When someone points to the Fed, the U.S. government and its “central planning” or “money printing” as the primary cause of the surge in the price of gold and justification of their USA hyperinflation theory, you might do them a favor and let them know that they’re right about the flaws of central planning and excessive money printing [but] that they’re focusing on the wrong central bank. [Let me explain why that is the case and who the real “culprit” is.] Words: 856

So says Cullen Roche (www.pragcap.com) in an article* which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Roche goes on to say:

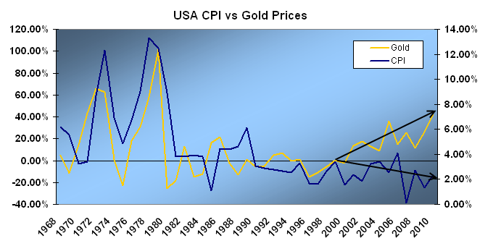

USA Inflation vs. Gold Price

Since the early 1970s US inflation and gold prices have maintained a fairly high correlation [see Figure 1 below]

(Click charts to enlarge)

(Figure 1)

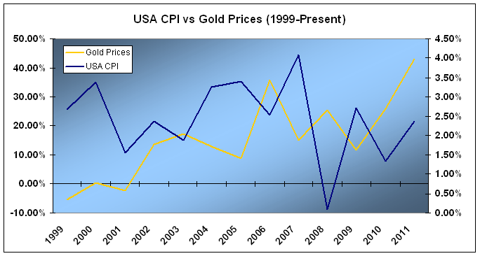

but there has been a notable divergence over the last 10 years [as] is shown more clearly in Figure 2 [below], where we clearly see that gold prices have soared nearly every year during a period of stagnant economic growth in the USA that has generally been characterized by low inflation (which can easily be confirmed by dozens of other independent variables including wages, bond yields, ISM price index data, ECRI Future Inflation Gauge, etc).

(Figure 2)

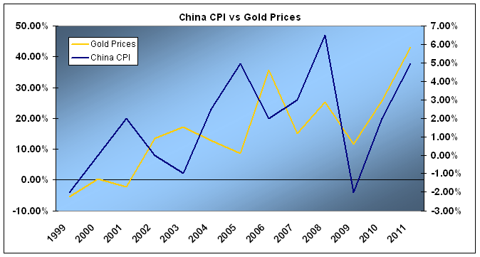

China Inflation vs. Gold Price

So what gives? Why do gold prices continue to soar as the USA continues to suffer through a period of low inflation and general economic malaise? The answer lies not in the “central planning” of the U.S. government, but everyone else’s favorite “central planners” – China.

Who in the world is currently reading this article along with you? Click here to find out.

As we all know, China’s economy has roared to life over the last 10 years. The government has increased the money supply at a 17% annualized rate as it tries to sustain growth. The inflation concerns are well documented and Figure 3 [below] shows the correlation between China’s CPI and gold prices over this period. As you can see, it tells a dramatically different story than the U.S. CPI data does:

(Figure 3)

[According to] UniCredit:The Chinese government has encouraged consumers to invest in gold, and with great success…Although China has evolved into the world’s largest gold producer in recent years[its] annual production…is by no means sufficient to satisfy demand…

Foreign companies are now permitted to offer their gold coins at the Shanghai Exchange, more banks are permitted to import gold from abroad, and more domestic, gold-based investment products are to be developed. As a result, demand of Chinese investors will increasingly be felt on the global market. But the Chinese government also has an ever greater interest in gold imports. [While China’s] gold reserves [have almost doubled of late] they are still at a very low 1.7% of the entire foreign exchange reserves. If China is targeting a gold reserve of, for example, 10%, it would have to purchase…2.4 times global annual production. If China were to meet the demand only from domestic producers, it would take 19 years to achieve this objective. Since the gold market is, per se, only a very small market, further increases in the price of gold are pre-programmed.

I…think gold is entering an irrational bubble and I believe one of the primary drivers of this inevitable bubble is this misconception that the USA and the Federal Reserve are the primary causes of inflation and gold prices. The reason the hyperinflation theory in the USA has been so wrong (aside from misunderstanding how the modern monetary system works) is because the hyperinflationists have misunderstood the actual cause of their inflation worries. They’ve no doubt been right (in terms of gold), but they’ve been right for the wrong reasons. In my opinion, it is not the “central planning” of the USA that is causing this fear trade, rather, the true fundamental driver is the Central Bank of China.

Conclusion

The key for investors will be understanding the point where the gold market reaches disequilibrium based on these misconceptions (the Euro crisis and the Fed contribute significantly to this misconception) and undergoes the inevitable collapse that always follows a bubble. I personally don’t think we’re there yet.

*http://pragcap.com/do-gold-prices-correlate-with-u-s-inflation

Related Articles:

- $325/ozt. Silver and $6,800 Gold Quite Possible – Here’s Why

- What’s the Difference Between 1 Gold Carat, 1 Diamond Carat and 1 Troy Ounce?

- Update: These 90 Analysts Believe Gold Will Go To $5,000 ozt. – or More

- How Much Gold Should You have in Your Portfolio

- $1,700 – $1,800 Still Not Too Much to Pay for Gold! Here’s Why

- Gold is Not an Investment – Gold is Money – and Here’s Why

- Richard Russell: Get Prepared – A Gold Tsunami is Coming

- Gold to Repeat?

- Gold & Silver: the Ideal ‘Buy and Hold’ Investments – Here’s Why

Editor’s Note:

The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

What global currency is all the Gold thats bought payed for with? If the US $ is knocked off its reserve currency status then there will be an instant snap move toward hyperinflation. The fact is that the Chinese want the Yuan to be the reserve currency because this is the only way they can become a super power and fund the internal expansion ie welfare state technology based expansion they want. Right now there is both wealth like you cannot imagine allong side third world poverty in China. The problem is that the USA will need to change places with China in this scenario and this will both create poverty America has never seen since the Great Depression and destroy the middle class.

Great article!

Remember China is 2nd largest economy in the world. China’s CPI increasing almost 50% ’08 and close to 40% ’11 shows that China has more inflation than USA. I’m not saying USA’s expansion of M3 is without dangers, but Asia buys more gold than USA. China, Thailand, India, Phillipines and so on all buy large amounts of gold, and they have a tradition to do so.

are you kidding? what about the bailouts and xcess money printing??