…Despite the ongoing rhetoric of those fearing inflation due to the Fed’s monetary  interventions, the reality is that such actions have, so far, failed to overcome the deflationary forces of weak global demand.

interventions, the reality is that such actions have, so far, failed to overcome the deflationary forces of weak global demand.

So writes Lance Roberts (www.streettalklive.com) in edited excerpts from his original article* entitled The Fed’s Real Worry – A Pick Up In Deflation.

[The following article is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Roberts goes on to say in further edited excerpts:

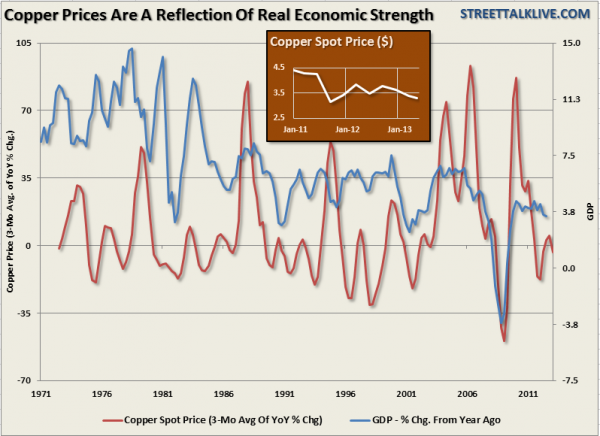

The chart below is the spot price of copper. Copper, often dubbed “Dr. Copper”, is very sensitive to economic growth as copper is used in everything from production, to manufacturing, transportation, housing, etc. So goes copper – so goes the economy. Copper is currently confirming the peak in economic growth for the current cycle.

However, the question remains, do we have inflation or don’t we? Are we experiencing the 1970’s all over again as inflation kills the economy, or in the words of Ben Bernanke, have we entered an era of low inflation and interest rates that will last for some time as the threat of deflation remains a prevalent enemy to the economic recovery?

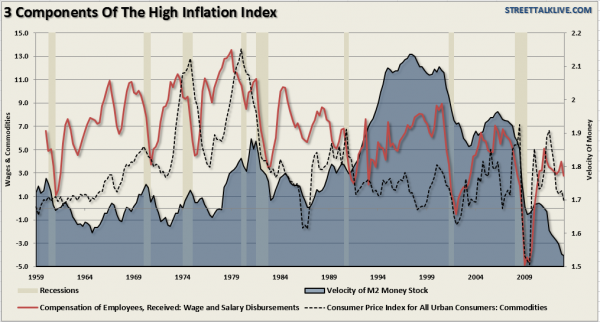

3 Components Of Inflation

There are three components required to create a truly inflation environment.

- Commodity price inflation [because] it immediately impacts the consumptive capability of the average consumer.

- The velocity of money, or how fast money is flowing through the system from the banks to small businesses and ultimately consumers.

- Wage growth which gives the consumer increased purchasing power.

Besides the rise and fall of commodity prices, which do indeed contribute to the inflationary backdrop, the demand for money to make productive investments by businesses which leads to higher levels of production, wage growth and, ultimately, consumption is what drives overall inflation. It is important to remember that in economics inflation is:

“…a rise in the general level of prices of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.”

It is very difficult to have a “general rise in price levels” amidst a lack of consumer demand driven by suppressed wages, high levels of unemployment and little demand for credit by businesses.

The lack of demand exerts downward pressures on the pricing of goods and services keeping businesses on the defensive. This virtual spiral is why deflationary environments are so dangerous and very difficult to break.

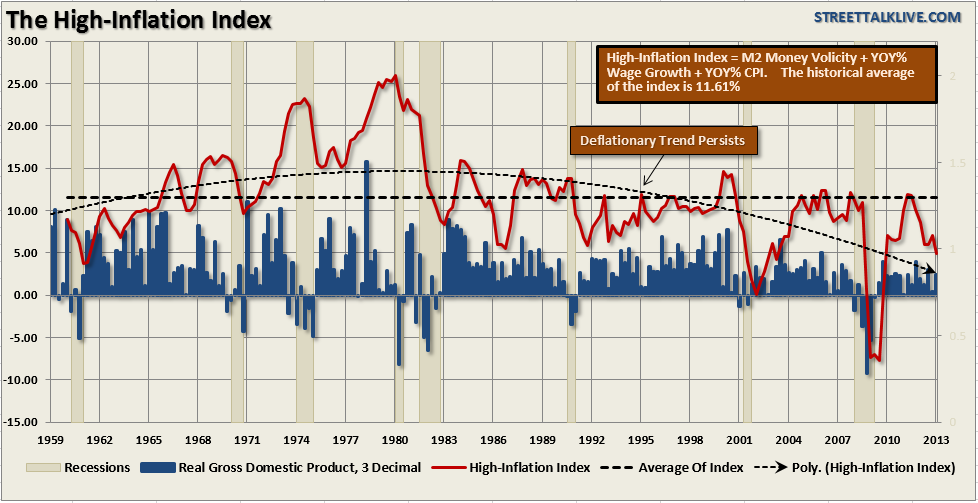

I have constructed a composite “High Inflation Index” in an attempt to measure these three legs of inflationary pressures. The purpose, of course, is to visualize the data to determine if inflation is prevalent in the current economic cycle or not. The index is equally weighted of the M2 Velocity of Money, the Year Over Year (YOY) percent change in wages and the YOY percent change in the Consumer Price Index (CPI). The first chart shows the historical levels of each of the three components.

