The average American needs their retirement savings to last them 14 to 17 years. With this in mind, is $1 million in savings enough for the average retiree?

This post by Lorimer Wilson, Managing Editor of munKNEE.com, is an edited ([ ]) and abridged (…) version of an article by VisualCapitalist for the sake of clarity and length to ensure a fast and easy read.

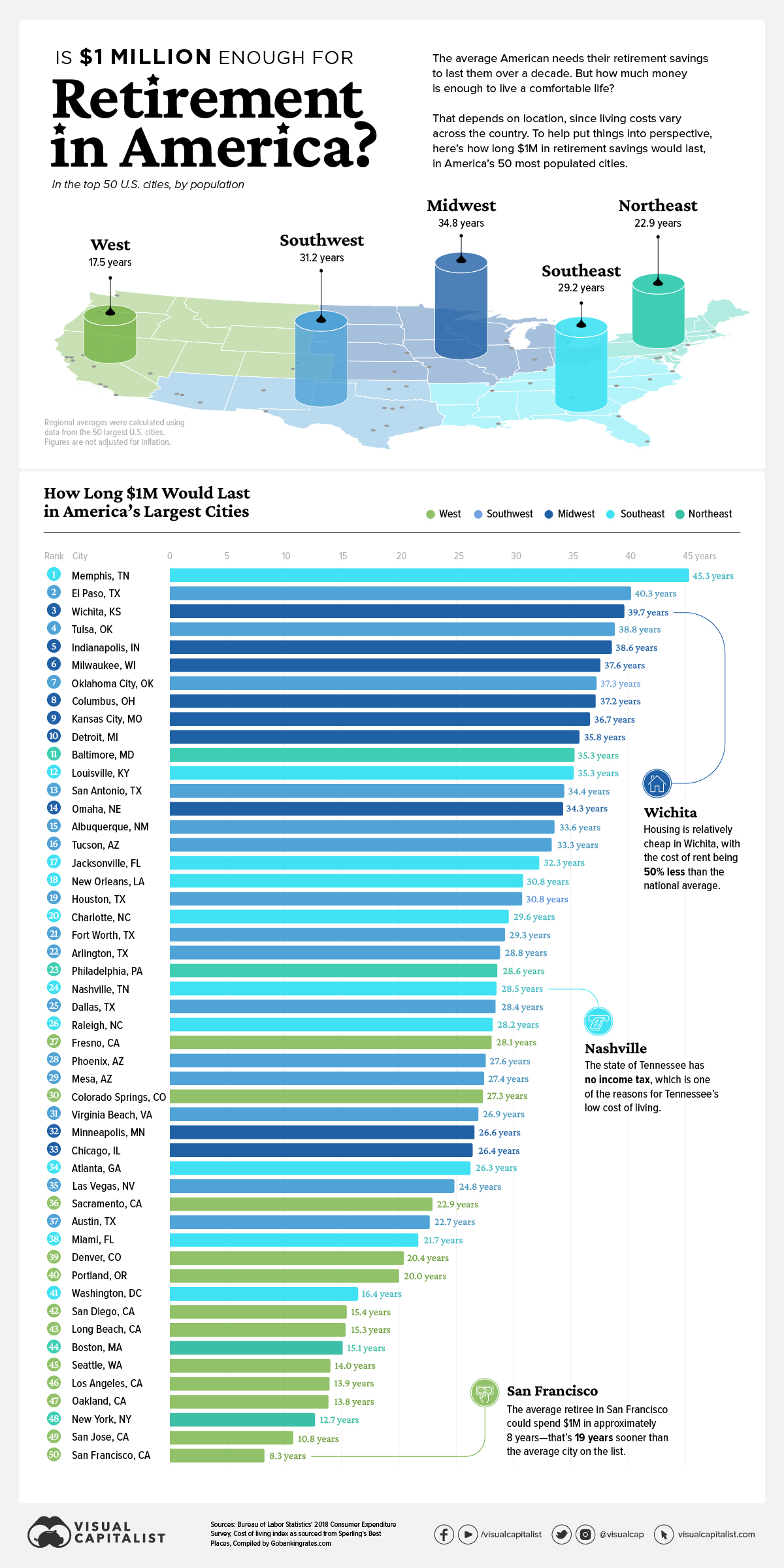

Ultimately, it depends on where you live, since the average cost of living varies across the country. This graphic, using data compiled by GOBankingRates.com shows how many years $1 million in retirement savings lasts in the top 50 most populated U.S. cities.

To compile this data, GOBankingRates calculated the average expenditures of people aged 65 or older in each city, using data from the Bureau of Labor Statistics and cost-of-living indices from Sperling’s Best Places. That figure was then reduced to account for average Social Security income. Then, GOBankingRates divided the one million by each city’s final figure to calculate how many years $1 million would last in each place.

Regardless of where you live, it’s helpful to start planning for retirement sooner rather than later but, according to a recent survey, only 41% of women and 58% of men are actively saving for retirement…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money