…”There is only one reason for declines in the price of gold and it is the exact opposite of the only reason that gold prices go up.”

Prepared by Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money!

[Editor’s Note: This version* of the original article by Kelsey Williams has been edited ([ ]), restructured and abridged (…) by 45% for a FASTER – and easier – read. Please note: This complete paragraph must be included in any re-posting to avoid copyright infringement.]

“Some people:

- assume that somewhat higher gold prices over the past several weeks are at least partially attributable to money fleeing stocks and moving into gold. Some investors may have acquired gold with proceeds from the sale of stocks but there is no correlation between lower stock prices and higher gold prices. (see Gold vs. Stocks: Ratios Do Not Imply Correlation)…

- think that a weakening economy will somehow translate to higher gold prices. It won’t.

- [think that it is based on]…the direction of interest rates…[but they have] no impact on the price of gold.

- [think the] fear of a credit implosion is another reason…[to] expect higher prices for gold. Wrong again. A credit collapse would wipe out trillions of dollars of worthless debt and clip asset prices of stocks, bonds, real estate, commodities, and gold by anywhere from 50% to 90%. There would be less dollars available for use – to have and to hold – and with which to purchase the goods and services that we need and want….The remaining dollars would be more valuable, however. They…[would] purchase more than they would before the collapse. However, there…[would] be less of them to go around.

- Trade tariffs? No.

- World War III? No.

It is all about the U.S. dollar. Declines in the price of gold are a reflection of increasing strength in the U.S. dollar. In other words, the price of gold reflects inversely the strength or weakness of the U.S. dollar.

- If you think the dollar is about to tank then move your dollars into gold – but don’t expect to get rich. The worse it gets for the dollar, the more you will need gold just to survive…

- If you think the U.S. dollar will remain relatively stable, or even increase in value as a result of deflation, then don’t expect higher prices for gold.

…If the dollar were to increase in value significantly, [however,] just how low might the price of gold go?

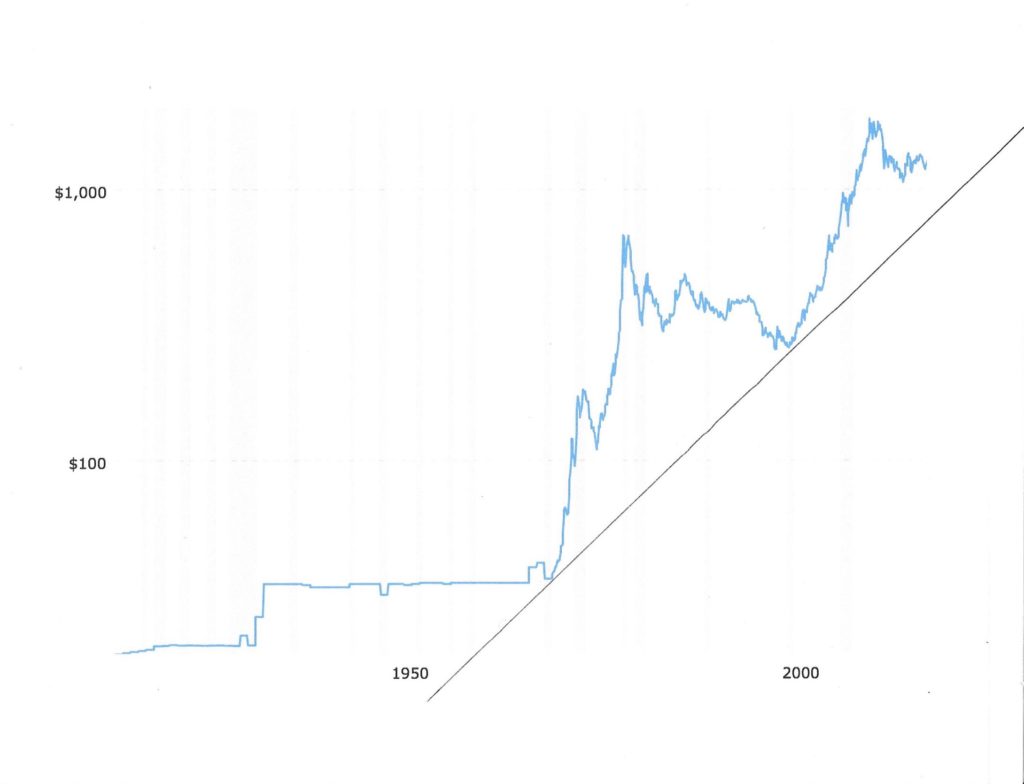

- [Well,] as you can see in the chart below, there is a long-term, forty-eight year uptrend in gold’s price dating back to December 1970 when gold was priced at $36.00 per [troy] ounce. If gold’s price were to decline back to that uptrend line within the next couple of years, then the price range indicated is roughly between $850-1,000.00 per [troy] ounce.

