LOOK! Everyone needs to see this. United States owes a lot of money. As of 2012, US debt is larger than the size of the economy. The debt ceiling is currently set at $16.394 Trillion, estimated to be hit around Sep 14, 2012. In the infographic below that enormous amount is illustrated in $100 bills. It’s frightening! Words: 605

2012, US debt is larger than the size of the economy. The debt ceiling is currently set at $16.394 Trillion, estimated to be hit around Sep 14, 2012. In the infographic below that enormous amount is illustrated in $100 bills. It’s frightening! Words: 605

| One Hundred Dollars |

| $100 – Most counterfeited money denomination in the world. Keeps the world moving. |

| Ten Thousand Dollars |

| $10,000 – Enough for a great vacation or to buy a used car. Approximately one year of work for the average human on earth. |

| One Million Dollars |

| $1,000,000 – Not as big of a pile as you thought, eh? Still this is 92 years of work for the average human on earth. |

| One Hundred Million Dollars |

| $100,000,000 – Plenty to go around for everyone. Fits nicely on an ISO / Military standard sized pallet.The couch below is worth $46.7 million. Made out of crispy $100 bills. |

| One Billion Dollars |

| $1,000,000,000 – You will need some help when robbing the bank. Interesting fact: $1 million dollars weights 10kg exactly. You are looking at 10 tons of money on those pallets below. |

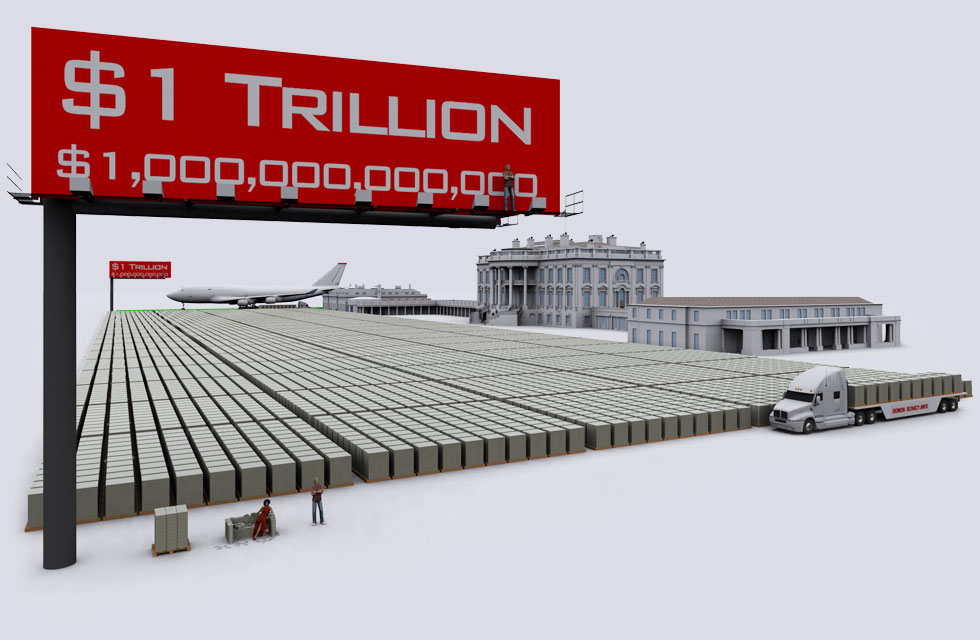

| One Trillion Dollars |

| $1,000,000,000,000 The 2011 US federal deficit was $1.412 Trillion– 41% more than you see here. If you spent $1 million a day since Jesus was born, you would have not spent $1 trillion by now…but ~$700 billion- same amount the banks got during bailout. |

