I believe that we are at the end of a very major economic cycle. Not only are markets insane, but so are deficits, debts and currency debasements but also moral and ethical values have now vanished into thin air and been replaced by lies, deceit and the golden calf. We are now in a very critical period for the world since excesses of the magnitude we are now seeing must be corrected… and the corrections will be of a similar magnitude to the rise but happen much quicker. [Let me explain.]

Virtual Illusions

Nobody believes such moves are possible with central banks and governments standing by with unlimited money printing combined with new Central Bank Digital Currencies that will save the world… but illusions cannot rescue the world economy…despite whatever concoctions central banks or Schwab (World Economic Forum) and his billionaire cronies come up with.

Virtual illusions in the form of fake money or empty promises can never repay debt, nor can they change the laws of nature. Clearly all these “evil forces” will use their power to orchestrate fake resets to “save the world” in an attempt to tighten their grip on the world economy and the financial system but a heavily indebted and fake system can never be reset in an orderly manner.

In my view, any artificial or fake reset will only have a very limited effect. It is just not possible to solve a debt problem with more debt whatever way the PTB (Powers That Be) try to dress it in sheep’s clothing so an orderly reset is bound to fail very quickly. A new digital Fiat and thus fake currency will not solve the world’s debt problem.

Writing off the debt is just another illusory act. If you write off the debt, the assets on the opposite side of the balance sheet will also implode by 90-100% in value… Few people believe this to be possible but with debt collapsing so will the bubble assets which are all inflated by worthless debt.

We must remember that the big stock market crash in 1929-32 saw the Dow lose 90% of its value. It then took 25 years for the Dow to get above the 1929 high and today, 92 years after that peak, debts, deficits, and asset bubbles are far greater than at the end of the 1920s.

The Everything Bubble

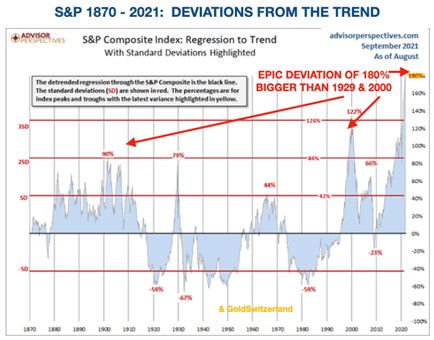

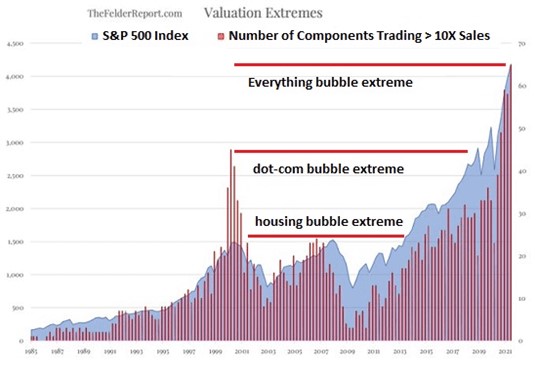

Below are a number of graphs that all point to the everything bubble.

1.

2.

3.

…[The above charts are] incontrovertible proof that this is the mother of all bubbles but, as we have learnt in this century, bubbles can always grow bigger and especially if we are looking at the end of a major super cycle which could be as big (or long) as 2,000 years. Nevertheless, the evidence keeps mounting of an epic asset bubble.

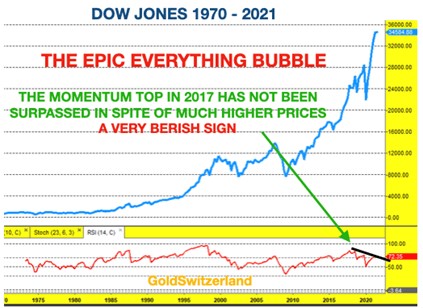

In addition to the charts above that point to illusions never seen before in markets, we have a number of technical indicators that all point to the end of the everything bubble.

In the chart below, the RSI (Relative Strength Index) momentum indicator for example topped in 2017 and the major rise in the Dow since then has not been confirmed by the indicator. This is a very bearish sign albeit not a short term indicator.

Many other technical indicators including Elliott Wave or Dow Theory all point to a top to the everything bubble…[being] imminent. Whether that means a top next week (which is possible), or in the next few months, time will tell…but what is much more important than pinpointing the exact timing of the top is to understand the risk involved.

If, as we believe, we are now at the end of the everything bubble, nobody needs to time it. Investors should understand the upside might be 10% and the downside 90%+. Who is foolish enough to accept a 10% move up…[and, more likely, a 90% fall? We are talking about a fall in real terms. If we get hyperinflation, stocks and other assets can rise in nominal terms but fall in real terms when measured in stable purchasing power, like gold.

More Quantitative Easing Coming

…The whole investment world, which has been spoilt by tens of trillions of dollars of fake money to fuel the Epic Everything Bubble, will expect much more of the same in coming months or years. Much more money will be created but this time it will have very little effect. Instead the dollar, euro, yen etc. will accelerate the falls that we have seen since 1913. They have all fallen 98-99% since then and by similar percentages since 1971 when Nixon closed the gold window. The final 1-2% fall will soon start and take most currencies to their intrinsic value of ZERO but don’t forget that this final fall is 100% from here.

…Measuring your assets in dollars, for example, is a futile exercise in self indulgence. You are just flattering your investment skills when you measure your performance in a currency that has lost 98% since 1971 and 84% since 2000. If you use the same method in coming years, your paper wealth might look OK but be worthless in real terms. Just ask anyone who has lived in a hyperinflationary economy like Yugoslavia, Argentina or Venezuela.

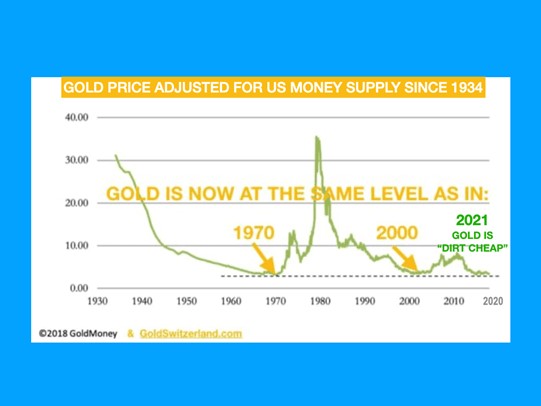

The Sleeping Beauty Investment – Gold

…A Sleeping Beauty investment…is an investment that you can forget about for 100 years and when you wake up, it will have maintained its purchasing power – and that is gold.

If we get the expected stock market crash, it is possible that gold and the precious metals continue to correct a bit further like in 2008…when weak hands needed to get liquidity against a crashing stock market [but] gold has now been in consolidation for years, and there are a lot fewer speculative investors compared to 2008…[so] I expect a much smaller and shorter correction, if any…

As long as you store gold in a safe place and safe country, you know that it will maintain its REAL value as it has for 5,000 years. Yes, there are fluctuations, but gold’s history tells us that it is not just the only money which has survived but also the only money which has maintained real purchasing power.

I will continue to show the chart below until that situation is rectified.

I have no doubt that gold will soon rectify the current undervaluation and reach levels that few can imagine. This is what both technicals and fundamentals are clearly indicating.

Editor’s Note: The original post by Egon von Greyerz has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money