Automatically receive the internet’s most informative articles bi-weekly via our free bi-weekly Market Intelligence Report newsletter (sample here). Register in the top right hand corner of this page.

…IF the bull market in stocks and bonds is to end, the implications will be dire because, historically, the Fed has always intervened to prop the market by lowering interest rates. Fed moves impact the broader market equities and impact resource equities alike so let’s take a look at the effect of a general market correction on our resource portfolio…

because, historically, the Fed has always intervened to prop the market by lowering interest rates. Fed moves impact the broader market equities and impact resource equities alike so let’s take a look at the effect of a general market correction on our resource portfolio…

The original article has been edited here for length (…) and clarity ([ ]) by munKNEE.com – a Site For Sore Eyes & Inquisitive Minds – to provide a fast & easy read.

How Does Physical Gold Do In A Recession?

One way to get bear market insurance is to buy physical gold. In bear markets, gold tends to perform better than stocks…because investors see gold as a safe haven…@Investment Insights

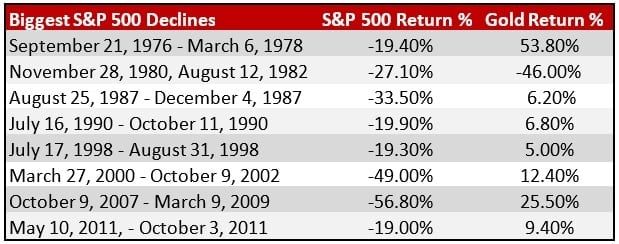

In the table below, you can see how gold tends to perform against the S&P 500 during the most extreme corrections since 1976.

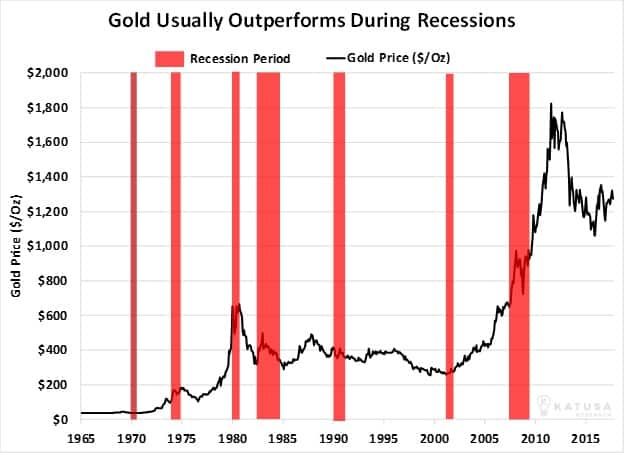

Put differently, the chart below shows how gold performs during recessions (shown in red bars). The black line is the price per one ounce of gold.

The data shows that gold will perform better than the S&P 500 if or when there is a recession in the future.

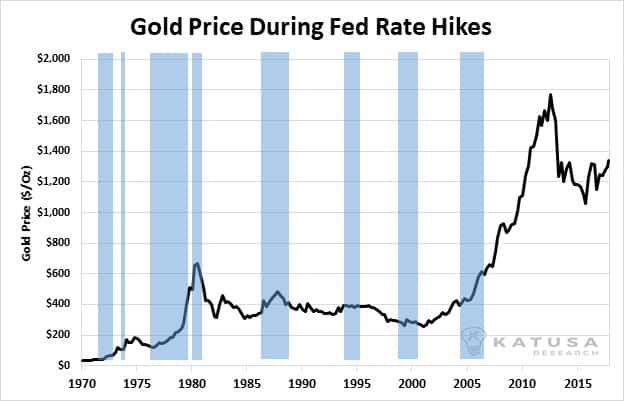

There is a misconception that gold cannot do well in an interest rising environment. The fact is that in a rising interest rate environment, gold can – and has – increased in price.

In the following chart, we overlay gold price action over the last 50 years and highlight times of rising interest rates in blue. You can see how gold performs in periods of interest rate increases by the U.S. Federal Reserve. The chart below breaks the misconception that rising rates are bad for gold, and gold can perform well in an environment of rising interest rates.

The questions you should be asking yourself is this: “Will the U.S Fed continue on the path of higher interest rates with a recently spooked stock market, or will they keep the easy money policy alive?” I will argue that gold will do well in both scenarios but that is a very complicated argument that I will explain in a future essay.

Now let’s turn the focus on gold equities.

How Do Gold Mining Stocks Do In A Recession?

Another way to hedge your exposure to the overall market is by turning to gold mining stocks.

Traditional diversification theory suggests that you invest in a sector by investing in the leading industry ETF. In this case, it suggests that you should invest in the VanEck Vectors Gold Miners ETF, GDX…

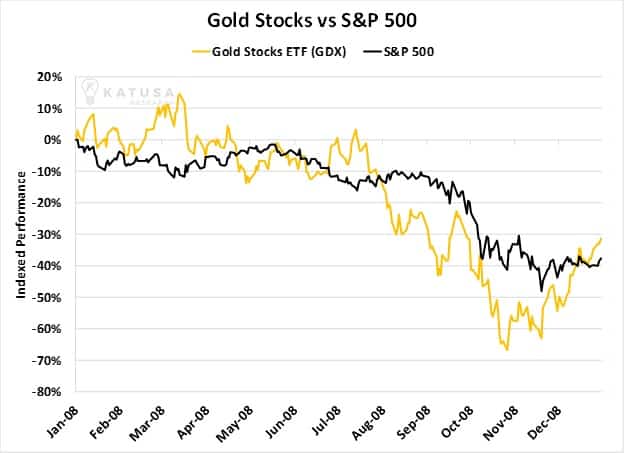

We think there are better ways to invest in the gold sector for the informed and active investor than putting your capital into gold ETFs…[because,] when a recession hits, gold stocks can get hit hard as shown below in a chart of the GDX vs the S&P 500 during the 2008-09 crash.

