You hear a lot of bull about the coming bear market. In fact, self-proclaimed experts have predicted 20 of the past 3 bears. Investing is about balance – balancing fear and greed, risk and reward, ignorance versus the cost of information. The greatest risk in the market cannot even be found “in the market”…[Instead,] our greatest risk is an internal one that resides in our hearts and minds, knowing when to buy and sell, when to hold ’em and when to fold ’em. Today, we’ll look at those internal risks and how they affect your investing…

of the past 3 bears. Investing is about balance – balancing fear and greed, risk and reward, ignorance versus the cost of information. The greatest risk in the market cannot even be found “in the market”…[Instead,] our greatest risk is an internal one that resides in our hearts and minds, knowing when to buy and sell, when to hold ’em and when to fold ’em. Today, we’ll look at those internal risks and how they affect your investing…

The comments above and below are excerpts from an article by Richard Berger which have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read.

My Perspective – Points Every Investor Should Consider:

[While] I…believe that we are getting into a very long-tooth end cycle of the current bull market, my personal bias is that no bear will rise before the U.S. elections.

Historically,

- presidential election years are the best performing of every such 4-year cycle. This is one of the most reliable predictors for market performance of all. The reason is clear: government spends huge amounts of pork and maximizes stimulus efforts in an all-out press to get themselves re-elected. This generally pumps up the economy.

- Likewise, the year following the election is the worst-performing year in the 4-year cycle, because government makes the “hard” choices in budget cutting and tax increases at this time. This allows maximum time to pass before the next election, thus giving voters time [to] forget the pain that has been voted upon them.

Granted, there are many things unusual about this year’s election, and the cycle is not 100% accurate. None the less, I would not bet against it.

“Market timing” is the attempt to predict the macro timing and direction of changes in market movement. This can be applied to the momentum trends of individual stocks, ETFs, or even whole-portfolio allocations of cash, equity, and bonds. Even given the powerful 4-year election market cycle and its strong historical reliability, I caution against market timing strategies.

There is 100% certainty there will be another bear market; it will run its course and be followed by a bull market, and so on — the cycle repeats so long as free and open markets exist. The long-term trend of the markets is always up. Given enough time (and enough diversity of quality holdings to ensure most of them survive), your investment will increase in value over time…

I prefer to ride out the bears rather than put my cash on the sidelines…[given the following risk factors of market timing, as follows]:

1. Trying to time the market for bull/bear turns is an effort fraught with all the classic self-imposed risks of fear and greed internal to each individual’s desire for maximum gain and avoidance of loss. This is a layer of personal psychological risk beyond the risks of micro- and macroeconomic factors.

Micro and macro trends can have strong and broad influence over market moves and trigger inflection points, making turns from bull to bear and back. However, it is your personal view, rather than the actual market turns, that is the greatest real risk to your long-term portfolio results if you are attempting to anticipate and time these turns, or even simply to recognize they have occurred.

2. If you get out early (say 10% below the top), you leave that on the table (or worse, it was just a correction, and you sit out another doubling in next 24 months). Maybe you get out and it turns out to look like just a correction, and so you get back in after a gap-up — and then the market collapses so, then, on the “exit,” you risk a lot of lost opportunity.

3. An additional risk for income or DGI (dividend growth) investors is present in market timing. You say you are willing to forgo income. We’re generating well above our target income, but let’s say we were only generating 10% dividend plus option premium boosts. Sidelined cash not being employed means a 10% annual decrease, and less for compounding going forward just at the suspension of that income stream. If you can afford to sideline and suspend income, then you are currently compounding some. Thus the 10% is more like 12% per annum. If you can’t afford to forgo the income, then we really need not even address the alternate of sidelining part of your income-generating power.

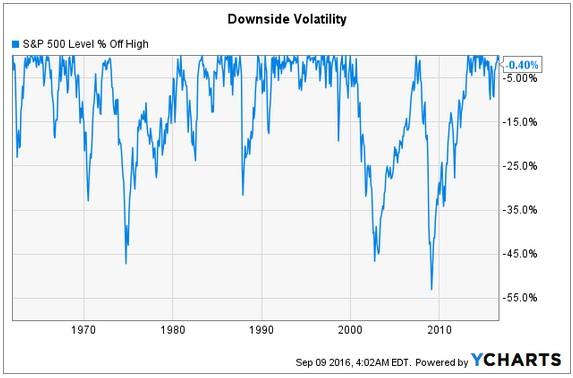

4. Duration of the bear is something you need to identify without a false step. A bear market is unlikely to run more than 2 years. Even the crash of 2008 had the market back to pre-crash levels within 27 months. If you ignore the very worst part of the bottom (which lasts only about 4 weeks total), most extreme bears reach a bottom of only 35% below the prior top.

As seen in the chart, there are many false bottoms in a bear bottom. How do you decide when to return? Again looking at the chart, a true bottom rebounds very quickly to about 25% below the prior market TOP. Thus, if you miss the top by just 10% and you miss the 1st month of the rebound off the true bear bottom (to be sure it’s not a false bottom), then you likely are left with just 15% of the top to bottom from which you actually “protected yourself” by sitting on the sidelines. Now remove the 2 years of 10% income lost, and you’re actually in the red. All this is if you play it perfectly, allowing for avoiding false bottoms and tops so you do not yo-yo in and out of the market multiple times and eat up further chunks.

5. On top of the false timing risk eating up any market timing advantage, there are the round-trip transaction fees, which may be significant, especially for a small investor and for those that experience many false-start trades trying to find the true market turns.

Summary

…If you are comfortable with your ability to “time the market,” certainly there is money to be “saved” and to be “made” by exiting near tops and re-entry near bottoms. On the other hand, you don’t sell your home because you have a growing worry about fires and flood. You buy insurance instead…

Another thought to mention is “shifting to quality,” overweight the dividend zombies. These are the proven survivors that never have cut or suspended their dividends, even in the worst of times, the Great Depression. Over 100 years of steady and increasing dividends without ever blinking. Of course, the yield will be lower on them because of this ultra-low risk, but over time, they tend to outperform the market very well too…

Closing Thoughts:

I hope this discussion and the cautionary points about market timing are useful in stimulating your thinking and perhaps revealing some of the hidden parameters that must be considered in attempting successful timing.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

markets always go up ? errr just one word ………….Japan

we are turning Japanese