aberrant monetary regime that is unsustainable and eventually heading for a crash landing. [Let me explain.]

rate ticks in the federal funds market. It’s actually about the fact that the entire post-crisis bull market is a monumental house of cards built on a historically aberrant monetary regime that is unsustainable and eventually heading for a crash landing. [Let me explain.]

By David Stockman (davidstockmanscontracorner.com). The original article* was entitled Six Years Of Bull Market Bull.

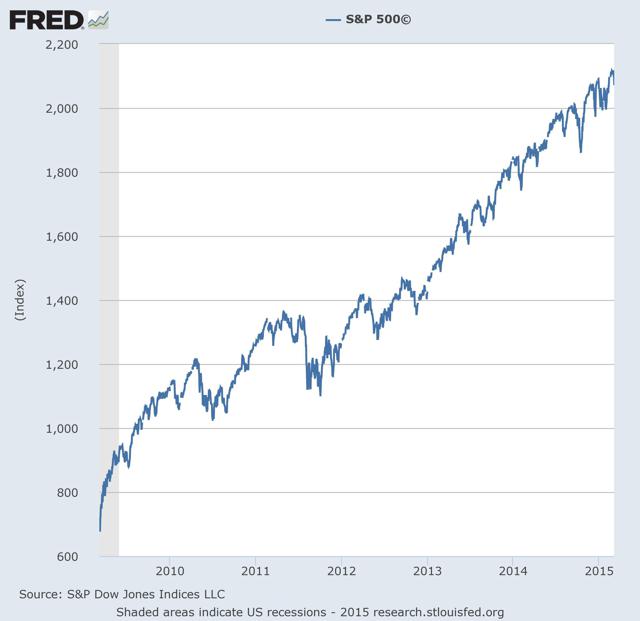

Never has there been a more artificial – indeed, phony – gain in the stock market than the 215% eruption orchestrated by the Fed since the post-crisis bottom six years ago today. The operative word is “orchestrated” because there is nothing fundamental, sustainable, logical or warranted about today’s S&P 500 index at 2080.

Will End of 6-year Run in Stocks Be Any Different This Time Round?

In fact, the fundamental financial and economic rot which gave rise to the 672 index bottom on March 9, 2009 has not been ameliorated at all. The U.S. economy remains mired in even:

- fewer breadwinner jobs

- more debt,

- less real productive investment,

- vastly more destructive financialization and asset price speculation

than had been prevalent at the time of the Lehman event in September 2008.

Indeed, embedded in Friday’s allegedly “strong” jobs report is striking proof that the main street economy is the very opposite of bullish.

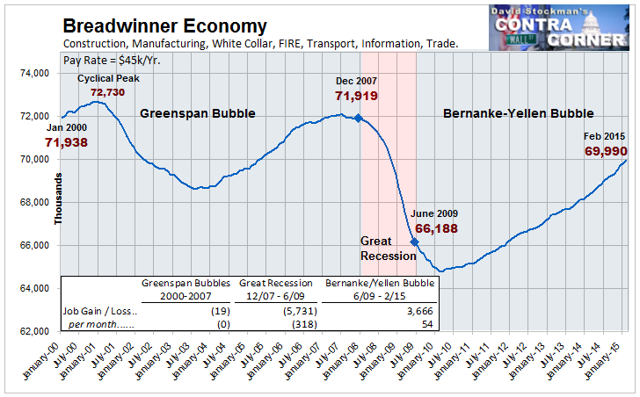

1. Fewer Breadwinner Jobs

In January 2015 there were still:

- 2 million fewer full-time, full-pay “breadwinner” jobs in the U.S. economy than there were before the crisis in December 2007 and, therefore, not surprisingly,

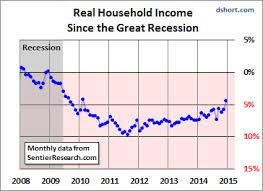

- real median household income is still 4% below where it stood prior to the crisis.

That cardinal fact nullifies in its entirety all of the Wall Street propaganda about “recovery” based on spurious paint-by-the-numbers data on waiter and bartender jobs or the temporary surge in car sales fueled by unrepayble subprime auto loans.

2. Household Sector Has Reached Peak Debt

As should be more than evident by now, the household sector has reached a condition of peak debt, meaning that sustainable consumption spending is now solely dependent upon income growth – and that’s not happening.

