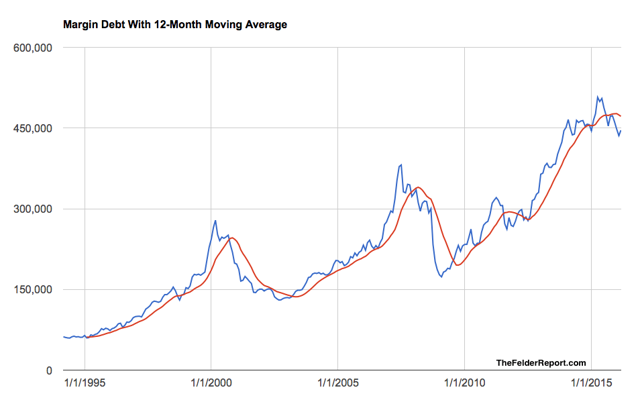

…Margin debt is now in a downtrend, coming off of the highest absolute…and relative…highs ever seen, [with] the nominal level of margin debt well below its 12-month average and, if you think of margin debt as a simple indicator of potential supply and demand for stocks (when borrowing is low, there is great potential demand and vice versa), then this should have you worried about another bear market – and the statistics bear this out.

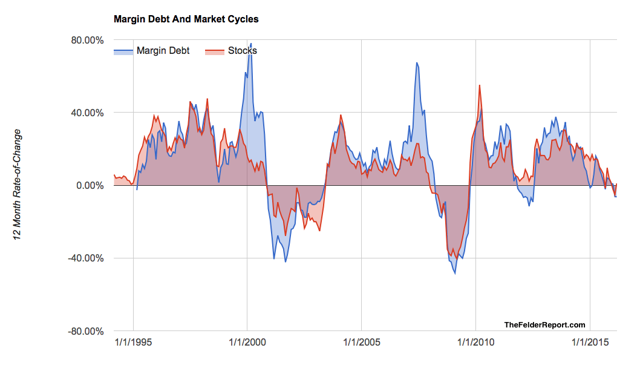

The 12-month rate of change, which is pretty tightly correlated with stocks’ same rate of change, is also still negative.

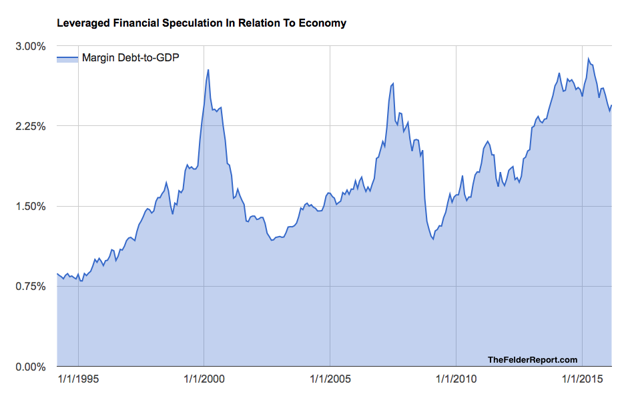

Now this sort of a downtrend in margin debt doesn’t always lead to a bear market, but let’s put it into some context. Not only is margin debt now in a downtrend, but also it’s coming off of the highest absolute (top chart) and relative (chart below) highs ever seen.

If you think if margin debt as a simple indicator of potential supply and demand for stocks (when borrowing is low, there is great potential demand and vice versa), this should have you worried about another bear market – and the statistics bear this out.

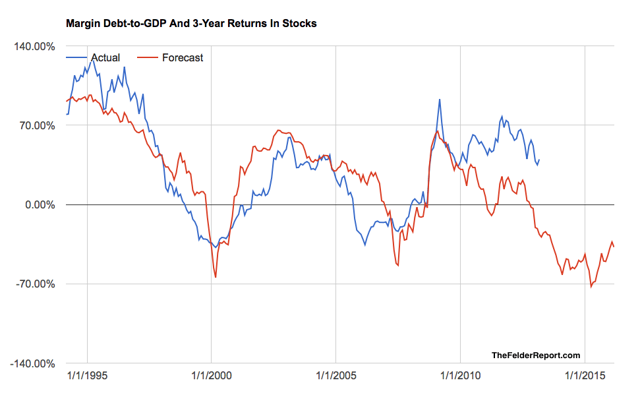

When margin debt has reached relative extremes, it has been a very good indicator of, in the words of Warren Buffett, broad investor, “fear and greed.” To demonstrate, when financial speculation relative to the overall size of the economy has been very low, forward three-year returns have been very good and vice versa.

Conclusion

…[The fact] that margin debt is now in a downtrend and its relatively massive size suggests returns over the next three years will be very poor. In other words, based solely on this one measure, buying stocks today presents investors with a great deal of risk for very little potential reward.

Disclosure: The original article, by , was edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money