Is a major top at hand? It is often said that bells do not ring to signal the end of a bull market but if the broad averages were in fact to plummet in the weeks ahead, never forget that bells did indeed ring. This article contains the opinions of three heavyweights in the guru world which are so insightful that any investors who ignore their observations do so at their great peril.

but if the broad averages were in fact to plummet in the weeks ahead, never forget that bells did indeed ring. This article contains the opinions of three heavyweights in the guru world which are so insightful that any investors who ignore their observations do so at their great peril.

The above introductory comments are edited excerpts from an article* by Rick Ackerman (rickackerman.com) entitled Death Knell for the Bull Market?

Ackerman goes on to say in further edited excerpts:

Permabulls and Wall Street managers charged with throwing Other People’s Money at stocks will not likely have noticed the bells ringing in the end of a bull market, so intent have they been on headlines proclaiming the soundness of America’s alleged economic recovery.

U.S. stocks closed at an all-time high last week [in spite of]:

- money velocity collapsing,

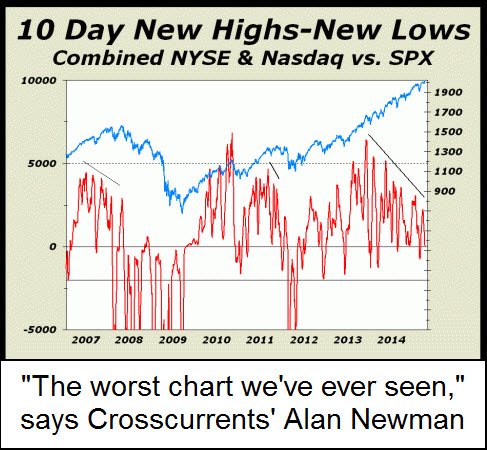

- ominous divergences developing in both the NYSE Advance/Decline line and the New Highs/New Lows summation,

- the Hindenburg Omen, which signals an increased probability of a stock market crash, flashing red on Friday,

- an unequivocal pronouncement from the Elliott Wave Theorist after the Dow Industrials came within a single point last week of fulfilling their long-term rally target at 17280: “Next week, the U.S. stock averages should begin their biggest decline ever” [and

- yours truly]…drum-rolling a key “Hidden Pivot” target at 2028 in the S&P 500 Index that has been 27 years in coming. On Friday, the index hit a record 2019.

For those trying to decide the bullish/bearish case for themselves, let me add the opinions of three heavyweights in the guru world with whom I’ve corresponded over the years: Peter Eliades, Alan Newman and Bob Hoye.

- Hoye’s latest Pivotal Events insightfully answers the question of how the stock market could be going bonkers while the U.S. economy continues to languish: “At the moment, cash hoarding is being used to explain another failure of interventionist theories that easy money forces GDP growth. Not when the public wants to speculate in financial assets such as now.”

- Eliades, like Hoye an analyst whose perspective on the markets stretches back not just decades, but centuries, notes in the latest issue of Stockmarket Cycles that the NYSE Advance-Decline line has failed since June to follow the broad averages higher and has, in fact, been falling since the beginning of August. This, he says, is “one of the fingerprints that accompanies important market highs that has been missing over the past year and longer.”

- As for Newman, market watchers may recall that for years his Crosscurrents newsletter diligently tracked the dollar volume of all NYSE transactions versus the total dollar value of U.S. GDP. Over decades, the former has grown to several times the size of the latter, supporting Newman’s contention that the main business of America is no longer selling goods and services, but trading stocks. Now he sees a looming train wreck in the chart above, which shows 10-Day New Highs/New Lows for the combined NYSE, Nasdaq and S&P indexes. “This could be the worst chart we’ve ever seen,” notes Newman in a bulletin sent out to subscribers over the weekend. “All the major indexes made new highs on Friday. For the S&P 500 and Dow Industrials, all-time records. For Nasdaq, the same level reached only two weeks before the final tech mania peak yet, when you measure new highs minus new lows for the last ten day period, the sum is barely positive. Fewer stocks are participating in this madness. “Frankly, we do not understand how anyone in their right mind could be bullish on the prospects for stocks. As far as we are concerned, this is a dreadful technical condition and we believe stocks are extremely vulnerable at this juncture.”

Conclusion

Odds of calling the exact top of a bull market, that has been snaking its way higher for five-and-a-half years, will never be great or even good no matter how savvy the forecaster. Even so— investors who ignore the observations above do so at their great peril.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.rickackerman.com/2014/09/when-will-the-bull-market-end-2014/ (All Contents © 2014, Hidden Pivot Enterprises. All Rights Reserved.)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Coming Stock Market Enema Will Be A VERY Messy Occasion!