3. Low Real Productive Investment

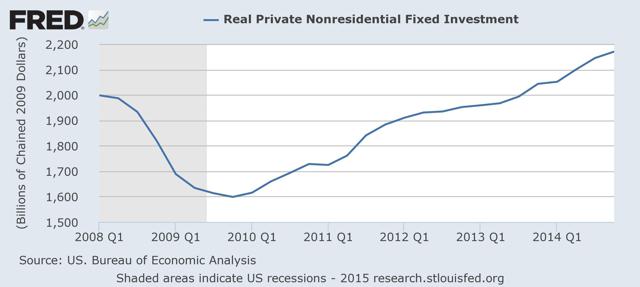

Likewise, the supply side of the economy (where income is actually generated) cannot grow if investment in productive assets lags. On that score, there is absolutely no reason for a bullish stock market, either. Even as measured by the false Keynesian investment “spending” metric, real investment in business fixed assets is up by only 1.1% per year from pre-crisis levels.

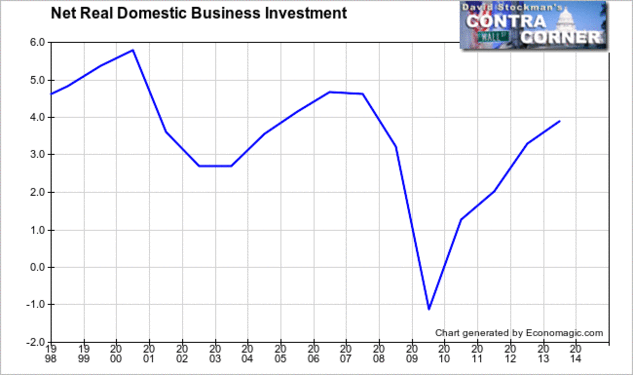

The flat-lining trend shown above doesn’t even take into account the consumption of plant, equipment and other assets in current production. Accordingly, the only valid measure of future economic growth prospects is real net investment (current spending as recorded in the GDP accounts less depreciation)…which stood at about $400 billion in Q4 or about 25% lower than the pre-crisis level of $500 billion, and nearly 33% lower than the level recorded at the turn of the century. Conclusion: there is nothing bullish at all in the single most important metric for future economic growth and profitability.

4. Vastly More Destructive Asset Price Speculation

In short, the endless buy-the-dip trajectory shown below is not the consequence of a sustainably improving outlook for main street prosperity and corporate profits or honest price discovery in the financial markets. Its just reflective of bull market bull; its the flashing daily scoreboard recorded in a casino that has been juiced by the greatest central bank monetary fraud in human history.

Needless to say, six years of continuous monetary levitation by the Fed and its fellow traveling central banks around the world has generated a ticking time bomb. That’s because after 80 months of drastic financial repression, financial markets have been reduced to a state of abject addiction to central bank monetary stimulus.

That pathological condition was evident once again in Friday’s stock market plunge – a kneejerk reflection of Wall Street’s abiding fear that its monetary narcotics will someday be withheld. In this case, its mini hissy fit arose from fear that a purportedly “strong” jobs report would induce the Fed to go ahead with a pinprick 25 basis point increase in money market interest rates – and as soon as 90 days down the road!

Do not be confused by this “goods news is bad news” tantrum. There is now a dangerous fragility embedded in the Wall Street casino. After all, the six year “bull market” being celebrated today by the financial media was powered upward dip-after-dip-after-dip by the very same headline-reading robo-machines, day traders, hedge fund hustlers and shameless Wall Street equity strategists who, it turns out, are actually afraid of financial mice. That is, they are petrified at the prospect of tiny interest rate increases that amount to irrelevant rounding errors to main street—–and which, at worst, may reach 100 basis points sometime in the year ahead.

Other than during the 24 months of the Greenspan panic between June 2003 and June 2005 during the 750 months between the end of WW II and December 2008 did interest rates come close to going below 1% so this is really not about interest rate ticks in the federal funds market. It’s actually about the fact that the entire post-crisis bull market is a monumental house of cards built on a historically aberrant monetary regime that is unsustainable and eventually heading for a crash landing.

Stated differently, today’s S&P 500 index at 3X its March 2009 low is rooted not in the real domestic and world economy, but in the perverse mechanics that ZIRP and QE have touched off within the canyons of Wall Street…

In fact, the Fed’s drastic money printing regime has transformed corporate America into an equity strip-mining machine. Virtually the entirety of S&P net income is being flushed back into the stock market, meaning that there is virtually no free cash flow left to fund growth – a development fully consistent with the sharply declining trend of real net investment for the overall U.S. economy depicted above.

- During the year ended in Q3 2014 (latest available data), the S&P 500 companies reported aggregate net income of $945 billion, but flushed fully $892 billion or 95% of that total back into the Wall Street casino in the form of dividends and share repurchases.

