Gold is becoming more and more acceptable in the investment community and especially since interest rates have approached zero and in some countries even gone negative. Until recently no portfolio manager would have mentioned gold and even less recommended it…[but now] the investment profession is starting to discover the liquidity trap and acknowledge the value of cash and, more specifically, gold and its place in a diversified portfolio.

especially since interest rates have approached zero and in some countries even gone negative. Until recently no portfolio manager would have mentioned gold and even less recommended it…[but now] the investment profession is starting to discover the liquidity trap and acknowledge the value of cash and, more specifically, gold and its place in a diversified portfolio.

A guest post by Dan Popescu (GoldBroker.net) which has been slightly edited ([ ]) and abridged (…) to provide a faster and easier read.

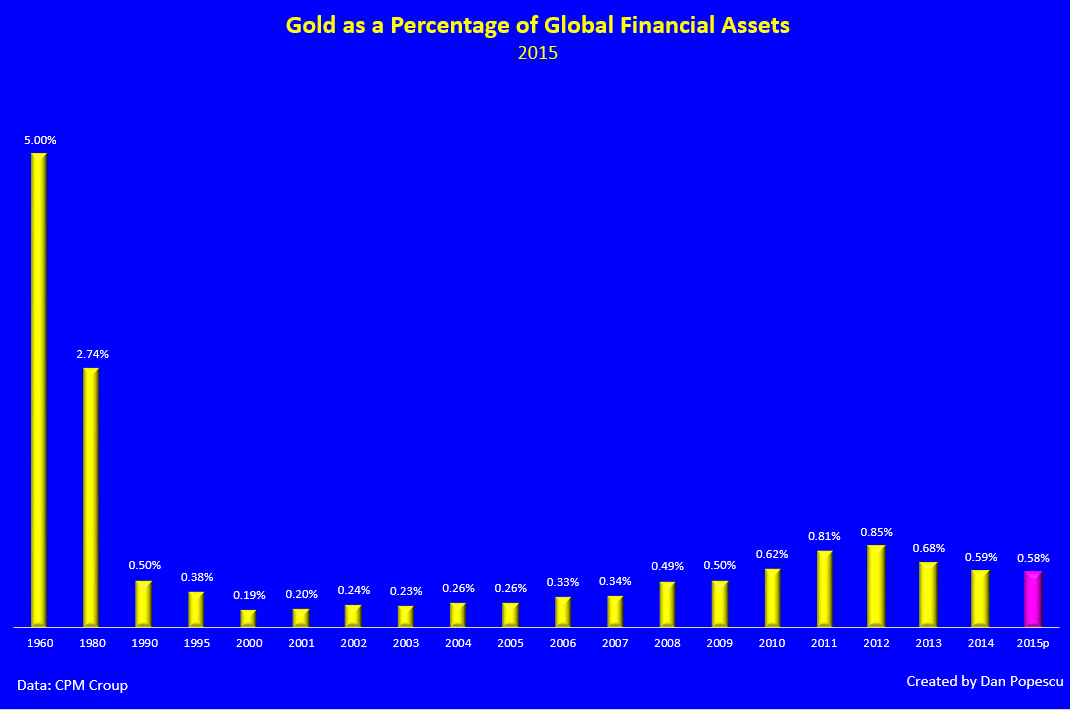

…Gold, as a percentage of global financial assets in 2015, represented only 0.58% vs 2.74% in the ‘80s and 5.00% in the ‘60s [see table below].

