One cliché I despise is, “it takes money to make money.” True, you can’t create money out of nothing (unless you’re the U.S. Federal Reserve), but it implies that only the rich can truly prosper. While that was true in regards to investing in stocks many years ago that certainly is not the case today. Here’s why.

(unless you’re the U.S. Federal Reserve), but it implies that only the rich can truly prosper. While that was true in regards to investing in stocks many years ago that certainly is not the case today. Here’s why.

By Sean Mason:

Over the years, I’ve studied the stock market with a passion that borders on obsession. After all, being financially free does take effort, yet it’s something I believe anyone can do successfully.

That being said, I’ve decided to share my thoughts, experiences, failures and successes in buying and selling stocks exclusively with the readers of munKNEE.com (Your Key to Making Money!) over the coming weeks.

HERE is my first introductory article in case you missed reading it.

Before 1975, fixed brokerage commissions ensured that buying shares in a company would cost, say, a minimum of $100, and likely much more depending on the amount of stock being bought or sold, just in trading fees (this on top of the cost of buying the stock itself). An investor would also be required to buy a minimum amount of stock (a board lot), and it would even be difficult to find a broker to place your order unless you had enough money to make it worth his or her while to handle your business.

That all changed on May 1, 1975, when the brokerage industry deregulated commissions, acting on a Securities and Exchange Commission (SEC) mandate. This spawned the rise of the discount brokerage firms, which has resulted in driving down the price of buying or selling a stock to $10 (or less) today.

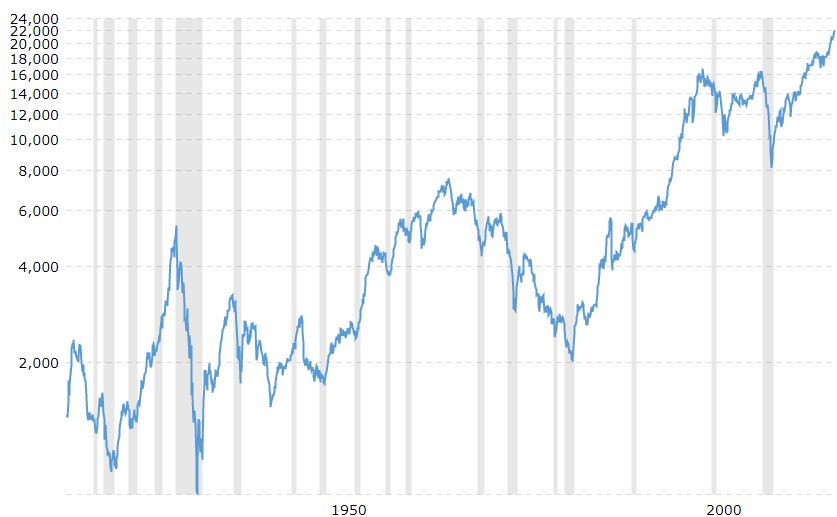

To put that into perspective, if you look at a chart of the performance Dow Jones Industrial Average over the past 100 years, the amount of gains made since 1982 has been breathtaking. The Dow was at the 2,000 level in early 1917 and had dropped down to the 2,000 level again in the summer of 1982. Today, 35 years later, the Dow has breached the 22,000 mark.

Source: Macrotrends

An ultra-low interest rate environment played an important part in this meteoric rise, no doubt, but I wouldn’t discount the contribution of severely-reduced trading fees over this time period, or what I like to call “the democratization of the stock market.” This inclusion of the middle class, in what had historically been the playground of rich, extended beyond the borders of the United States, radiating into the fast-growing economies of Asia.

With more and more money chasing fewer and fewer good companies, the stock market’s record rise should come as no surprise and, seeing that globalization is making more people richer, stock market gains have become a long-term trend that should continue for the foreseeable future.

After all, who wouldn’t want to own even a small piece of the ‘American Dream’ and now that dream can begin to come true with ownership in a great business, at less than $10 a trade, without even having to live in the United States.

Sean Mason has been investing in the stock market for more than 25 years and written for financial publications such as SmallCapPower.com, Investor’s Digest of Canada, and Stockhouse.

Related Article

Sean Mason: “Why I Love the Stock Market”

Thanks for reading! If you want more articles like the one above visit our Facebook page (here) and “Like” any article so you can get future articles automatically delivered to your feed. You can also “Follow the munKNEE” on Twitter or register to receive our FREE tri-weekly newsletter (see sample here , sign up in top right hand corner).

Remember: munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money