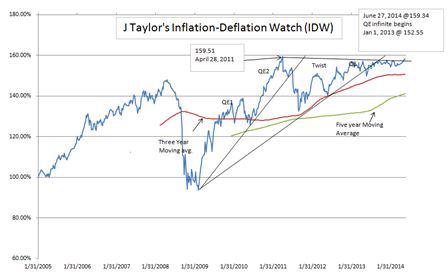

Might our IDW be suggesting a breakout in asset price inflation is about to take place? Could it in fact be presaging the start of John William’s hyperinflationary depression in which prices rise exponentially even in light of massive unemployment and bankruptcies?

Might our IDW be suggesting a breakout in asset price inflation is about to take place? Could it in fact be presaging the start of John William’s hyperinflationary depression in which prices rise exponentially even in light of massive unemployment and bankruptcies? One point worth noting is that commodities…have been showing price strength of late. Copper has suddenly shown new life, especially over the last couple of weeks. It closed at $3.16 this week and is up 7.6% since its March low. Oil is up by 6.8% since its March lows and the Rogers Fund is up 9.2% since its January lows.

One point worth noting is that commodities…have been showing price strength of late. Copper has suddenly shown new life, especially over the last couple of weeks. It closed at $3.16 this week and is up 7.6% since its March low. Oil is up by 6.8% since its March lows and the Rogers Fund is up 9.2% since its January lows.

Prospects for Future Inflation

If we are on the precipice of a serious inflation problem, we should start to see:

- a major decline in the dollar index and

- materials prices start to take off.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://jaytaylormedia.com/are-we-approaching-an-inflation-tipping-point/ (2014 Copyright © Jay Taylor Media )

Related Articles:

1. Fed & Yellen So Far Behind Inflation Curve Chance of Hyperinflation Is Now 35%! Here’s Why

Janet Yellen and the Federal Reserve are so behind the inflation curve, and many other market implication curves, that we probably are staring at a 35% chance of a Hyper-Inflationary period by the time the Federal Reserve realizes that “noise” is actually real inflation! Read More »

2. Probability of Deflation Is 60%, Inflation Is 25% and Muddling Through Is 15% – Here’s Why

At the end of last year virtually every every single economist expected interest rates to rise this year as the Fed tapered their purchases and the economy improved but, in fact, interest rates on the 10 year U.S. Treasury have been going down year to date (from 3% to 2.5% after rising from about 1.6% to 3% last year). The masses, going along with this crowd, got fooled but we have been calling for a decline in interest rates for some time now due to world-wide deflation and it couldn’t be clearer to us that this is the most likely scenario for the United States. Let us explain. Read More »

3. there is no inflation, There is No Inflation, THERE IS NO INFLATION! Yeah, Sure!

Don’t listen to what the official numbers say. Inflation is a big problem already for the U.S. economy – and in an inflationary environment, gold bullion goes up and stock prices go down, because materials cost more and consumers spend less. I’d adjust my portfolio accordingly for the rapid inflation that awaits us. Read More »

4. Inflation: What You Need to Know

The March year-over-year inflation rate was 1.51%, which is well below the 3.88% average since the end of the Second World War and 37% below its 10-year moving average. Read More »

5. 21 Countries Have Experienced Hyperinflation In the Last 25 Years

Hyperinflation is not an unusual phenomenon. 32 countries have experienced hyperinflation over the last 100 years of which no less than 21 have experienced it in the past 25 years and 3 in the past 10 years. The United States is one of the few countries to have experienced two currency collapses during its history (1812-1814 and 1861-1865). Could it happen again? Words: 1450 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money