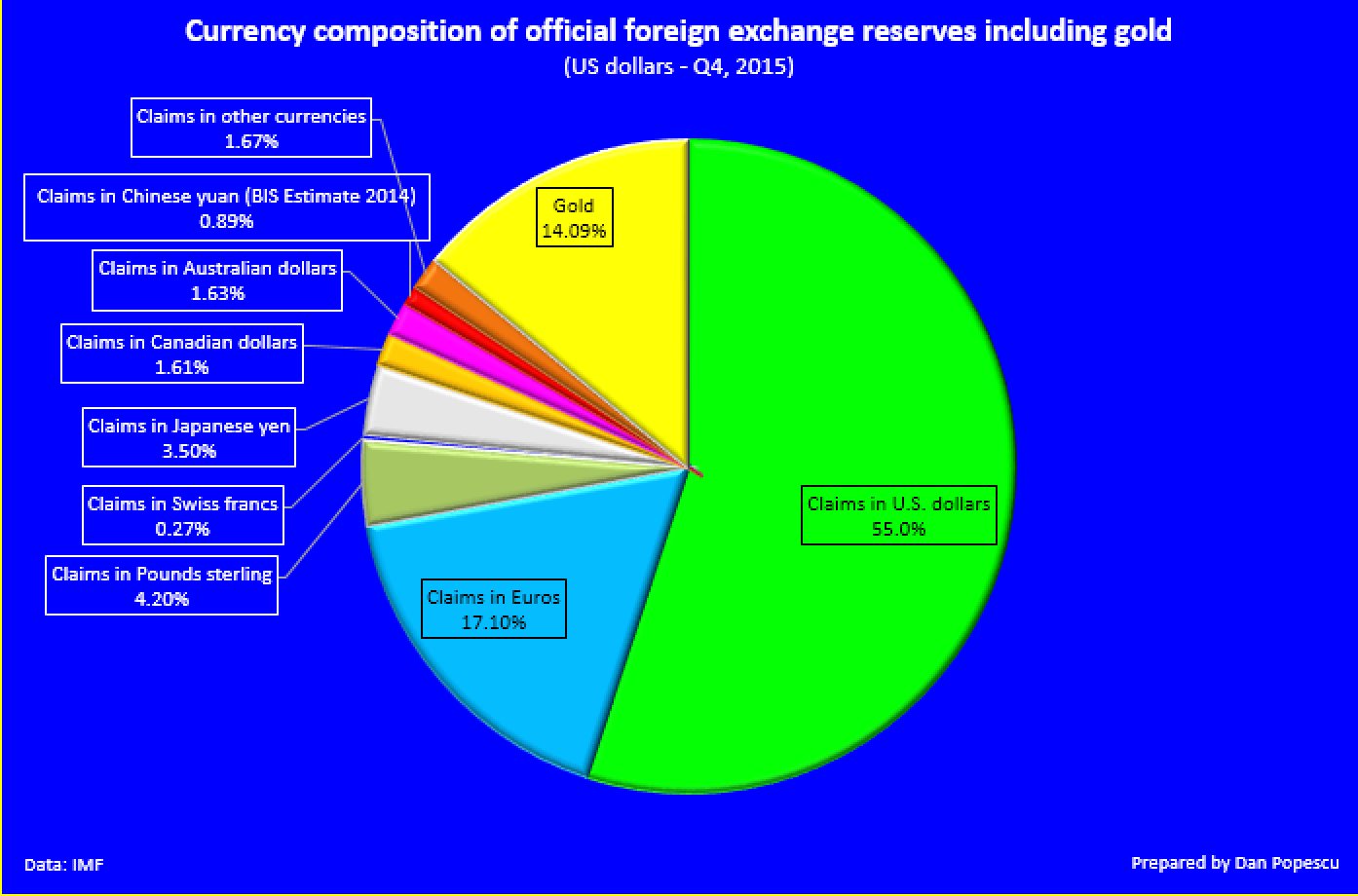

In 2015 the central banks of the world had 14.09% of their international reserves in gold (see chart below)…with the U.S. and the Eurozone well above a historically considered prudent level of 10% in a balanced investment portfolio at 74.9% and 55.9% respectively…

In a recent (May 11, 2016) interview Solita Marcelli, from JPMorgan Private Bank, said, “Central banks may consider diversifying their reserves [as they anticipate] negative rates on existing holdings,” and, “Gold is a great portfolio hedge in an environment where the world government bonds are yielding at historically low levels.” She also added that, “Gold is looking more and more attractive every single day … As a non-yielding asset, it has a minimal storage cost, so when you compare it to negative-yielding assets, it actually has a positive carry.”…

