It’s Economics 101. Price works to balance supply and demand. Limited supply causes higher prices; higher prices help curb demand…[and] that equation is playing out right now in the silver market. Mined silver supplies have been drying up over the past few years, while silver prices have climbed 20% in the same time frame…

The original article has been edited here for length (…) and clarity ([ ]) by munKNEE.com – A Site For Sore Eyes & Inquisitive Minds – to provide a fast & easy read.

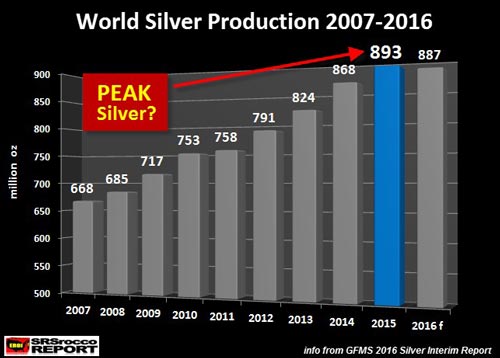

Silver Production Won’t Ever Be as High Again

2015 may well have marked a long-term peak in global silver production. That’s when the world’s mines produced 893 million ounces. The following year, 2016, saw the first drop in a decade, with output falling to 887 million ounces. 2017 was no better, with production falling another 30 million ounces, to just 857 million ounces.

Forecasts point to a very small increase of 867 million ounces in 2018, up only 1% over the 2017 haul…The troubles come mainly in the form of:

- falling ore grades, expressed in ounces of silver per ton of ore mined, combined with

- rising production costs.

Silver Production Has Plummeted All Over the World

The following table (we only have numbers up to 2016 for now) ranks countries by annual silver output.

The takeaway here: Fully eight of the top 11 silver-producing nations have seen their production fall.

As we said earlier, supply would normally rise to meet higher prices. The average silver price was $15.68 in 2015, then rose to $17.14 in 2016, and yet, world silver production fell. That’s not a normal response, which suggests that 2015 may, in fact, have been the moment of peak silver production.

Global Industry Will Drive Demand Like Never Before

Physical silver demand has retreated in the last couple of years, but I don’t think that’s going to last.

- Investors bought less silver coins and bars last year…

- Jewelry demand was up slightly in 2017, with slower Chinese buying partially offset by stronger Indian and North American demand.

- Industrial demand surged 3%, mostly due to rapidly expanding production in the solar industry. I think the industrial sector will help drive stronger demand for silver in the next couple of years, as solar panels, automotive, and electronics continue to see strong gains…

Here’s How You Can Play the Inevitability of Peak Silver, Coupled With Rising Demand

The Global X Silver Miners ETF (NYSE Arca: SIL) is my preferred “peak silver” proxy.

- The ETF has over $400 million in assets spread globally across 27 silver mining companies.

- Of those we do find both Tahoe Resources and Hecla Mining, both of which could see their silver output challenged until outstanding issues are resolved but, together, they only represent about 8% of the allocation, so I’m not overly concerned about their impact.

- Geographical allocation is nicely balanced. It works out to 39.07% in Canada, 17.72% in Mexico, 12.89% in Russia, 12.52% in United States, 11.61% in South Korea, and 6.19% in Peru.

It’s true that silver producers will find they have a challenging environment in which to grow their output as grades continue to deteriorate. However, this is the mining sector: I expect many will end up doing deals to take over smaller players in the exploration and/or development stages in order to grow production.

The bottom line:

Silver is in a massive bull market, and important production challenges will only add to the metal’s irresistible attractiveness and price gains in 2018.

Related Articles From the munKNEE Vault:

1. Silver Is A “Must Own” – Here’s Why

Silver has often rebounded nearly 100% within 12-15 months after bad and long bear markets. History says Silver is ripe for a similar move over the next 12 to 18 months.

2. Silver Prices: How High Will They Go? $100? $300? $500?

Silver prices have risen exponentially for the past 90 years as the dollar has been consistently devalued. Expect continued silver price rises.

3. Silver is Now Even More Precious Than Gold! Do You Own Any?

Our review of the best places to buy gold online are dependent on what your goal with the gold is — amassing physical bullion for financial security or to speculate on gold prices. Below are strategies and recommended dealers for each approach.

5. Silver Is THE Antidote to Bubble Craziness – Here’s Why

Silver in early 2018 is inexpensive compared to M3, National Debt, government expenditures, the Dow and gold.

6. Gold Measurements: What Do the Terms “Karat” & “Troy Ounce” Actually Mean?

You have no doubt read countless articles on the price of gold costing “x dollars per ounce”, own a gold ring or some other piece of gold jewellery and/or wear or have bought/plan to buy a diamond ring but do you really understand exactly what you are buying? What’s the difference between 1 troy ounce of gold and 1 (regular) ounce? What’s the difference between 18 and 10 karat gold? What’s the difference between a .75 and a 1.0 carat diamond? Let me explain.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money