In the investment management process…[it is important to] actively monitor both short- and long-term cycles…in order to manage expectations based on historical patterns…[as well as] oscillators – diagnostic tools that help us measure a security’s upward and downward price volatility. To understand how oscillators work, though, you first need to become familiar with standard deviation and mean reversion. In this article, we do just that.

short- and long-term cycles…in order to manage expectations based on historical patterns…[as well as] oscillators – diagnostic tools that help us measure a security’s upward and downward price volatility. To understand how oscillators work, though, you first need to become familiar with standard deviation and mean reversion. In this article, we do just that.

The above introductory comments are edited excerpts from Part 2* of a series of articles by Frank Holmes (usfunds.com) entitled Managing Expectations. Go here for Part 1 and here for Part 3.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Holmes goes on to say in further edited excerpts:

Oscillators

Oscillators are diagnostic tools that help us measure a security’s upward and downward price volatility. Think of an oscillator as a thermometer; with it, we can accurately take a security’s “temperature.” The knowledge extrapolated from this reading is materially useful in:

- managing expectations,

- appreciating the dimensionality of a security’s short-term volatility and

- identifying when to accumulate or trade a stock.

To understand how oscillators work, though, you’ll first need to be familiar with standard deviation and mean reversion.

Standard Deviation (Sigma)

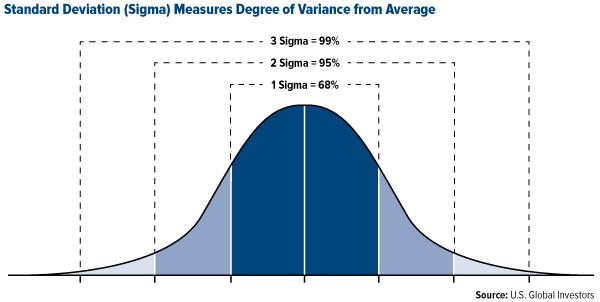

Standard deviation, also known by its Greek letter sigma, is a probability tool that gauges a security’s volatility. Specifically, it measures the typical fluctuation of a security around its mean or average return over a period of time ranging from one day to 12 months or more.

In the following bell-shaped curve, the center line represents a security’s average return over a given period of time—one day, 20 days, 60 days or 12 months. To the left and right of the line, the darkest blue sections indicate one standard deviation, or sigma, either above or below the mean; the next lightest, two sigma above or below; and so on.

No matter the security, returns can be expected to trade within:

- one sigma of their mean 68% of the time,

- two sigma of their mean 95% of the time and

- three sigma of their mean nearly 100% of the time.

Why should investors care about this? Generally speaking, the higher the sigma, the higher a security’s volatility; the probability that it will fall back toward the mean also rises.

A speculative tech stock, for example, has a greater tendency to have a higher sigma than a blue chip stock. This tells you the tech stock’s returns will fluctuate more widely, more erratically, than the blue chip stock’s.

Sigma is not as black and white as this comparison might suggest. Rather, it more closely resembles multiple shades of color that help investors manage their emotional reactions to the market’s swings and focus instead on the power of using statistics. It’s easy to get pulled into market fears or “irrational exuberance” – to use former Federal Reserve Chairman Alan Greenspan’s phrase – and this probability model helps us be more objective.

To illustrate how these statistics operate in the real world, let’s look at the S&P 500 Index. Over the last 10 years, it has had a rolling 12-month standard deviation of 17%. This means that if you were to chart its returns over the course of 12 months, you could expect them:

- to stay within ±17% from the mean about 70% of the time. That’s one sigma.

- to rise or fall within ±34%, or two sigma, 95% of the time.

Knowing this, it probably wouldn’t be a huge cause for celebration if the S&P 500 rose, say, 8% during a 12-month period, since this figure falls within the “normal” one-sigma range. Conversely, a loss of 8% wouldn’t be a total disaster. A one-sigma move is a non-event from a historical perspective.

To put the above in perspective, the S&P 500 rose about 30% last year which is close to a significant two-sigma move from its 12-month average. Incidentally, 2013 was the index’s best annual performance since 1997.

The most important thing to keep in mind is that, just as we all have different fingerprints, every commodity, every stock, every fund and every index has its own DNA of volatility. The S&P 500 might have a sigma of 17%, but over the same 12-month period, the MSCI Emerging Markets Index has a much more volatile 29%. Investors must strive to remain objective in the face of emotional factors that move markets and adjust their expectations of how these two indexes behave compared to one another.

Mean Reversion

This leads us to mean reversion. Mean reversion is the theory that, although prices might trend up for many years (as in a bull market), or fall for many years (as in a bear market), they tend to move back toward their historic averages eventually. Such elasticity is the basis for knowing when a security is under or overvalued and when to buy low and sell high.

We have just experienced a bull market with the S&P 500 and a bear market with gold stocks. Within these trends, though, are great internal volatility and oscillator tools that monitor these actions. Even in a bull or bear market, we can measure the 20- and 60-day volatility of any kind of security.

Let’s use Minneapolis as an illustration…[It has] wide-ranging temperature fluctuations throughout the year, from highs reaching the 80s to lows flirting with zero. This being so, it would be unreasonable to expect the weather to remain freezing indefinitely… Eventually it reverts back to its 12-month mean of 45 degrees.