Gold Prices – 100 Year Historical Chart

That may sound distressing to some, but it could be a lot worse.

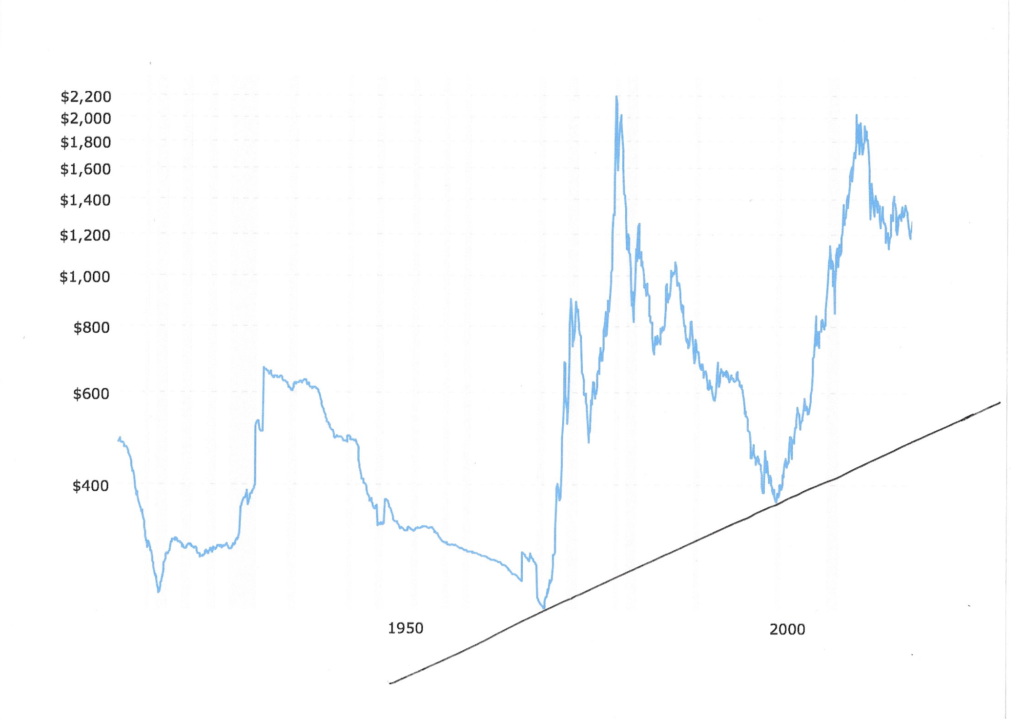

2. The chart below is the same one-hundred year history on an inflation-adjusted basis. The possible downside target changes to somewhere between $550-600.00 per [troy] ounce.

How low can gold go? A lot lower than most want to admit. Under reasonably normal conditions, maybe $850.00-900.00 per ounce. ($850.00 was the January 1980 high point.)…

How low can gold go? A lot lower than most want to admit. Under reasonably normal conditions, maybe $850.00-900.00 per ounce. ($850.00 was the January 1980 high point.)…

There are several scenarios but there is only one thing you need to focus on – the U.S. dollar.

- If the dollar heads lower and accelerates its long-term decline, then the price of gold will reflect that by moving higher.

- If, on the other hand, the dollar continues to stabilize and strengthen, then gold’s price will reflect that by moving lower.

My best guess for 2019 – stronger dollar, lower gold prices (also see The Case For Gold Is Not About Price).”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

Want your very own financial site? munKNEE.com is being GIVEN away – Check it out!A note from Lorimer Wilson, owner/editor of munKNEE.com – Your KEY to Making Money!:

“Illness necessitates that I spend less time on this unique & successful site so:

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Lorimer,

I am not at all certain about the fit, but I think we should at least talk about your offer. Let me know.

Kelsey