We are of the opinion that the miners and explorers (and their indexes GDX and GDXJ} should be “swapped” for the precious metals – gold, silver, and their proxies (GLD and SLV). This way investors will maintain exposure to precious metals while reducing their exposure to the more volatile miners as some of the share dilution and recent investor exuberance play out – and at least hedge themselves if the price continues to rise.

the precious metals – gold, silver, and their proxies (GLD and SLV). This way investors will maintain exposure to precious metals while reducing their exposure to the more volatile miners as some of the share dilution and recent investor exuberance play out – and at least hedge themselves if the price continues to rise.

The above comments are edited excerpts from an article* by Hebba Investments (hebbainvestments.com) as posted on SeekingAlpha.com under the title Investors Take Note That 2 Headwinds May Restrain Share Price Increases For Gold And Silver Miners.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and the FREE Market Intelligence Report newsletter (register here; sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say in further edited excerpts:

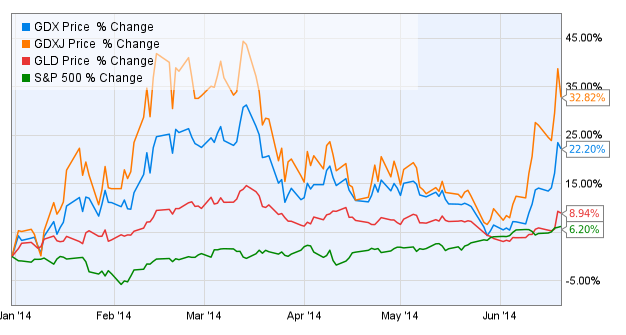

By almost any measure of evaluation the gold miners have given investors a reason to smile in 2014 after a lot of tears (or worse) in 2013. The YTD chart below shows that the Market Vectors Gold Miners ETF (GDX) up 22% and the Market Vectors Junior Gold Miners ETF (GDXJ) up a tremendous 33% – these are huge returns compared to SPDR Gold Shares (GLD) and the SPDR S&P 500 (SPY).

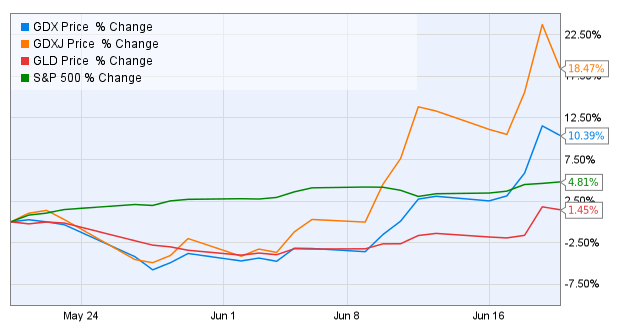

When we break it down even further and look at the gains over the past month it is even more stunning as the GDX is up 10% and the GDXJ is up 18%, compared to gold’s lethargic 1.45% rise.

Even taking into account the leveraged performance we expect from miners versus the underlying gold price, this is a pretty extreme move and the miners have far outpaced their underlying asset, gold.

Is it Time to Sell and Take Profits?

That is the question any investor should ask whenever we see such extreme moves, and the answer depends on the root of the move – do the fundamentals support the rise or are these speculative players (or shorts covering their positions) which can quickly reverse course?

We think now is the time gold mining investors should be careful, and indeed take a bit of profits as a number of factors may provide some short to intermediate term headwinds for the miners. We want to stress that (1) there is a big difference between the miners and gold and we don’t think investors should be taking profits on gold (this article is specific to the miners), and (2) taking profits does not mean selling an investor’s whole position.

This article doesn’t concern long-term investors with time horizons in years or investors in quality explorers that are illiquid, but is more for the short-term and intermediate term investors who have the desire and the nimbleness to take advantage of these types of moves

[Below are 2]…headwinds that we see and reasons to be cautious.

1. Miners Will Take Advantage of Rising Stock Prices

It is always important for investors to put themselves in the positions of the managers in the companies that they own – what would you be doing if you were mining company executive? That’s what we like to do with our investments, and at this point one clear thing stands out for us to do (as mining executives): raise additional capital (i.e. share dilution).

New share issuance gets a bad name but it is a necessity in the exploration and mining industry, and there are advantages that may make it much more attractive then debt in certain situations but it does often send share prices down, and unless the company is significantly undervalued it is better to purchase shares afterward so the terms of the dilution can be evaluated.

The rollercoaster rise for explorers in 2014 has made the psychological desire to raise capital even greater than in a more traditional year, as many of these companies have seen their share prices rise significantly (30% and more), fall back to almost even in April and May, and then rise 30% or more in a matter of weeks. Companies that did not raise capital earlier in the year (at higher share prices) were probably surprised at the depth of the drop in April and May and were forced to the sidelines despite the need for new capital. Well, many of these companies are back (or close) to earlier 2014 highs and may quickly take advantage of the increased share prices to raise capital that they weren’t able to raise earlier in the year.

