There are all sorts of rules of thumb about saving for  retirement…[but, while they] can be helpful as a baseline for setting expectations…[you need to] make a plan and monitor your progress as you age…to be effective in the real world.

retirement…[but, while they] can be helpful as a baseline for setting expectations…[you need to] make a plan and monitor your progress as you age…to be effective in the real world.

The original article has been edited for length (…) and clarity ([ ]) by munKNEE.com to provide a fast & easy read. For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

The original article has been edited for length (…) and clarity ([ ]) by munKNEE.com to provide a fast & easy read. For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

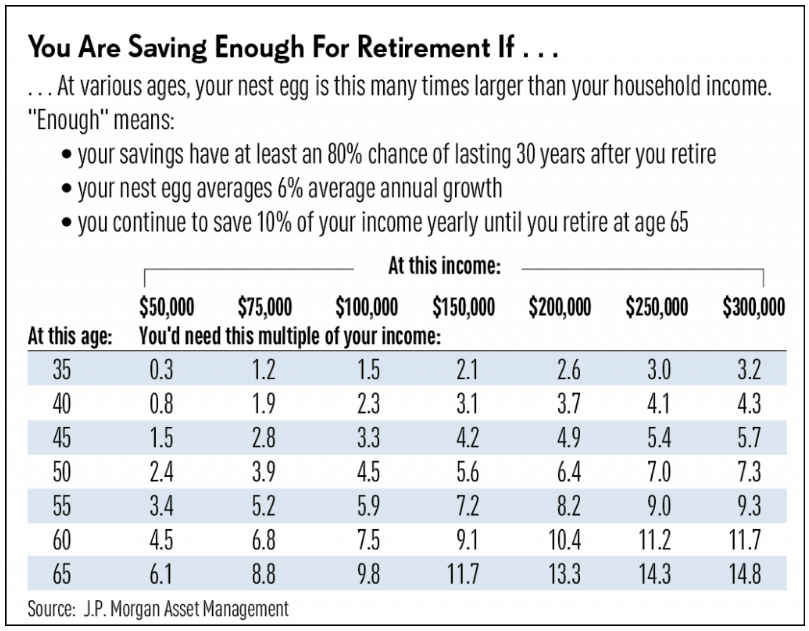

Investors Business Daily published a table from JP Morgan Asset Management…that sought to show how much you should have saved at certain ages relative to your income level using some fairly simple assumptions:

There’s no one-size-fits-all with this type of thing but this is another baseline to give people an idea of where they stand in terms of retirement preparedness. My problem with this type of analysis is that it only considers one side of the equation — your income level.

[As I see it,] it’s pointless to try to figure out how much you’ll need in savings or income if you don’t have a good understanding of how much it costs for you to live [and] where you are in your lifecycle will obviously have a lot to do with how you think about these factors.In your younger years, it’s almost impossible to plan ahead for the exact amount you’ll need based on the exact amount you’ll spend when you retire. There are simply too many variables to consider, many of which can and will change by the time you do decide to accept that gold watch and retire. At this stage in the process, it’s more important to develop good saving habits than anything. The great thing about having a high savings rate is that it means you’ll have less income to replace during your retirement years. Saving more when you’re young is a built-in margin of safety for your future self.

As you approach retirement you’ll have a much better grasp of how much you spend on an annual basis and what your wants, needs, and desires will be in your retirement years. From those numbers, you can come up with a much better estimate of how much of a nest egg you’ll need to cover your annual expenditures and needs from your portfolio. These things are still far from certain since you still have to deal with unknowns such as future financial market returns, your actual lifespan, healthcare costs and those times where life invariably gets in the way and causes you to spend more than you planned for…

‘How much do I need to retire?’ is the question everyone wants to be answered but here are some others to consider as you try to figure it all out:

- How much, if any, debt will I be carrying at retirement?

- What is my lifestyle inflation?

- What is my savings rate and how will it change over time?

- What assumptions am I using for market returns?

- Will I have any dependents relying on me to support them financially?

- How expensive is the cost of living where I reside?

- How much of my portfolio do I plan on spending down each year?

- How will my spending change as I age?

- How flexible will I be with my spending depending on market performance?

- What are my other sources of income in retirement (pensions, social security, part-time work, etc.)?

- Will I continue to work in any capacity when I retire?

- What do I actually want to do with my money?

…No one has this stuff completely figured out. You can run through all the calculations and spreadsheets you want but life will inevitably throw you a curve ball or some of your assumptions will prove to be untrue. This is an unfortunate side effect of trying to plan in the face of never-ending uncertainty. In a way, there’s a lot of guessing involved in the process and this is why financial planning is a process and not an event. You don’t simply set a course of action and follow that exact plan for your remaining days.

Financial plans should be open-ended because there will always be corrective actions, updates, changes in strategy, or difficult decisions that have to be made. It’s like the old saying, “Plans are useless but planning is indispensable.”

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money