Notice that there is a very tight relationship between the rise and fall of compensation of employees and the velocity of M2 money supply. With M2 velocity plunging to historically low levels this does not bode well for sustained increases in either employment or compensation as the demand for money simply does not exist currently.

Automatically receive our easy-to-read articles as they get posted!

Sign up for our FREE Market Intelligence Report newsletter (sample)

“Follow the munKNEE” daily posts via Twitter or Facebook

Set up an RSS feed: It’s really easy – here’s how

The next chart is the weighted average of the three components into an index.

The index clearly shows that:

- “high inflationary” pressures were prevalent in the 1970’s as the economy suffered real inflation and rapidly rising interest rates

- inflationary pressures rose as economic growth surged from the lows of the financial crisis as the economic system was flooded by trillions of dollars of stimulus, bailouts and financial supports [and that]

- surges in both the economic growth and the inflationary pressures peaked in early 2011 and have been on the decline since.

This is why the Federal Reserve remains extremely worried about the diminishing rate of return on their monetary experiments as it relates to the economy. Inflating asset prices higher have increased consumer confidence has had little translation into the creation of underlying economic growth.

With the index clearly warning of rising deflationary pressures in the economy, which has recently been seen in many of the manufacturing reports that have shown downward pricing pressures both on prices paid and received, there is no “exit” currently for the Federal Reserve to reduce its monetary supports.

The real concern is that with the index at just 4.88%, which is well below the long term average of 11.63%, the economy is far [too] weak to handle much of an exogenous shock.

The risk…is that the Fed is now caught within a “liquidity trap.”

- The Fed cannot effectively withdraw from monetary interventions and raise interest rates to more productive levels without pushing the economy back into a recession.

- The overriding deflationary drag on the economy is forcing the Federal Reserve to remain ultra-accommodative to support the current level of economic activity.

What is interesting is that mainstream economists and analysts keep predicting stronger levels of economic growth while all economic indications are indicating just the opposite.

Despite the Fed’s recent communications that they are planning to “taper” the current monetary program by the end of this year – the index is suggesting that their interventions, in one form or another, are unlikely to end anytime soon. The threat of “deflation” remains the Fed’s primary concern.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://www.streettalklive.com/daily-x-change/1711-the-fed-s-real-worry-a-pick-up-in-deflation.html

Related Articles:

1. We’re Headed for Crippling Deflation First & Then Rampant Inflation – Here’s Why

Are we headed for rampant inflation or crippling deflation? I believe that we will see both. The next major financial panic will cause a substantial deflationary wave first, and after that we will see unprecedented inflation as the central bankers and our politicians respond to the financial crisis. [Let me explain why I think that will unfold.] Words: 1025 Charts: 3 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

RE: “This is why the Federal Reserve remains extremely worried about the diminishing rate of return on their monetary experiments as it relates to the economy.”

The Fed should be lowering the rate of interest charged by the Big Banks not only to students but also to anyone on Social Security; so that all the Seniors that depend upon Social Security can refinance their homes to one point over what the Big Banks are paying for their money, which is almost ZERO! Then Seniors could help the US economy recover, as they could then spend the difference between their old high mortgage and their new much lower mortgage on making their homes more energy efficient, which would then create good jobs and restart the “supplying” business for Main Street.

Each day that the Fed allows the Big Banks to hold Seniors as credit hostages (because they have little to no “income”), is yet another day our economy will collapse a bit more toward financial DOOM for the majority of Americans! If the Fed along with the POTUS declared WAR on Senior poverty, every Senior in the USA could refinance their loans and in doing so help jump start our economy!

Uncle Sam Needs You …

… To Refinance

In reality the USA is steadily heading downhill and the Ultra Wealthy are enjoying every minute of it as things just keep getting cheaper (for them) to acquire!

Expect to see additional civil unrest, as the youth of America gets frustrated by their elected Leaders who are now just looking out for themselves and their wealthy donors, instead of the majority of their constituents!

+

Two great graphics:

These 6 Corporations Control 90% Of The Media In America – Business Insider

http://www.businessinsider.com/these-6-corporations-control-90-of-the-media-in-america-2012-6

This Chart Shows The Bilderberg Group’s Connection To Everything In The World – Business Insider

http://www.businessinsider.com/this-chart-shows-the-bilderberg-groups-connection-to-everything-in-the-world-2012-6