Who knows how long before the Dow Jones Index finally receives a well overdue market enema, but I can assure you of this, when it arrives it will be a VERY messy occasion! Read More »

2. History Says “Expect An Economic Crash AGAIN In 2015″ – Here’s Why

Large numbers of people believe that an economic crash is coming next year based on a 7-year cycle of economic crashes that goes all the way back to the Great Depression. Such a premise is very controversial – some of you will love it, and some of you will think that it is utter rubbish – so I just present the bare bone facts below for you decide for yourself if it is something to seriously consider protecting yourself from in 2015. Read More »

3. This Weekend’s Financial Entertainment: “A Stock Market Crash IS Coming!”

Our financial system is in far worse shape than it was just prior to the financial crash of 2008. The truth is that we are right on schedule for the next great financial crash. You can choose to ignore the warnings if you would like but, ultimately, time will reveal who was right and who was wrong and, unfortunately, I think I will be proven to have been right. Read More »

4. Present Bull Rally In Stocks Dangerously “Beyond the Pale” – Here’s Why

It is frighteningly clear to any objective analyst and/or intelligent investor that the present bull market rally in stocks (2006-2014) is “beyond the pale” (outside the bounds of acceptable behavior) i.e. the excess valuation is dangerously above the market excesses of the 1920s. Read More »

5. We’re All Cued Up For A Bear! Here’s Why

When taking a step back and viewing longer-term gauges, we see warning signs flashing. Many of these readings are in extreme territories, and historically bear markets have occurred from such overbought positioning. We are all cued up for a bear! Read More »

6. SELL! U.S. Stock Market Is An Investor’s Nightmare – Here’s Why

The stock market is presently a roulette wheel with dimes on black and dynamite on red. We continue to have extreme concerns about the extent of potential market losses over the completion of the present market cycle. Read More »

7. Harry Dent: Get Into Cash – Stock Market Will Crash to 5,500-6,000 By 2017!

You have to get out of stocks. Stocks have bubbled again and when they go down they’re going to go down hard. Read More »

8. Coming Bear Market Could Turn Into A Historic Crash – Here’s Why

Amazingly, we are on the verge of a global deflationary downturn and what could be a historic bear market, yet Wall Street prognosticators remain focused on the inflationary risks of excessive monetary stimulus. Their focus could not be more wrong. Let me explain further. Read More »

If the past long-term cyclical correlations between interest rates, equities, and commodities were to play out as they have done going back to the 1880s, U.S. stocks and interest rates should continue to rise as commodities either fall or underperform according to a 60-year cyclical pattern model referred to as The Market Map. Read More »

10. It’s Just A Matter Of Time Before the Stock Market Bubble Is Pricked! Here’s Why

Once again the stock market is in full bubble mode. The market was already overvalued earlier this year and the froth continues to build. Valuations are off the chart and euphoria is setting in while, at the same time, you have inflation eroding the purchasing power of regular Americans not participating in this casino. All the signs of a bubble top are there – massive speculation, unexplainable valuations, and blind optimism – even though the fundamentals don’t make any sense. This article substantiates that contention. Read More »

11. These 6 Indicators Reveal A Great Deal About Market’s “Upside” Potential

Trying to predict markets more than a couple of days into the future is nothing more than a “wild ass guess” at best but, that being said, we can make some reasonable assumptions about potential outcomes based on our extensive analysis of these 6 specific price trend and momentum indicators. Read More »

12. What Does the 10-year Yield’s Death Cross Mean For Stocks?

The 10-year yield’s Death Cross has proven to be a pretty significant risk-off shot across the bow over the last decade and this matters today because the 10-year yield put in a Death Cross back in early April of this year. So what does the 10-Year’s Death Cross mean for stocks this time? Read More »

13. Financial Asset Values Hang In Mid-air Like Wile E. Coyote – Here’s Why

The financial markets are drastically over-capitalizing earnings and over-valuing all asset classes so, as the Fed and its central bank confederates around the world increasingly run out of excuses for extending the radical monetary experiments of the present era, even the gamblers will come to recognize who is really the Wile E Coyote in the piece. Then they will panic. Read More »

14. Look Out Below? Buffett Market Indicator Has Now Surpassed 2007 Level

Market Cap to GDP is a long-term valuation indicator that has become popular in recent years, thanks to Warren Buffett and it is now at the second highest level in the past 60 years – even surpassing the levels reached in 2007. Read More »

15. World’s Stock Markets Are Saying “Let’s Get Ready to Tumble!”

To ignore all the compelling charts and data below would be irresponsible and, as such, will NOT go unnoticed by institutional investors. Such bearish barometers for stocks worldwide will, unfortunately, be ignored by the ignorant and gullible hoi pollo causing them severe financial loss as investor complacency in the past has nearly always led to a stock market crash. Read More »

16. Stock Market Bubble to “POP” and Cause Global Depression

In their infinite wisdom the Fed thinks they have rescued the economy by inflating asset prices and creating a so called “wealth affect”. In reality they have created the conditions for the next Great Depression and now it’s just a matter of time…[until] the forces of regression collapse this parabolic structure. When they do it will drag the global economy into the next depression. Let me explain further. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money