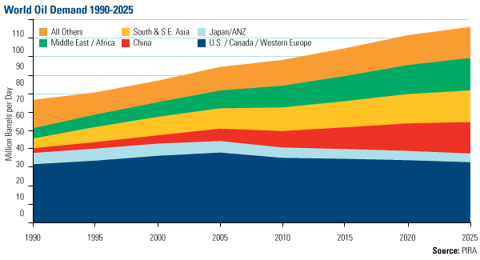

World oil demand is…expected to surpass 115 million barrels per day in 2025 from only 91 million barrels per day today yet production in many countries is either waning or being consumed by the producing country. [In this article I identify those countries whose production is in decline, 2 countries who have increased production thanks to unique sources and how to invest accordingly.] Words: 595

So says Nick Hodge (www.energyandcapital.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Hodge goes on to say, in part:

Oil Demand is Increasing in Most Regions of World

Oil Supply From Many Countries is Decreasing

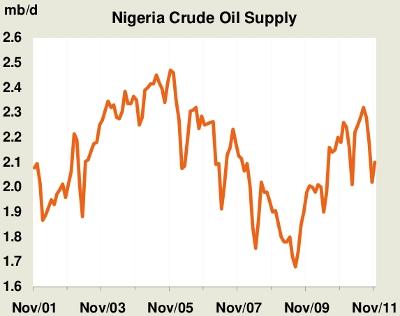

Nigeria

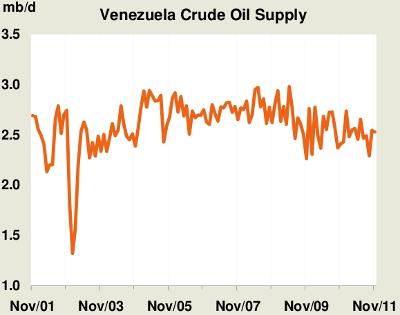

Venezuela

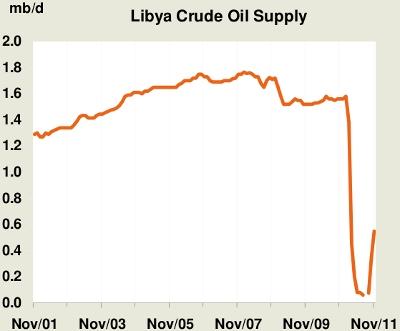

Libya

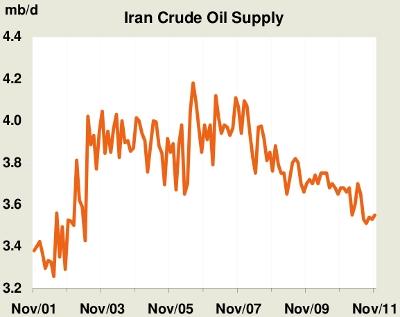

Iran

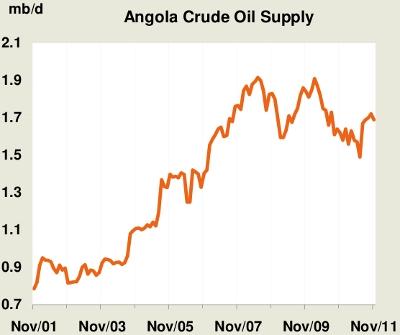

Angola

That’s five OPEC nations with supply heading down and it doesn’t get any better in non-OPEC countries that were once major producers…

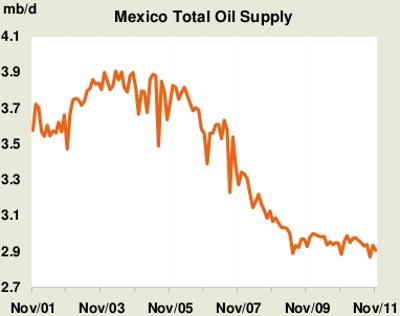

Mexico

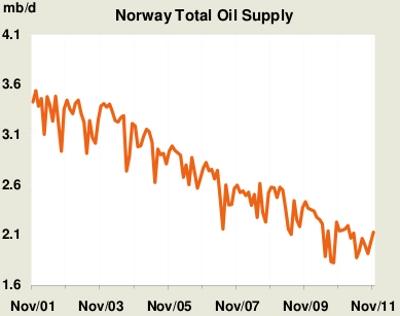

Norway

Oil Consumption of Oil-exporting Countries Increasing

In countries whose supply isn’t shrinking, there’s another problem: growing economies.

