In this article I present 12 dividend growth stocks that are fairly valued and offer above-average earnings and dividend growth potential.

The above comments, and those below, have been edited by Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – register here) for the sake of clarity ([ ]) and brevity (…) to provide a fast and easy read. The contents of this post have been excerpted from an article* by Chuck Carnevale (fastgraphs.com) originally entitled 12 Attractive Fast-Growing Dividend Growth Stocks For High Total Return and which can be read in its unabridged format HERE. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

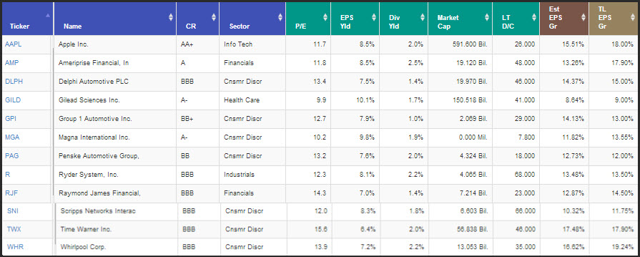

[In my determination of 12 such stocks I have only] included companies that meet some of my own personal investment philosophies, in addition to attractive valuation…[such as] consistent above-average historical earnings growth over the past 5 to 7 years. and dividend growth with a history of annual dividend increases.My process generated the following 12 above-average growing dividend growth stocks that appear attractively valued in today’s market environment. I want to be clear that these are not offered as a recommendation of 12 stocks to build a portfolio with. Instead, each research candidate is offered so that the reader can pick and choose any, none, or all of the candidates that meet their own unique goals and objectives.

A review of each individual candidate [as presented at length in the original article, complete with a multitude of graphs] provides significant fundamental research on each selection:

- a short business description on each company courtesy of S&P Capital IQ,

- the historical earnings and price correlated graph,

- the associated performance on each research candidate over the time frame graphed and

- two forecasting calculators, one short to midterm and one longer-term….

Summary And Conclusions

The 12 research candidates presented in this article were difficult to find as a result of the current moderately high level of the overall market… and only come from 5 of the 10 sectors available in the overall market. Additionally, many of the names in each sector also operate in the same or very similar businesses. This is an additional reason why I do not suggest these 12 research candidates as a portfolio. Instead, they are offered as interesting fairly-valued, above-average growing dividend growth stocks with the potential to provide above-average, long-term total return and a growing dividend income stream.

I leave it up to the reader to pick and choose according to their own preferences, objectives and goals.

*http://www.fastgraphs.com/research_articles/2015-08-27-carnevale-12-attractive-fast-growing

“Follow the munKNEE” via:

- Twitter: #munKNEE

- Facebook: @Facebook

- Market Intelligence Report newsletter (Sign up HERE; sample HERE)

Check them out. They make it easy to keep informed of what’s new on munKNEE.com.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money