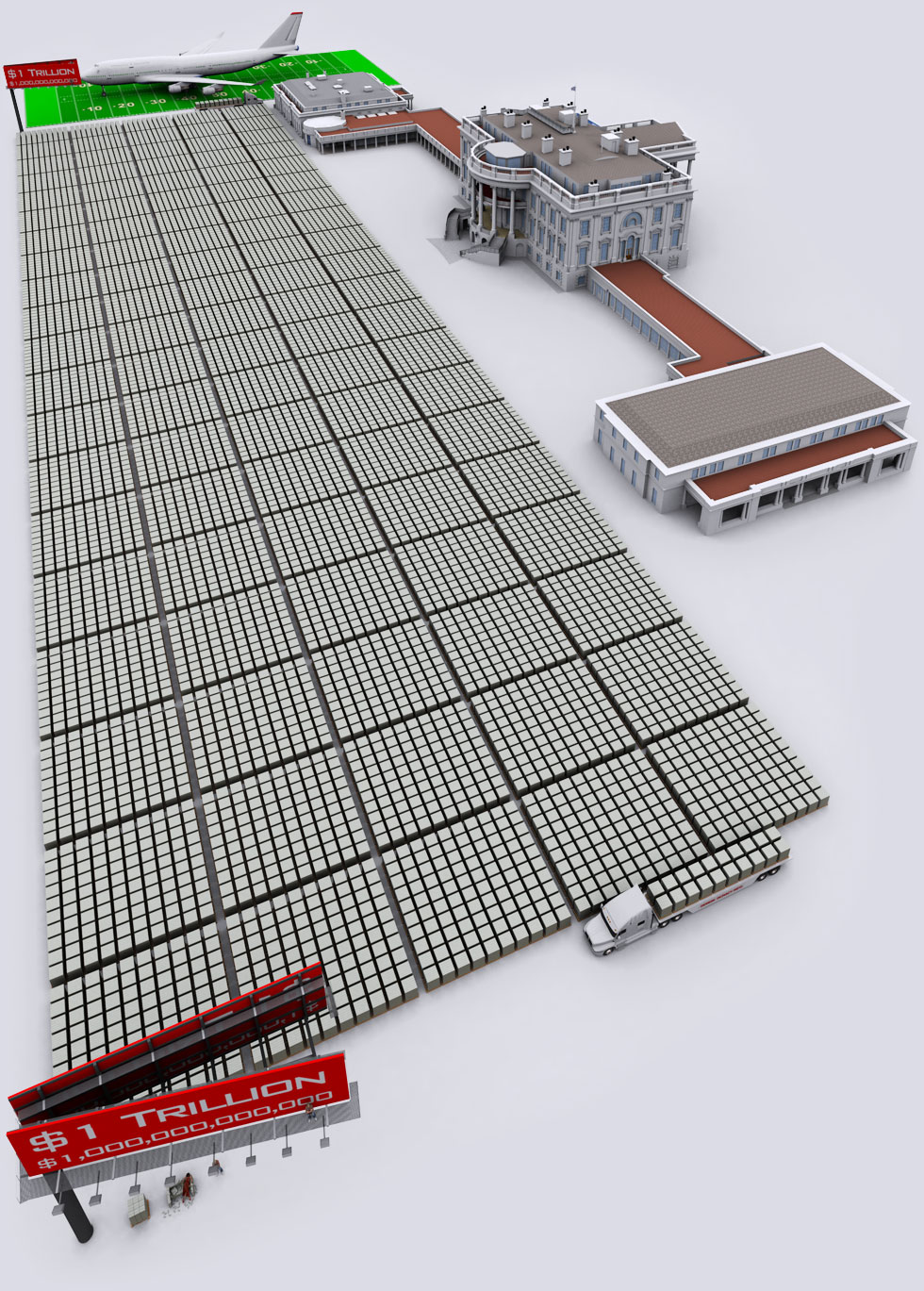

| One Trillion Dollars |

| Comparison of $1,000,000,000,000 dollars to a standard sized American football field. Say hello to the Boeing 747-400 transcontinental airliner that’s hiding in the back. This was until recently the biggest passenger plane in the world. You can see the White House with both wings to the right.”My reading of history convinces me that most bad government results from too much government.” – Thomas Jefferson |