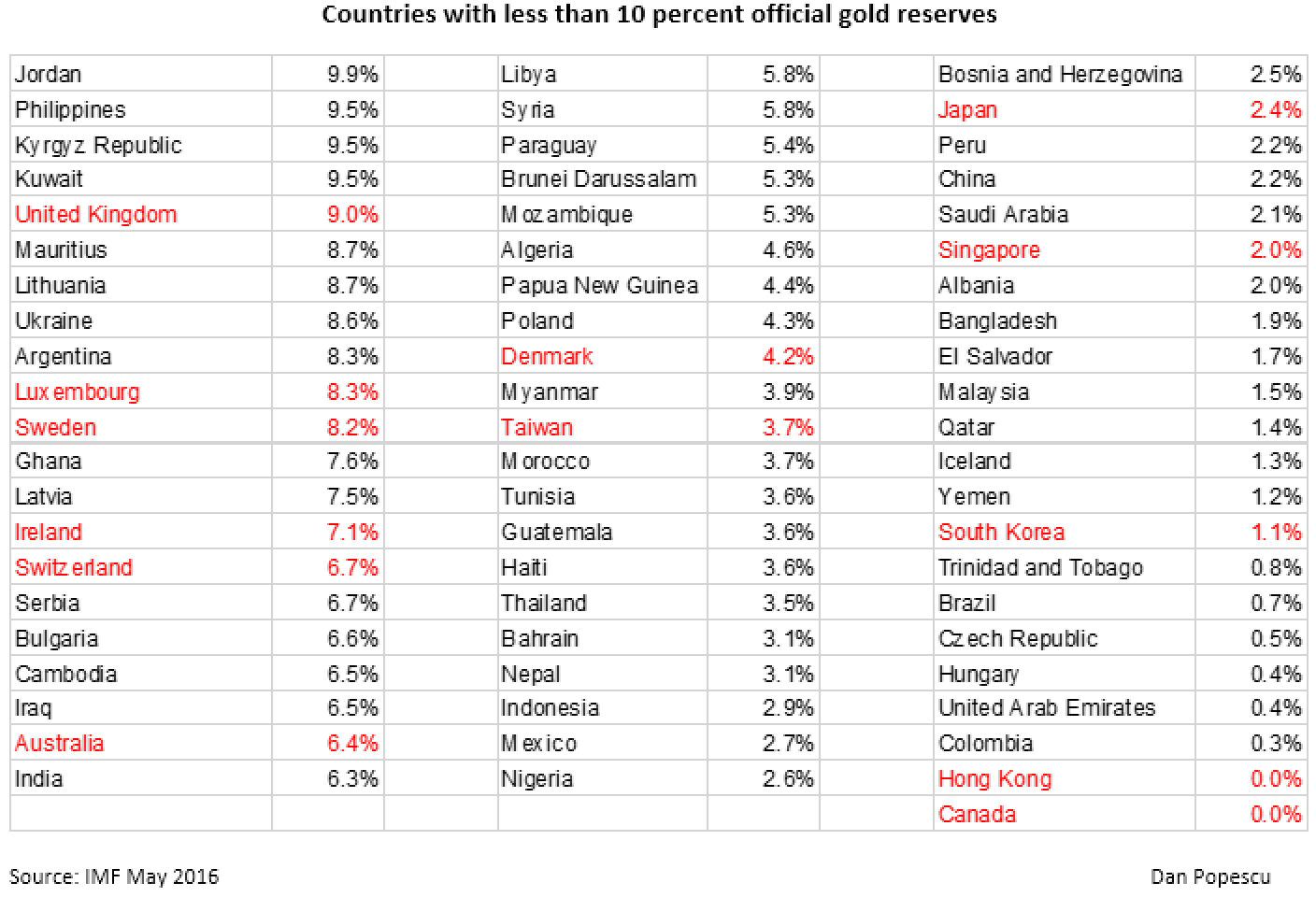

Below I created a table with all the IMF countries with gold reserves below 10%… The major developed countries are in red and the developing countries are in black.

In a May 3rd, 2016 article Kenneth Rogoff, former chief economist of the IMF and Professor of Economics and Public Policy at Harvard University, recommended that developing countries and, more specifically, China, increase their gold reserves above 10%…[saying:] “there is a case to be made that gold is an extremely low-risk asset with average real returns comparable to very short-term debt and, because gold is a highly liquid asset – a key criterion for a reserve asset – central banks can afford to look past its short-term volatility to longer-run average returns.”

Gold, after being denigrated for years by the investment and economic profession as a worthless and useless rock (not even a metal), to hear an eminent economist (not from the Austrian School of economics which are supposed to be “American far-right crackpots“) calling gold “extremely low-risk asset” and “highly liquid asset” is quite a surprise.

Why would…[Rogoff say such a thing] and why now? Author Jim Rickards of The New Case for Gold speculates in his latest newsletter Strategic Intelligence, that what Mr. Rogoff wants is to push the price of gold up and, in so doing, create inflation by having the IMF and emerging markets do the dirty work so the U.S. Congress and the taxpayers wouldn’t know where the inflation is coming from. I think he is right….

If Kenneth Rogoff’s recommendation is reiterated by other well-known personalities it will give credibility and acceptance by central banks in general to increase their gold reserves, ridicule Bank of Canada’s decision to sell all its gold reserves, and encourage the investment management community to do the same, creating a stampede on gold as in the ‘70s. The major players in the official gold reserves sector that could follow Mr. Rogoff’s advice are already major buyers of gold: China, India, Iran and Saudi Arabia. Russia is already above that level at 15% and is continuing to increase its gold reserves at a fast pace.

Mr. Rogoff doesn’t mention developed countries but I would not be surprised if some would do it too. I am thinking of the UK, Switzerland and Canada who, in recent years, have been quite anti-gold. Economists like Mr. Rogoff can give public officials the needed cover to reverse their decision.

In an interview I did in 2014 with Marc Faber, editor of the The Gloom, Boom & Doom Report, he told me to “be your own central bank and buy gold”. I think this is excellent advice. The 10% Mr. Rogoff recommends for developing countries’ central banks is also a good allocation, more or less, for individuals, depending on their personal circumstances.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money