Rebalancing is a form of both risk management and a systematic way to carry out a contrarian investment strategy. The entire point of allocating money to different investments in a thoughtful way is to create a risk-return profile that balances out your long-term objectives with your short-term comfort level. Deviating from that risk-return profile can be a huge behavioral risk if you’re not aware of how it can change your portfolio’s composition.

entire point of allocating money to different investments in a thoughtful way is to create a risk-return profile that balances out your long-term objectives with your short-term comfort level. Deviating from that risk-return profile can be a huge behavioral risk if you’re not aware of how it can change your portfolio’s composition.

The comments above and below are edited ([ ]) & abridged (…) excerpts from an article by Ben Carlson (awealthofcommonsense.com) to provide a faster and easier read.

The way I see it, asset allocation does not matter very much without diversification which doesn’t work very well if you don’t rebalance your portfolio back to target weights.

A disciplined rebalancing process forces you to go against the crowd. It won’t always be the right move at the right time, but over time it can help manage risk and potentially increase returns.The question then becomes what the optimal rebalancing intervals are. The answer, as with most investment related questions, is — it depends.

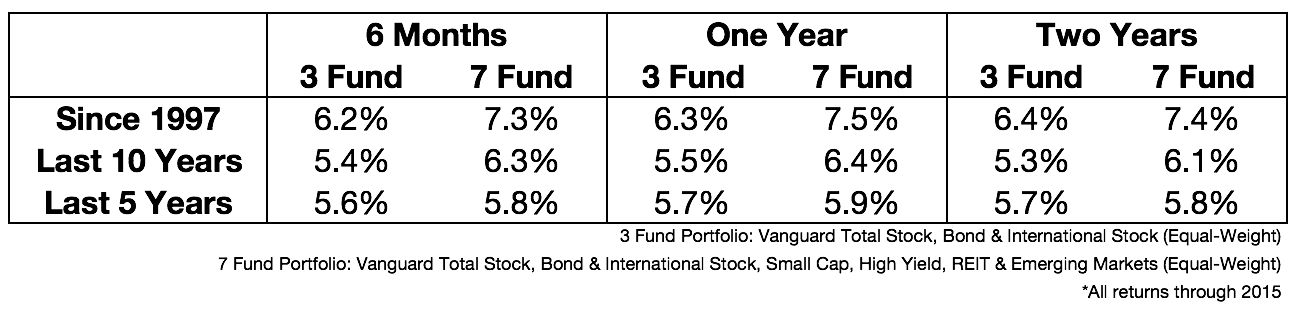

I ran the numbers on two separate portfolios over three different rebalancing intervals — 6 months, one year and two years. I used all Vanguard funds for the portfolios, using one fairly simple 3 fund portfolio and a 7 fund portfolio using more asset classes. Here are the results over a few different time frames:

You can see that the rebalancing period chosen didn’t really make much of a difference either way. Over some periods waiting to rebalance provided a slight boost. Other times it hurt results. Some investors like to rebalance quite often while others are more apt to let their winners ride for a little longer. Plus, these numbers are all so close that either some or all of the differences could be explained away by the dates you choose to rebalance or how you execute your strategy, and real world execution is never quite as easy as it looks in a backtest.

Here are a few more real world considerations:

- Are you rebalancing for spending needs in retirement?

- Have you weighed the benefits of rebalancing with the tax consequences involved?

- Which accounts (taxable or tax deferred) are you making your trades in?

- Are you able to rebalance with new contributions?

- How much complexity is too much in your portfolio in terms of number of funds/holdings?

- How willing are you to allow your allocations to drift and potentially change your risk/return profile?

- Are you able to automatically set your rebalancing schedule up to take yourself out of the equation?

- Are you considering all of your holdings and accounts when making your rebalancing trades?

Having said all of this, rebalancing is the sort of decision that you don’t want to overthink too much. You’ll never achieve perfect optimization. The first step in creating a good plan is letting go of any thoughts that you’ll be creating a perfect plan.

Most of the time rebalancing means you’ll be slightly out of line with conventional wisdom. Where rebalancing will likely matter the most is during bear markets or market bubbles because it will require substantial selling of what has worked and buying of what hasn’t. This is where it really matters.

If you even have a rebalancing policy to begin with you’re likely doing better than most investors who at best allow their portfolios to drift with the markets and at worst are anti-rebalancers who buy after asset classes have risen and sell after they have fallen.

How you choose to rebalance doesn’t matter nearly as much as finding an approach that suits you and allows you to manage risk as well as your own sanity when investing.

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money