There [appears to be] light at the end of the tunnel for gold investors. Here’s why

The comments above and below are excerpts from an article by Albert Sung (Katchum.blogspot.ca) which has been edited ([ ]) and abridged (…) to provide a faster & easier read.

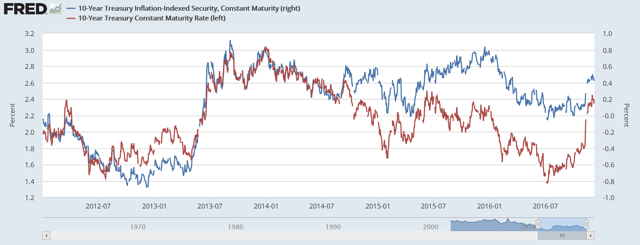

[As you can see in the chart below] the 10 year bond yield has…[risen] from 1.8% to 2.4% since the election, but 10 year Treasury Inflation Protected Security (TIPS) yields have…[risen] from 0.14% to 0.45%…That means there is more demand for TIPS than for normal bonds [and, since] people buy TIPS…to hedge against inflation, I expect there will be a higher inflation rate going forward.

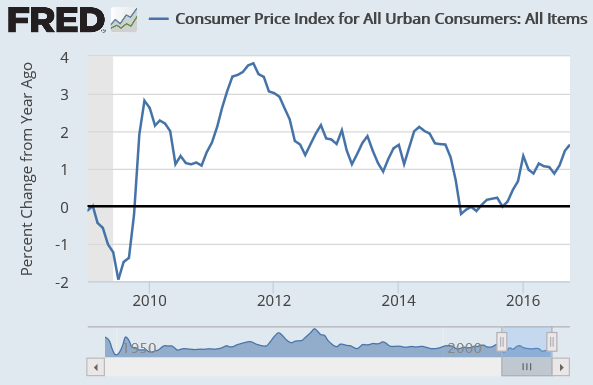

CPI

The CPI has been consistently rising year over year.

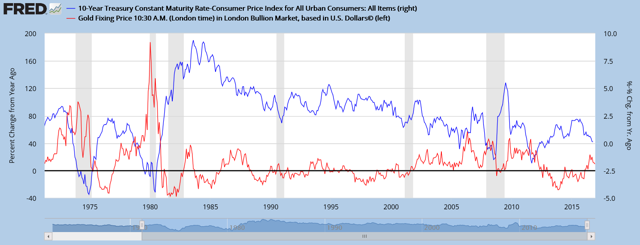

TIPS Yield vs. Gold Price

If the CPI rises faster than bond yields rise, then that would be good for gold and it looks like the blue line [in the chart below] (TIPS yield) is trending to the downside, which means the red line (gold price) will be rising.

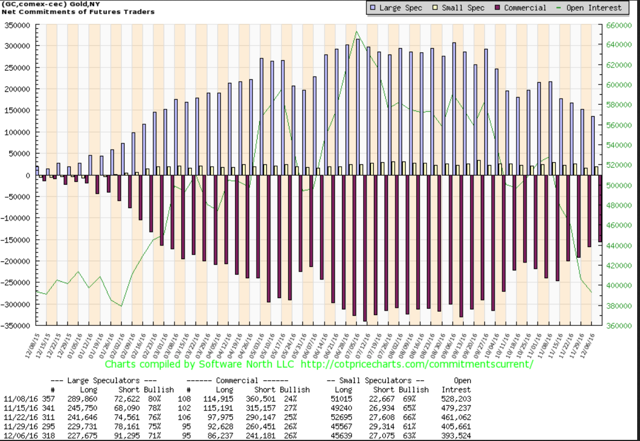

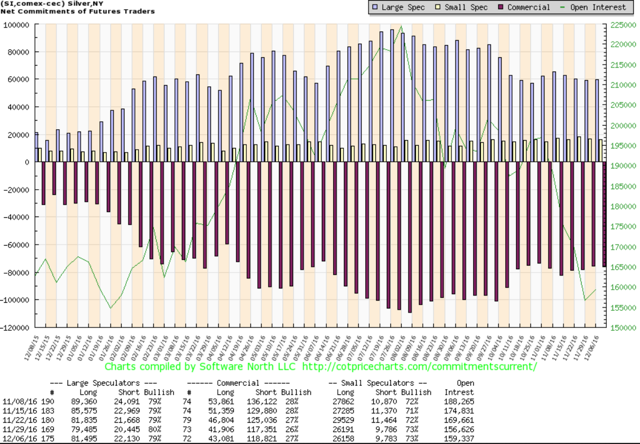

COT Report

The COT report for this week was bullish for gold [see below]. Managed money shorts have been rising and commercials have been covering their shorts.

At this rate I will be buying gold end December-January.

Silver

Silver is less bullish, but will eventually follow where gold is headed.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money