[A]s we’ve consistently seen, when financial conditions get particularly rough, gold and silver lose their safe-haven appeal [but their]…prices may have already struck bottom and, [al]though we don’t expect them to run away to the upside, now may be the time for long-term investors to accumulate positions. That said, what should an investor buy: gold or silver? That is always an interesting question, but especially so during periods of rapid price movements such as now. [Below I analyze the gold/silver ratio and come up with the answer.] Words: 760

Gold/Silver Ratio

When prices were falling, silver got hit harder [than gold because]…it has a much more significant industrial-demand component [than] that [of] gold… – 46% vs. 11%, [respectively]. [As such], when economic concerns are prevalent as they have been recently, it’s no surprise that silver would fall more. On the other hand, when economic conditions improve, silver typically outperforms. This has been the paradigm over the past 20 years. The best way to see this is through the gold/silver ratio, which measures the relative value of the two precious metals. The higher the gold/silver ratio, the more expensive gold is relative to silver. Conversely, the lower the ratio, the more expensive silver is relative to gold.

From 1950 to 1980

Since 1950, the ratio has been quite volatile. From 1950 to 1980, it fluctuated mostly between 20 and 50.

From 1980 to 1990

From 1980 to 1990, the ratio surged to 100 as the sector plunged from their record highs amid a taming of inflation and central bank selling of gold.

From 1990 to 2000

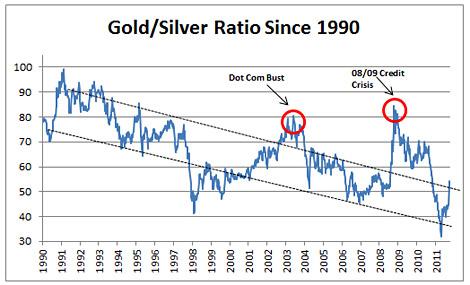

The period from 1990 to 2000 saw a normalization in the ratio as silver prices ticked up a bit. Below is the gold/silver ratio since 1990, when the ratio peaked close to 100.

From 2000 to Date

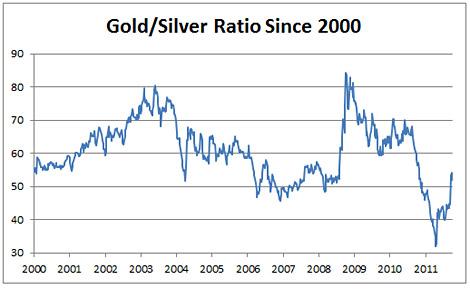

2000 to 2011 is the latest period in which the ratio has trended significantly lower, as both gold and silver prices have rallied sharply [- but silver more so than gold].

The trend has been gradually, but consistently, lower. The only instance when the ratio deviated significantly from the overall downtrend was in 2008/2009 during the depths of the financial crisis in those years. Another peak corresponded with the dot-com bust during the early part of the last decade.

2011 Forward?

Many investors believe that the gold/silver ratio will continue to decline over the next decade as both gold and silver prices appreciate, with the latter rising more swiftly. Ultimately, the ratio may fall to levels below 20, where it last stood during 1980, when inflation ran rampant in the United States and other major economies.

While inflation isn’t yet at the double-digit levels witnessed back then, the argument is that the enormous debt burdens facing many countries will be monetized by central banks, eventually leading to inflation. We’ve already seen the beginnings of this to some extent. The quantitative easing programs in the U.S. and the U.K. have led to the monetization of more than $2 trillion worth of sovereign debt, while headline inflation figures are well above target ranges in both countries. At the same time, recent central bank buying has legitimized gold and silver as monetary alternatives to traditional fiat currencies. Meanwhile, robust demand growth from investors and consumers in emerging markets such as China and India is a bullish catalyst that wasn’t evident during the last major precious metals bull market. All of these factors bode well for continued gains in gold and silver prices, and a continued decline in the gold/silver ratio.

Conclusion

Looking at more recent price action, the ratio last stood at [around] 52,…[which] is above the upper trend line and thus signals that silver may be a relative bargain compared to gold. Earlier this year, the ratio hit a 31-year low near 32.

*http://www.hardassetsinvestor.com/features/3113-goldsilver-ratio-suggests-silver-buying-opportunity.html

Related Articles:

1. $325/ozt. Silver and $6,800 Gold Quite Possible – Here’s Why

The majority of analysts are now of the opinion that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and silver could escalate dramatically in price over the next few years. How much? This article takes a look at historical gold:silver ratios and what attaining certain relationships would mean for the price of silver should specific price levels for gold be realized. Words: 1411

2. Eric Sprott: Financial Train Wreck Coming Soon! Got Gold? Better Yet, Got Silver?

We have a financial system that’s on the edge of a cliff here. People have to be in precious metals if they want to protect themselves. Everyone who’s an investor has money. They have it invested in some paper instrument and when they realise they have a problem with their money in a bank or owning some government note the demand for gold could just be overwhelming! It could be parabolic all of a sudden. Currently, only o.75% of the world’s financial assets are in gold so just imagine what a 5% to 10% interest in gold would mean for its price. On top of that, I believe that silver will get back into a 16:1 ratio to gold in three to five years for sure so that means that silver is going to have a great upside potential. Got gold? Better yet, got silver? Words: 5169

We are at the beginning of a major shift out of paper assets into real assets [and] those that are starting to come to this revelation have no real understanding what they are doing when they are buying gold…[they just want] to get out of paper assets. I bought gold as a gut reaction [but] the more I learned about silver, [however,] the more I realized that silver was the smart decision. [Let me explain.] Words: 2190

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

While the markets are troubled with liquidity, it’s more likely silver will move sideways and the GSR will rise. Around 60 GSR might be a good time to scale back into silver.

I’m a long term silver bull, but we just had 2 major down moves and it will take some time for traders to step back in and buy with the same kind of fervor. The silver market needs time to reform a base.