- Nor are these results an aberration. In fact, go back to the beginning of today’s six-year bull market and the data show that the stock market is essentially capitalizing at higher and higher multiples the earnings generated by companies with steadily deteriorating growth prospects and balance sheets. By the end of March 2015, the S&P companies will have flushed the staggering sum of $4 trillion back into the market in the form of dividends and buybacks or upwards of 85% of the their net earnings since the post-crisis bottom.

The six year bull market amounts to this. The quality of current earnings is being deeply impaired by the very cash extraction and recycling process that has funded the soaring index averages.

The above means that PE multiples should be shrinking, not expanding to nearly all-time highs yet, with 98% of companies reporting, GAAP earnings for the S&P 500 came in at $102/share during Q4, meaning that today’s 6th anniversary market is trading at 20.5X LTM profits. Needless to say, the last time outside of recession quarters that the broad market PE ratio was above 20X was during the fall of 2007.

Even that is cold comfort, however. At least back then when reported earnings peaked at $85 per share in Q2 2007 they had not yet been

- deformed by 75 quarters of ZIRP – a distortion that has subsequently ballooned earnings by $5-10 per share owing to artificially cheap interest carry costs on upwards of $3 trillion of S&P company debt.

- Nor had a concerted global central bank driven economic boom lifted materials, energy and industrial company earnings to wholly artificial heights.

- Nor had virtually zero cost funding—–extracted from the hides of savers and depositors—–artificially boosted bank and financial company earnings by triple digit billions.

Conclusion: there has been an enormous deterioration in the quality of reported earnings. On an apples-to-apples basis, today’s $102/share does not likely even equal the $85/share reported way back in the June 2007 quarter. Moreover, after adjusting for the impact of inflation it is not even close.

The more important point, however, is that all of these bull market stimulants are now in the rear-view mirror. Thus, the global economy is rapidly cooling under the double whammy of

- $200 trillion of credit market debt compared to $140 billion prior to the financial crisis and

- profitability being hammered by

- a deflationary crunch in the energy, materials and industrial sector and by

- the rising dollar exchange rate propelled by the global scramble to fund massive amounts of off-shore dollar debts.

Conclusion: six years on from the bottom the market is now chasing its own tail, valuing artificially inflated earnings at nosebleed PE multiples and buying the dips on any faint sign that the central bank stimulus drugs will be dispensed for a while longer. All the while, of course, the fundamental malady that triggered the last crisis goes unrelieved – namely, the crushing burden of public and private debt that has been enabled by more than two decades of drastic financial repression and systematically false pricing throughout the financial markets.

In fact, the U.S. economy now has $8 trillion, or 16%, more public and private debt outstanding than it did when the “debt crisis” first incepted in Q4 2007.

Conclusion

Once upon a time it was understood that nations can not borrow their way to prosperity. By contrast, today’s celebrants of the 6-year “bull market” are apparently happy to believe that wealth can be manufactured out of thin air by central bank printing presses. That amounts to something for nothing. Its never worked before, and most assuredly this time is not different.

[The above article is presented by Lorimer Wilson, editor of www.munKNEE.com and has been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

*Original Source: http://davidstockmanscontracorner.com/six-years-of-bull-market-bull/ (Copyright © 2014 Conyers LLC . All Rights Reserved)

Related Articles from the munKNEE Vault:

1. The Stock Market Party Is About To End – Here’s Why

Even though the overall U.S. economy continues to be deeply troubled, we have seen the Dow, the S&P 500 and the Nasdaq set record after record but no bull market lasts forever – particularly one that has no relation to economic reality whatsoever – and the cold, hard facts are telling us that this party is about to end. The following are 7 signs that a stock market peak is happening right now. Read More »

2. Will End of 6-year Run in Stocks Be Any Different This Time Round?

On March 9th, 2009 the S&P 500 hit a low of 676.53 and, since that day, it has risen more than 200%. On only 2 other occasions within the last 100 years has the S&P 500 performed this well over a 6 year time frame. This has been great for investors but in both previous instances (1929 & 1999), the end result was utter disaster. Will it be different this time? Read More »

3. Is This the Beginning of the Stock Market Crash So Many Analysts Have Forecast?

For months numerous articles have been posted on this site substantiating why a stock market collapse of epic proportions is in the cards to happen soon. The basis for such a conclusion are based on a diverse perspective that warrants your attention. With your money on the line – your future quality of life at risk – here is your opportunity to be forewarned and do something about it. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

It’s really a cool and helpoful piece of info. I’m glad

tat you just shared this helpful information with us.

Please keep us up to date like this. Thanks for sharing.