At the end of November 2011 the U.S. behavioral indicator for the U.S. stock market, based on insights on investor psychology, touched the crisis threshold for the fifth time (1971,1979, 1986, 2006) since 1970. If the current case follows the four prior cases, we expect a similar positive return from November 2011 to the end of October 2012 as in the four prior periods followed by a decline somewhere between 15% and 30%. [Let me explain.] Words: 317

based on insights on investor psychology, touched the crisis threshold for the fifth time (1971,1979, 1986, 2006) since 1970. If the current case follows the four prior cases, we expect a similar positive return from November 2011 to the end of October 2012 as in the four prior periods followed by a decline somewhere between 15% and 30%. [Let me explain.] Words: 317

So says Todd Feldman in edited excerpts from a recent article* posted on www.SeekingAlpha.com.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Feldman goes on to say, in part:

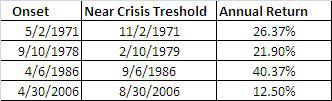

Let’s take us take a look at the annual return of the four prior cases once the indicator hits the crisis threshold [in the table below].

Table 1: Return

Assuming that the 2012 return corresponds to the returns above, we should expect high returns for the majority of 2012. Therefore, we are bullish for the U.S. stock market in 2012 up until November.

Who in the world is currently reading this article along with you? Click here

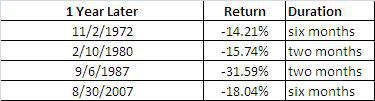

Once the years noted above ended, the stock market declined in all four instances… [as shown in the table below]…

Table 2

Given the dynamics of the current 2011-2012 indicator, we believe this current cycle is more closely related to 1979-1980 and 1986-1987. Therefore, if the return of the U.S. stock market going into October of 2012 is around 20%, we then predict a 15% decline in the following two months. If the return is between 30-40% or more, we then would predict a larger decline over two to three months…

*http://seekingalpha.com/article/327022-why-investors-should-be-fully-invested-in-u-s-markets-for-2012?source=email_macro_view&ifp=0

Why spend time surfing the internet looking for informative and well-written articles on the health of the economies of the U.S., Canada and Europe; the development and implications of the world’s financial crisis and the various investment opportunities that present themselves related to commodities (gold and silver in particular) and the stock market when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read.

Sign-up for Automatic Receipt of Articles in your Inbox or via

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet edited for clarity and brevity to ensure you a fast an easy read.

Related Articles:

1. Yardeni: Lower Unemployment in 2012 = Higher Stock Market in 2012

Initial unemployment claims may be the most important economic indicator for the stock market in 2012. It is one of the three components of our Fundamental Stock Market Indicator (FSMI), which is highly correlated with the S&P 500, [see graph below] so if initial unemployment claims remain under 400,000 and possibly continue to head lower during January, that would support the strong stock market rally that has kicked off the New Year so far. Words: 395

2. Don’t Invest in the Stock Market Without Reading This Article First

History has shown that investors who stick to disciplined, fundamental-focused strategies give themselves a good chance of beating the market over the long haul and James O’Shaughnessy has compiled data that stretches back to before the Great Depression…back-tested numerous strategies, and has come to some very intriguing conclusions. [Let me share some of them with you.] Words: 1325

3. What Does 2012, as an Election Year, Mean for Stock Market Returns? Here Are the Facts

Next year is a Presidential election year, and the stock market is almost always positive in election years. Right? At least that assurance has been a supposed truism for many decades, and repeated as fact each year in numerous interviews and financial columns. [Let’s explore just how correct those assumptions really are.] Words: 367

4. What Do the Presidential and Decennial Cycles Infer Will Happen in 2012?

Should we jump into the market now? [Let’s take a look at the 178 year history of the 4-year Presidential Cycles and the Decennial (10-year) Cycles and see what they suggest might well unfold in 2012.] Words: 1174

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money