The New York Times reports:

The economies of many big oil-exporting countries are growing so fast that their need for energy within their borders is crimping how much they can sell abroad, adding new strains to the global oil market.

Experts say the sharp growth, if it continues, means several of the world’s most important suppliers may need to start importing oil within a decade to power all the new cars, houses and businesses they are buying and creating with their oil wealth.

Indonesia has already made this flip. By some projections, the same thing could happen within five years to Mexico, the No. 2 source of foreign oil for the United States, and soon after that to Iran, the world’s fourth-largest exporter.

It is a very serious threat that a lot of major exporters that we count on today for international oil supply are no longer going to be net exporters any more in 5 to 10 years.

To recap, many countries — both inside and outside OPEC — are undergoing supply contraction. Those that aren’t are exporting less because they’re using more internally.It’s the perfect recipe for higher oil prices, which, by the way, Goldman Sachs (GS), Barclays (BCS), and Deutsche Bank (DB) are all forecasting for this year.

Who in the world is currently reading this article along with you? Click here

Countries Whose Oil Supply is Increasing

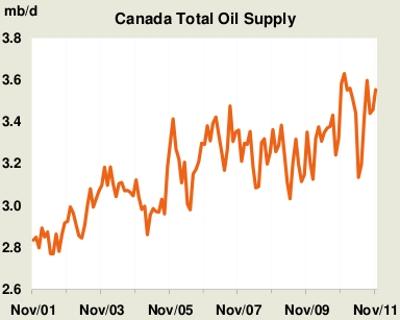

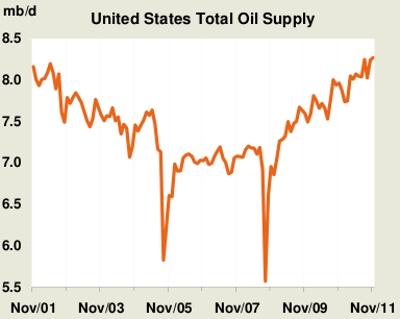

Canada (Oil Sands/Shale Oil) and the U.S. (Shale Oil)

Canadian oil production has been surging for years [while] American production is undergoing a renaissance. As prices rise due to falling production elsewhere in the world, rising demand [across the globe], and [the anticipated] consequences of the Iran situation, companies operating in the United States and Canada, especially in rich new shale finds, will be the main beneficiaries.

Shale Oil Stocks Outperforming Dow

Companies like Northern Oil and Gas (NYSE: NOG), Oasis Petroleum (NYSE: OAS), Continental Resources (NYSE: CLR), Whiting Petroleum (NYSE: WLL), Petrobakken, and more are already showing how the strength of new North American oil production is translating into financial wealth. [As the graph below shows,] even as the Dow has tacked on 2,000 points since October, it can’t keep pace with shale oil stocks.

Conclusion

Oil prices aren’t getting any lower and shale production isn’t slowing down anytime soon, so you need to be putting yourself in a position to profit now.

*http://www.energyandcapital.com/articles/north-american-oil-production-on-the-rise/2004

If you enjoyed reading the above article then:Sign-up for Automatic Receipt of Articles in your Inbox or via

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet edited for clarity and brevity to ensure you a fast an easy read.

Related Articles:

People often say: “You can’t squeeze blood from a stone.” However that’s exactly what shale oil is. An alternative fuel, created by squeezing our planet’s proverbial “Life Blood” out of rock. Words: 1066

2. New Discoveries Insufficient to Avoid Peak Oil

The imbalance between oil demand and supply is likely to result in a decade long upward trajectory in energy prices, marked by volatility. The world is going to be running short of oil production in the not too distant future and these new discoveries don’t change that reality. Words: 2032

3. 10 Questions You Need Answers to Before Investing in Oil & Gas Stocks

10 questions to ask before deciding whether or not to invest in an oil or gas company. Words: 820

4. More of What You Need to Know Before Investing in Oil & Gas Stocks

Here are 10 more questions potential investors should be asking oil and gas company management teams or searching for on the company website. Words: 1046

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money