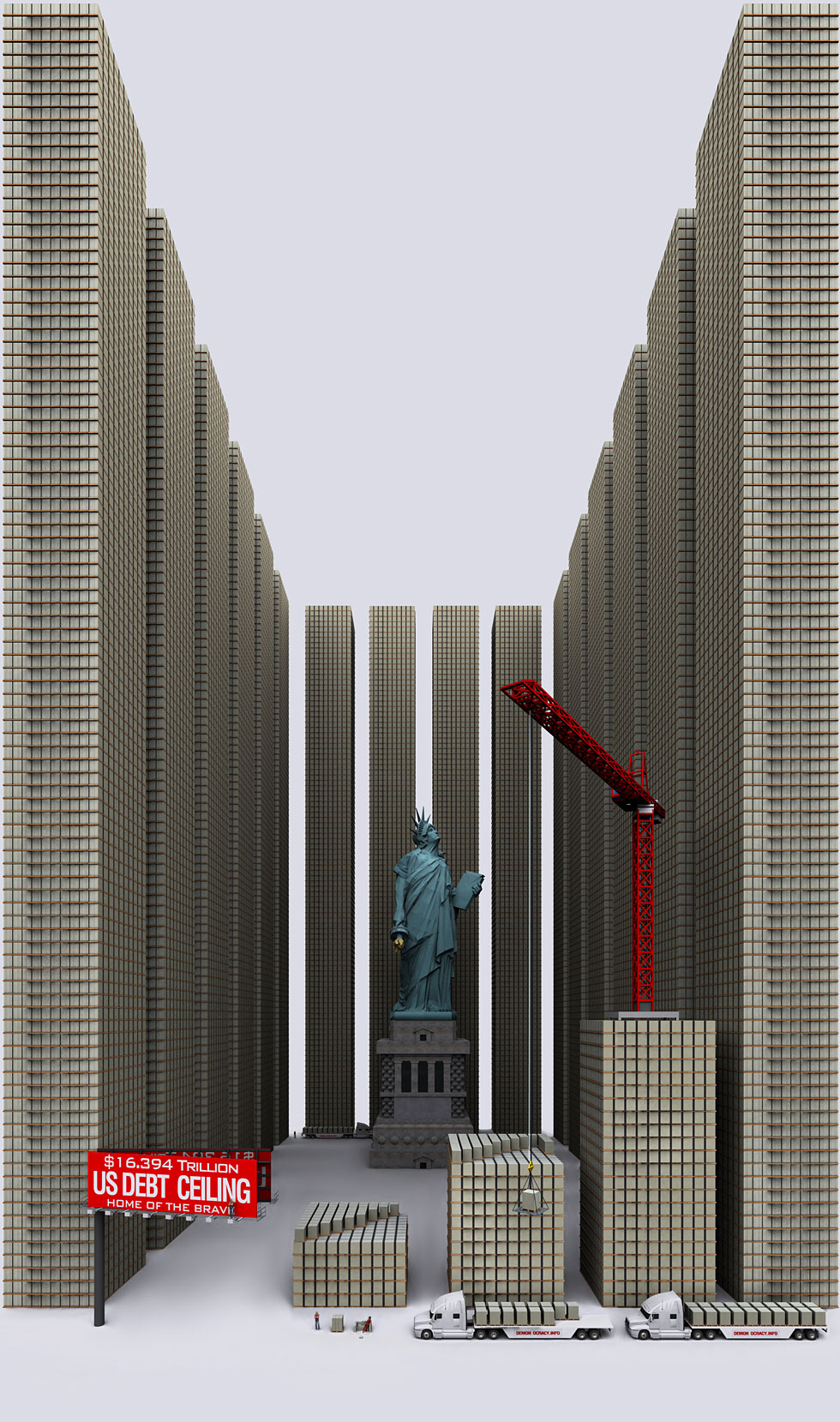

| $16.394 Trillion – 2012 US Debt Ceiling |

| The U.S. debt ceiling limit D-Day is estimated for September 14, 2012. US Debt has now surpassed the size of US economy in 2011– rated @ $15,064 Trillion. The Statue of Liberty below seems rather worried as United States national debt is soon to pass 20% of the entire world’s combined economy (GDP / Gross Domestic Product).“I predict future happiness for Americans if they can prevent the government from wasting the labors of the people under the pretense of taking care of them.” – Thomas Jefferson |

| 122.1 Trillion Dollars |

| $122,100,000,000,000. – US unfunded liabilities by Dec 31, 2012.Above you can see the pillar of cold hard $100 bills that dwarfs the WTC & Empire State Building – both at one point world’s tallest buildings. If you look carefully you can see the Statue of Liberty.The 122.1 Trillion dollar super-skyscraper wall is the amount of money the U.S. Government knows it does not have to fully fund the Medicare, Medicare Prescription Drug Program, Social Security, Military and civil servant pensions. It is the money USA knows it will not have to pay all its bills. If you live in USA this is also your personal credit card bill; you are responsible along with everyone else to pay this back. The citizens of USA created the U.S. Government to serve them, this is what the U.S. Government has done while serving The People.The unfunded liability is calculated on current tax and funding inputs, and future demographic shifts in US Population.Note: On the above 122.1T image the size of the bases of the money stacks are $10 billion, and 400 stories @ $4 trillion”It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars of the world.” – Thomas Jefferson Everyone needs to see this. Source: Federal Reserve & www.USdebtclock.org – visit it to see the debt in real time and get a better grasp of this amazing number. *http://demonocracy.info/infographics/usa/us_debt/us_debt.html Related Articles: The derivative market has blown a galactic bubble…and since there is literally no economist in the world who knows exactly how the derivative money flows or how the system works,…we really don’t know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times. [If, and when, it happens it] will be catastrophic for the world financial system. If you ever wanted a tool to help yourself or others visualize the staggering magnitude of US debt and derivatives, the infographic below is a good one to share. It visualizes who those 9 too-big-fail banks are, what their derivative exposures are, and what scandals they’ve been lately involved in. Words: 1915 2. Amazing Stats: % of U.S. Debt Held By Foreigners Keeps Growing – Here’s Who Over the years foreigners have been buying more and more U.S. debt and now amounts to 33% of the total which is up from “just” 27% at this time 4 years ago and less than 15% only 20 years ago. However, given the dire state of U.S. finances it makes one wonder how much longer this trend will continue and what the consequences will be when the U.S. nolonger has a ready buyers to subsidize their excessive ways. Let’s take a look at which countries and entities hold the U.S. debt and the extent to which it has changed over the years. Words: 480 3. The Zombification of the Financial System: Debt is NOT a Free Lunch, Debt is NOT Wealth! Why are both debtors and creditors willing to build a status quo of massive unprecedented debt? [After all, the delusions of] creditors that debt is wealth and should never be liquidated, and of debtors that debt is an easy or free lunch have been smashed by the juggernaut of history many times before…[and] I think they will soon be smashed again. [Let me explain.] Words: 1150 4. U.S Likely to Hit the Financial Wall by 2017! Here’s Why The deficits aren’t going to stop anytime soon. The debt mountain will keep growing…Obviously, the debt can’t keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things….The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for….[and] the Federal Reserve will hear their prayer. When will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. [Let me explain what I expect to unfold.] Words: 1833 5. True Money Supply Is Already Hyperinflationary! What’s Next? |

*http://demonocracy.info/infographics/usa/us_debt/us_debt.html

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money