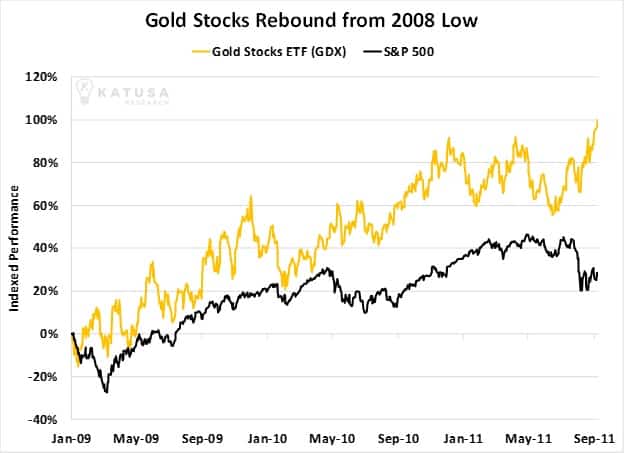

Gold stocks are extremely cyclical in nature. They can have explosive recoveries unlike their broad market equity counterparts after a steep and sharp correction as seen during the recovery from the 2008 low in the chart below…

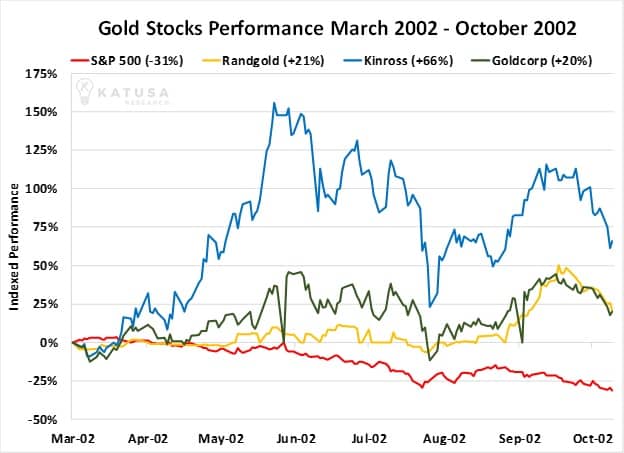

Going back to the dot-com bubble reveals a similar trend. Between March and October of 2002, the S&P declined by 31%. On the other hand, gold stocks like Goldcorp, Kinross, and Randgold were all up over 20% as you can see in the chart below.

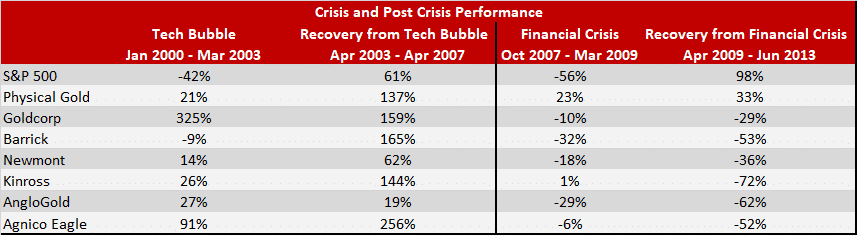

Below is a table which shows the performance of individual gold stocks during the past 2 crises. The recovery period is the time taken to approximately regain the pre-crisis levels in the S&P 500.

It’s clear from the table above that gold equities are very cyclical. Whatever gold stock you own or plan on owning make sure that the company is run by experienced invested management and that the projects can survive a decline in the gold price.

Even though I am very bullish on gold and gold equities, in the long run, we’ve seen that anything and everything will happen in the global markets. U.S. interest rates can:

- rise,

- stay where they are

- or even decrease

- and even the unthinkable-negative interest rates could happen under President Trump.

Each option has incredible ripple effects on the global economy which will affect the gold spot price and even gold equities.

Final Thoughts

When overall stock market corrections happen, they don’t leave any stocks behind. Contrary to popular belief, gold stocks are not spared while physical gold has proven to perform well in corrections.

Prudent investors will look for any market drop to add to existing gold stock positions at bargain prices. Greed will always lure frantic buyers for fear of missing out (FOMO), but panic selling presents buyers with excellent opportunities for entry into your favorite gold stock.

Depending on whether gold is for your own portfolio or not, you need to ask yourself a few questions on your personal tolerance for risk and style of investing…

Where am I putting my own money?

I believe the precious metals sector has massive upside from today’s levels and that gold and gold stocks play a pivotal role in any investor’s portfolio…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I like that you’ve pulled 50+ years of data on gold performance. Although, depending on how you invest in it, gold has been a terrible investment compared to equities. I’ll link to research why on my name. Although, I’m a big fan of “pick and shovel” plays. In past gold rushes, some prospectors made money by finding gold. But the real money was made by providing prospecting tools, saloons, etc.

It’s really a great and useful piece of info.

I’m glad that you simply shared this helpful info with us.

Please stay us up to date like this. Thank you for sharing.