We are not going to discuss individual companies in this article, but investors should emphasize taking profits in companies with the following attributes:

- Low cash positions

- Large 2014 exploration programs

- Explorers or developers that have seen large rises in share prices and have not raised money recently

- Companies with large debt loads (i.e. greater than 30% of market capitalization)

These are all prime candidates for new share issuance programs, and we expect a decent amount of that in the coming weeks – investors need to know their companies’ capital requirements and invest accordingly. Again, we want to emphasize that share dilution is not a reason to sell (it’s a necessity after all in this industry) but it is a reason to take at least some profits and wait for a better re-entry point especially if companies issue shares at less attractive terms.

After all, the terms of the share dilution are VERY important to us and capital raises can be positive if we see the company raising capital on strong terms (no warrants, high-priced warrants, or short durations on the warrants, etc) versus weak terms – thus it is very important to read the details on any capital raises.

2. Rising Oil Prices May Favor Gold and Silver Over Miners

For all that has been made about the U.S. oil shale boom, we currently still see oil prices over $100 per barrel – a price level that had NEVER been seen before 2008. We aren’t going to get into oil prices in this article, but with the additional geopolitical pressures in the Middle-East we could see oil prices much higher – and this is despite an extremely weak recovery (if you can call it that) that should be restraining energy prices.

Investors should remember that energy costs are a significant contributor to the expenses of a mining company. These are huge projects that many of these miners run and they eat up electricity and oil.

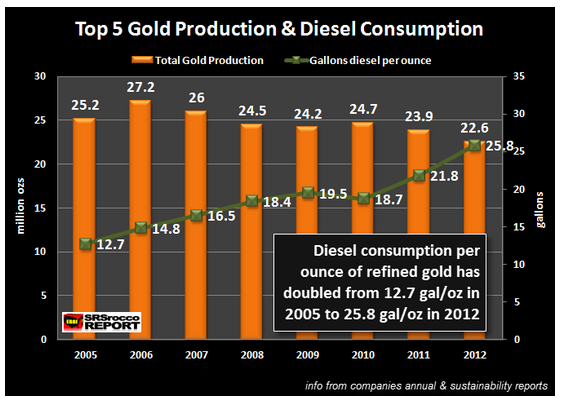

Source: SRSRocco Report

Even though the graph above is a little bit dated, investors can see that the trend for energy costs per ounce is up for the top 5 miners (we assume that Goldcorp (GG), Newmont Mining (NEM), and Barrick (ABX) are included) and we have little doubt that we can extrapolate this across the industry.

[2 points to take special note of:]- If energy prices rise faster than the price of gold, then the profit margins of the miners can be negatively impacted despite a rising gold price. This is a very important point to note and is often missing when analysts estimate valuations based on a future gold price.

- It is not only the relationship between the oil and gold price that makes a difference to profit margins, it is also the amount of consumption PER ounce of production that matters. If a company is seeing fewer grams per tonne of gold or silver, then it is also using more energy to extract that gold – thus a rising oil price will impact the bottom-line greater than a rising gold price.

- A rising oil price is extremely inflationary – since it boosts the costs of almost everything in our society – thus gold’s inflation hedge properties are much more attractive and, [as such,] would actually bolster the gold price at the expense of miners.

It is one of the above factors that may make investors want to trade miners for gold and the gold ETFs.

Conclusion for Investors

- The recent rise in the gold miners and explorers may be a good time to take profits as companies have quite a bit of incentive to raise shares and dilute investors.

- Additionally, the rising oil price may actually be a negative factor for gold miners such as Goldcorp, Newmont, Barrick Gold, and any other miners as it cuts into profit margins – especially if the oil price is rising faster than the gold price.

- As we stressed earlier, this must be done on a company-by-company basis (share issuance will not be needed by everyone) and taking profits is not the same as completely selling a position and may not be relevant to long-term investors.

- Additionally, we would not be selling the miners without increasing our position in physical gold, physical silver, and the gold/silver ETF’s (note the separation) – we still believe that investors should have a significant position in precious metals.

The miners and explorers (and their indexes GDX and GDXJ} should be “swapped” for the precious metals – gold, silver, and their proxies (GLD and SLV). This way investors will maintain exposure to precious metals while reducing their exposure to the more volatile miners, as some of the share dilution and recent investor exuberance play out – and at least hedge themselves if the price continues to rise.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

* http://seekingalpha.com/article/2280463-investors-take-note-that-2-headwinds-may-restrain-share-price-increases-for-gold-and-silver-miners (© 2014 Seeking Alpha )

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

PM in the hand is in my opinion far better than the paper promise of PM’s in the future, especially if flat money collapsed for any reason.