The output gap is a critical concept in economics that measures the real economy today relative to trend potential….and the biggest question in the economy today is how long will it take to close the gap.

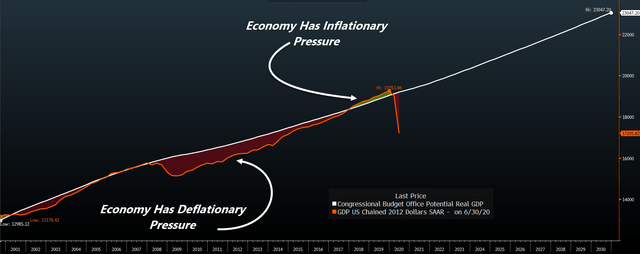

The chart below illustrates that:

- when the economy is below trend potential, monetary policy is tight, and there is dis-inflationary pressure in the economy and,

- when the economy is above trend potential, monetary policy is loose and inflationary pressure will start building….

Source: Bloomberg

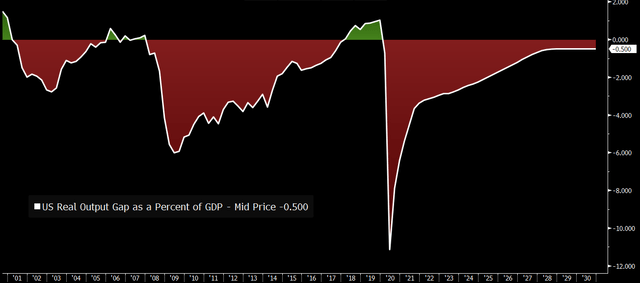

…The chart below shows the output gap expressed as a percentage of GDP:

- When the chart is red, the economy has a negative output gap, the economy is below potential, and there is dis-inflationary pressure building.

- When the chart is green, the economy is growing above potential, and inflationary pressure is building.

Source: Bloomberg

The output gap has been persistently negative for decades as the economy has struggled to generate sustainable growth under rapidly accelerating debt loads…

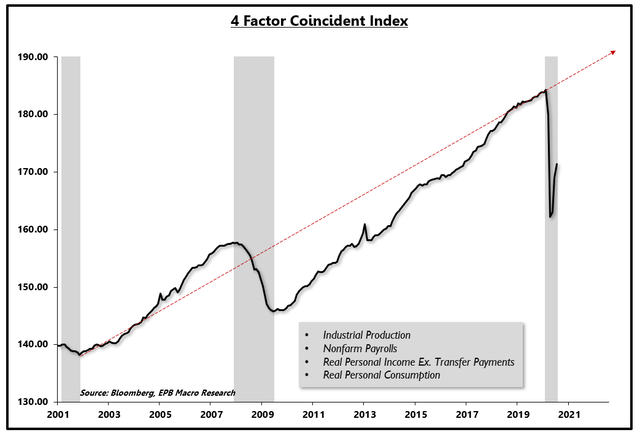

4-Factor Coincident Index: Output Gap

The chart below is a composite index of the four critical monthly indicators of the economy: non-farm payrolls, industrial production, real personal income, and real personal consumption…

Source: Bloomberg, EPB Macro Research

The biggest question in the economy today is how long will it take to close the gap?

- If it takes 10 years or more, we’ll see a long work-off period of deleveraging from consumers and businesses that borrowed and spent based on the previous expectation of trend growth.

- Choosing to pile more debt onto an economy that is already struggling to grow due to an excessive debt overhang will make the process of closing the gap more challenging and lead to an even more persistent case of disinflation.

Conclusion

The economy will struggle to build sustainable inflation pressure with a large output gap, as excess capacity will prove too significant. The economy won’t feel “back to normal” as it was before the COVID shock until the output gap is closed, which could take in excess of 10 years according to projections from the CBO.

Editor’s Note: The original article by Eric Basmajian has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

EPB Macro Research provides 1) macroeconomic analysis on the most significant long-term and short-term economic trends, 2) the impact on various asset prices, including stocks, bonds, gold, and commodities and 3) a low volatility monthly asset allocation model that translates the economic research into an actionable portfolio of ETFs. To understand how we translate these powerful economic trends into a long-term portfolio strategy, click this link for a 14-day free trial.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money