The same goes in the world of investing. Mean reversion applies to everything, in both a micro and macro setting…Entire countries have their own means, which they eventually revert back to. After charting Chinese stock performance over a 10-year time span, a pattern emerged…[that] Chinese stocks landed in the top half (of emerging markets) 4 out of 10 years – 2002, 2003, 2006 and 2007. In 2003, China climbed an astounding 163%; in 2007, it was the top emerging market again, returning nearly 60%. Since then, the country has fallen to the bottom half… so, if you apply the principle of mean reversion, history appears to favor China landing in the top half during this Year of the Dragon. Indeed, by the end of 2012, Chinese stocks jumped nearly 40% from the previous year, placing the country in the top half of emerging markets – just as predicted using the theory of mean reversion.

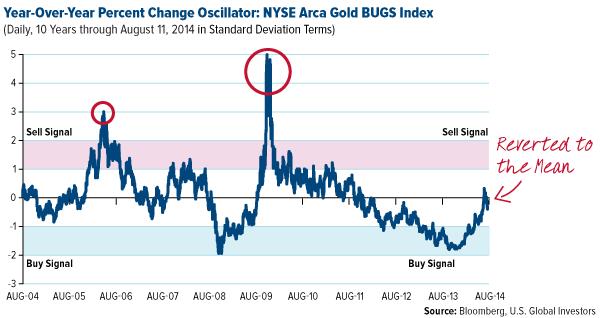

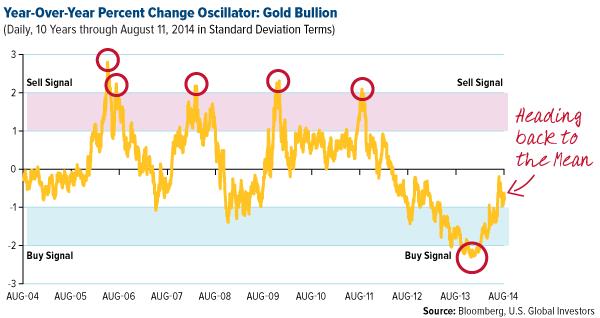

Look at the two oscillator charts below. They show the up-and-down movements in the price of gold stocks (top chart) and bullion (bottom chart) over the past ten years. One row above or below the mean, indicated by the black horizontal line, equates to one sigma; two rows above or below equates to two sigma; and so on. As you can see, mining stocks have recently reverted to their mean for the first time in about three years, while spot gold is gradually working its way back.

Again, every security has a different sigma for a specific period of time, and as such your expectations should reflect these differences. Gold bullion currently has a one-day standard deviation of ±1% and a 12-month standard deviation of ±18.8% (the one-day will always be lower than the 12-month) so if gold’s return falls within a range of ±1 on any given day or ±18.8% for a 12-month period, it’s behaving normally, as this is only one sigma. Anything over 18.8% for a 12-month period would be heading toward two sigma, which is when a buy or sell action is advised.

Now compare spot gold to the NYSE Arca Gold BUGS Index, which has a 12-month standard deviation of 35.5% – nearly double that of bullion. Plus or minus 35.5% might sound incredibly scary and volatile, but for gold stocks, a fluctuation of this sort is “normal,” occurring 68% of the time. It’s all about managing your expectations and emotions.

Look at the following oscillator that charts the S&P 500 and gold bullion’s 60-day percent change over the past five years. Like the EKG tracings of a healthy patient, the lines bottom and peak, bottom and peak – but revert back to their mean with regular frequency.

Oscillators are vital to identifying the optimal time to buy or sell.

- When prices exceed two sigma above the mean, it might be a good time to sell because the statistical data suggest the commodity is overvalued and, therefore, prices are due to drop toward their mean.

- When prices exceed two sigma below the mean, it indicates the commodity is undervalued. Buying the laggards at this time could enable you to participate in a potential rally.

No statistical tools are accurate 100% of the time, but investors can take ownership in how they use probability tools such as oscillators to manage the emotions of the market. It’s when an asset moves more than one sigma that the power of mean reversion raises your chances to capture opportunity. This is part of what makes investing so exciting. Strap yourself in and enjoy the ride.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.usfunds.com/media/files/pdfs/investor-alert/_2014/2014-08-15/Investor_Alert_08-15-2014.pdf

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Part 1: Should Financial Market Cycles Play A Role In Your Decision-making Process?

Financial markets are influenced by relatively predictable cycles…[and should] play a big role in one’s decision-making process just as they do in our day-to-day lives. This article, part 1 of a 3 part series, takes a look at several and discusses their relevance to one’s investment management process.

2. Part 3: The Best Times to Buy & Sell (or not) Your Stocks to Maximize Returns

Statistically speaking there is an optimal time to buy or sell a security and knowing such, or at least knowing when not to do so, would be quite beneficial to your financial health. This article provides the answers as to what are the best months, and work its way down to half-hours of the trading day, to engage in trading.

3. Time the Market With These Market Strength & Volatility Indicators

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on! Words: 974 Read More »

4. Yes, You Can Time the Market – Use These Trend Indicators

Remember, the trend is your friend and now you have an arsenal of such indicators to make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it. Words: 1579 Read More »

5. Make Money! Time the Market Using Market Strength Indicators- Here’s How

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on! Words: 974 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money