The Master Sentiment Index – a composite indicator made from the puts to calls ratio, COT data, dollar purchases of bearish ETFs and four other classic sentiment indicators against the S&P 500 Spider ETF – is signaling the end of this bear market. Let me explain further.

The Theory Of Contrary Opinion

Extreme bearish sentiment – the theory of contrary opinion – states that:

- when the vast majority of investors think stock prices will advance, they almost always decline and, likewise,

- when the vast majority think prices will decline, they usually advance.

- In other words, prices will move contrary to what investors expect but only when those expectations have reached an extreme.

The theory does not consider the economic reasons that are making everyone bullish or bearish in its forecast. It simply states that the necessary and sufficient condition for a major market top or bottom is the existence of an extreme level of bullish or bearish sentiment.

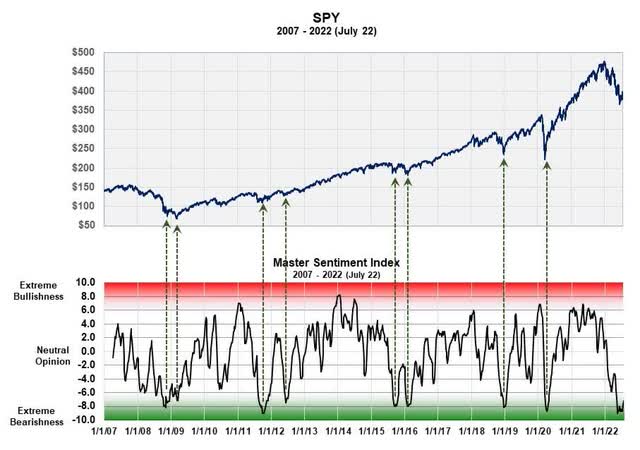

Extreme bearish sentiment is better than any other technical or economic statistic at signaling endings of bear markets as illustrated in the 16-year chart below since the current level is at the same levels registered at the eight previous bear market lows.

The Master Sentiment Index [MSI] vs SPY (Michael McDonald)

Measuring Bearish Sentiment

How do you determine when there is “extreme bearish sentiment?” Since the theory was first formulated by Humphrey Neill in 1954, different ways to “measure” investor opinion have developed.

- Some are based on investor activity, such as the amount of investor short selling, short interest or put buying.

- Some are based on market surveys such as the “American Association of Individual Investors” bullish and bearish percent, or the “Investors Intelligence” bullish-bearish advisory ratios. The latter was started in the mid-1960s and history shows it has worked pretty well over the last 60 years at locating market bottoms.

While sentiment indicators worked better at locating and forecasting bear market bottoms than bull market tops, however, no one indicator always worked best; one or two seemed to work better in some markets than others, so it became important to see if the different sentiment indicators could be combined into one composite sentiment indicator in a logical and mathematically consistent way…

Understanding Why the Theory of Contrary Opinion Works So Well

…The reasons people usually give for why it works is that:

- at the market top, when everybody’s bullish, there are no buyers left to push prices higher, so they decline and, vice a versa

- at the bottom when, after everyone’s turned bearish and sold their positions expecting prices to go lower, there’s no one left to sell so prices begin to rise with just a meager amount of buying

but there is more to it than this.

My Conclusion

I believe in contrary opinion as a fundamental theory in predicting stock prices, but there’s also an economic aspect to the theory and that is that the economic outlook that is making everyone bullish or bearish must be wrong—there must be some holes in the data or thinking about the data – so, in applying the theory, you try to discover the true economic scenario people are missing, i.e. finding today the economic scene that is about to emerge that will explain why stock prices moved opposite to what everyone expected.

I believe it’s this:

- The sudden jump in inflation is temporary and about to end. Serious, endemic inflation doesn’t start this way; it starts gradually then grows bigger and bigger. Both the suddenness and the size of this current round are clear signs to me of a temporary situation.

- The Fed rate hikes will bring an end to inflation quickly and even bring about some deflation and they will quickly reverse their actions and, by that time, the market will be 25% to 50% higher.

The above version of the original article by Michael James McDonald has been edited ([ ]), abridged (…) and reformatted for the sake of clarity and brevity to provide the reader with a faster and easier read.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Could it be that the error lies in the public being misled by economists, and by the Fed and Wall Street?