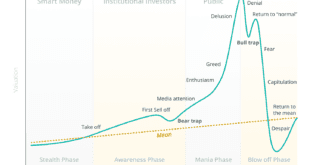

The odds of a correction in the magnitude of around 20% for the major averages  have greatly increased. The economic turmoil resulting from any one of 3 scenarios discussed in this article should bring central banks around the globe into a new money printing spree that would dwarf anything investors have seen to date.

have greatly increased. The economic turmoil resulting from any one of 3 scenarios discussed in this article should bring central banks around the globe into a new money printing spree that would dwarf anything investors have seen to date.

So writes Michael Pento (pentoport.com) in edited excerpts from his original article* entitled 3 Reasons to Fear the Fall.

[The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Pento goes on to say in further edited (and perhaps in some instances paraphrased) excerpts:

I generally shy away from making time-specific economic and stock market predictions simply because odds are very low you’ll be correct on both the prediction and the timing. However, there are certain times when the environment is conducive for a prediction that comes along with an expiration date. Today is one of those times.

The following 3 reasons are why I believe the stock market and the economy could be in for some serious trouble by the end of October. [For another view of the investment climate based on the same 3 issues read 4 Main Macro Issues Are Shaping the Investment Climate – Here’s An Update]:

1. The fiscal dysfunction and discord in Washington comes to a head once again in late September and into October.

There is an October 1st deadline for funding the government and a debt ceiling that needs to be raised around that same time. Such acrimony in D.C. has caused major disruptions in the stock market in the past. In the summer of 2011, Congress attempted to use the debt ceiling as leverage for deficit reduction.

-

The delay in raising the debt ceiling led to the first ever downgrade in the U.S. government’s credit rating.

-

The Dow Jones Industrial Average dropped 2,000 points from July 7th to August 8th and the very same day of Standard and Poor’s downgrade on August 5th, the DJIA had one of its worst days in history (down 635 points).

There is a high probability of more such action over the next few weeks because the gridlock in D.C. has only become worse.

2. The Japanese stock bubble has been extremely volatile of late, as the nation sprints towards a bond and equity market crisis.

- The Nikkei Dow surged over 70% in less than 6 months on the back of Abenomics—an economic system that is predicated on raising taxes and creating inflation by destroying the currency – but the benchmark index has since peaked in mid-May.

- The relatively new Abe regime has already been able to create inflation after…years of falling prices. The problem is, [however, that] this new paradigm of perpetually rising prices must very soon be reflected by rising bond yields as well. The Japanese 10-year note is trading at 0.76% even though the nation now has accumulated over one quadrillion Yen in debt. The interest rate level is far below the 1.5% yield it displayed just prior to the Great Recession of 2008. It should be noted that the yield was twice as high as it is today, despite the fact that Japanese CPI was near zero percent. Nevertheless, we have recently viewed the YOY change in inflation rising from -0.9% in April, to +0.2% in July.

At this current pace, the rate of inflation will be close to 1.0% within three months. This should cause a significant back up in yields and force the nation to use most of its revenue just to pay the interest on its debt; leading to extreme turmoil in Japanese equities. Depending on the response from the BOJ, investors may see a reversal of the Yen carry trade, which will also lead to extreme disruptions in currency values and equity exchanges worldwide.

The tenuous situation in Japan is not currently being factored into global markets and is another shock that could hit the system within the next 90 days.

3. The start of Fed tapering in the fall will send U.S. Treasury prices lower and pop the bubbles that exist in stocks and home prices.

- The S&P 500 is up 23% since last August, despite the fact that there hasn’t been any revenue growth to accompany that move, and

- home prices are up double digits YOY (the same growth rate seen at the height of the real estate bubble)

primarily because interest rates have been artificially suppressed to record lows for the past 5 years. Money printing and interest rate manipulation are the reasons why we have re-ignited those two asset bubbles.

Markets are currently extremely confused about when the tapering will commence and how much Mr. Bernanke will reduce his purchases of bonds….I believe Bernanke wants to start unwinding his purchases before his tenure is completed this year.

Wall Street is currently miscalculating how important the Fed’s bond purchases are to the continued bull market in equity and real estate. An extremely high percentage of investors either believe tapering won’t start this year; or believe if such a reduction of bond purchases occurs, the effect on asset prices and bond yields will be inconsequential. The truth is that the removal of the Fed’s bid for bonds could cause a stampede out of fixed income products and cause interest rates to soar.

The free market wants no part of a U.S. Treasuries at current yields unless investors can be sure that the Fed will continue to be the dominant buyer.

- A spike in bond yields would put more pressure on the real estate sector which has already witnessed increased order cancellations for new homes and a 30% hit to the stock prices of home builders since the tapering talk began in May.

- Without $85 billion worth of newly created credit stuffed into banks’ coffers each month, a significant bid in the stock market will be removed as well.

- Of course, I have to mention the government’s fiscal duress that will come from ballooning deficits caused by increased debt service payments on U.S. debt.

Whether or not the bond market crashes before November cannot be known for certain. Nevertheless, the bond market will eventually collapse with devastating consequences whenever it does occur.

Conclusion

Although there are no guarantees in this game of investing, I find it imperative to understand that the odds of a correction in the magnitude of around 20% for the major averages have greatly increased during the next three months. The economic turmoil resulting from any one of the above scenarios should bring central banks around the globe into a new money printing spree that would dwarf anything investors have seen to date.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://www.pentoport.com/pentonomics.php

Related Articles:

1. 4 Main Macro Issues Are Shaping the Investment Climate – Here’s An Update

There are four main macro issues shaping the investment climate: 1.the tapering anticipation in the U.S.; 2.the stabilization of the Chinese economy; 3.a cyclical recovery in Europe and 4. the long awaited Japanese purchases of foreign bonds. Read More »

2. The 1987 Doomers Are Back & They’re Wrong! Here’s Why

According to some pundits, the market is dangerously close to a repeat performance of 1987. Today, I’m going to show you why they’re wrong. Read More »

3. Don’t Worry About the Threat of Higher Interest Rates Hurting Stocks – Here’s Why

History clearly shows that stocks don’t fall during periods of rising interest rates. Sure, they might fall a little when a rate hike is announced – maybe for a week or so – but they usually bounce back quickly – and then they go higher. Read More »

4. We Think the Prognosis for Stocks Looks Good – Here’s Why

Stocks have generally performed very well in rising-rate environments but the current rate cycle is unlike any other of the past 40 years, keeping investors on edge. A lot will depend on how inflation behaves. Read More »

5. The Great American Debt Downgrade Debacle That Wasn’t!

It’s been exactly two years since Standard & Poor’s did the unthinkable and downgraded the U.S. government’s debt rating…and yet, it’s as if it never happened… Read More »

6. Another Crisis Is Coming & It May Be Imminent – Here’s Why

Is there going to be another crisis? Of course there is. The liberalised global financial system remains intact and unregulated, if a little battered…The question therefore becomes one of timing: when will the next crash happen? To that I offer the tentative answer: it may be imminent…[This article puts forth my explanation as to why that will likely be the case.] Read More »

7. HELP! I’m Long Government Bonds!

One look at the chart below clearly illustrates that owners of Government bonds need all the help they can get right now! Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money