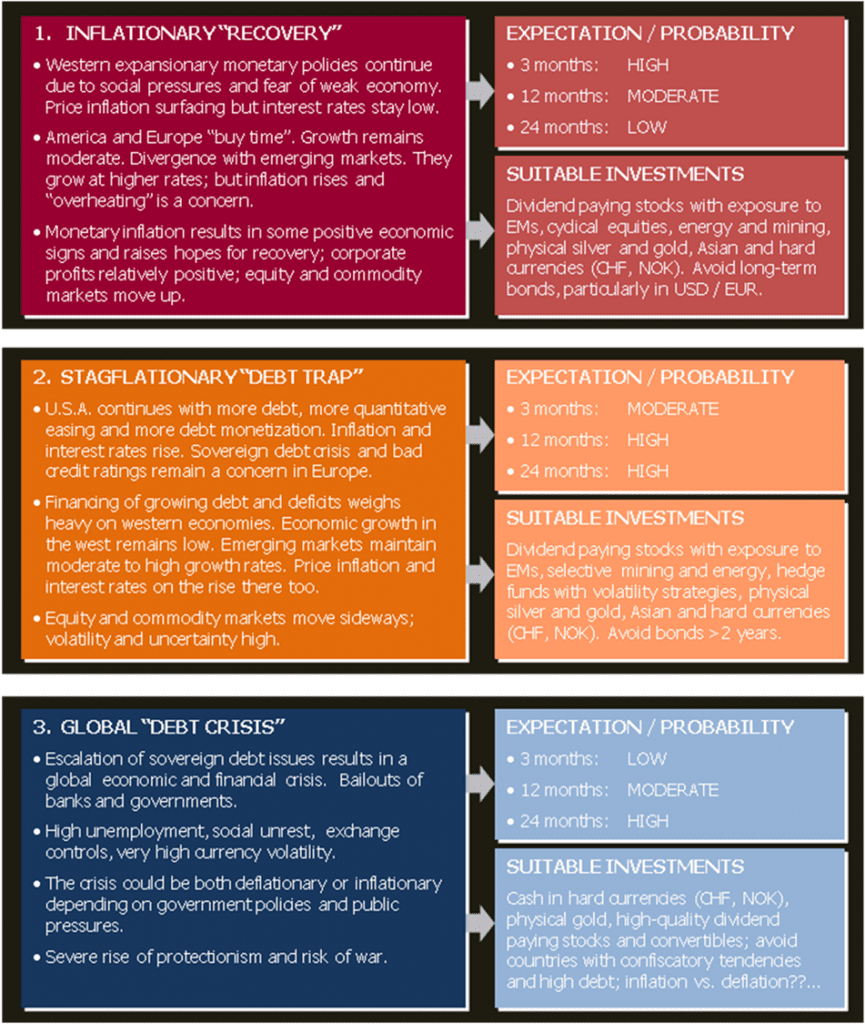

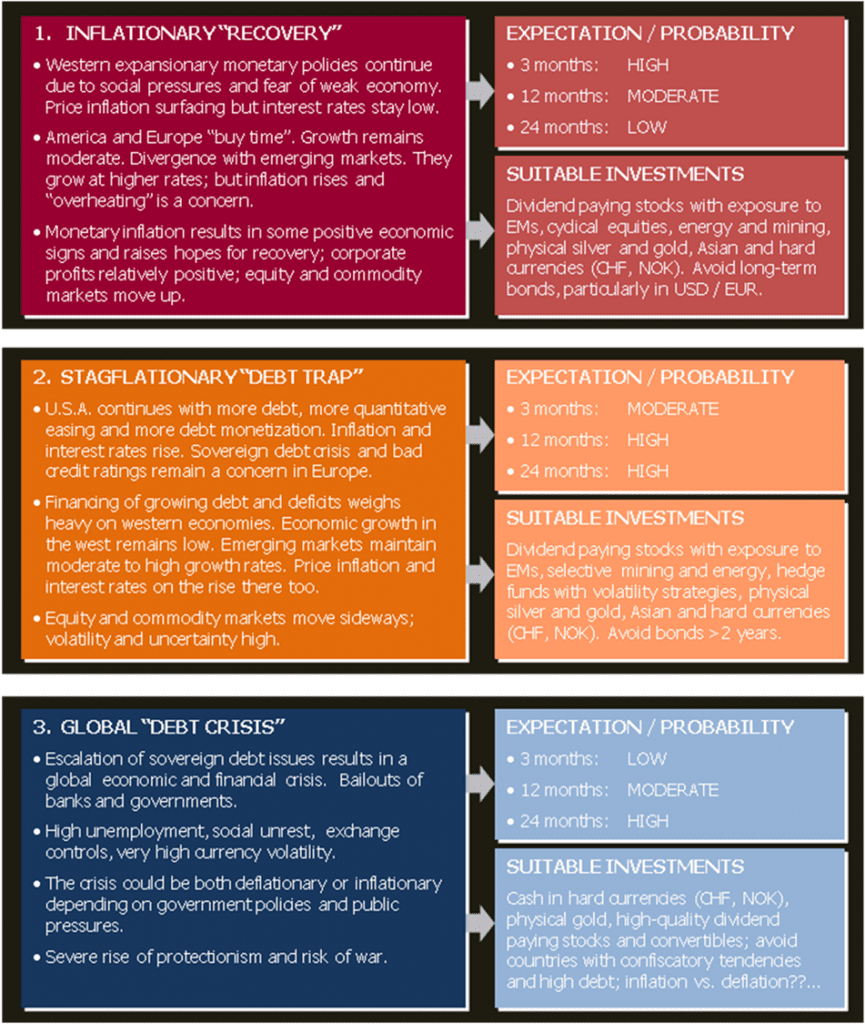

| Inflation is the big ‘sword of Damocles´ hanging over our heads and the higher interest rates that may arrive with it over time. We believe that one of three scenarios is probable in the months and years ahead and in this article we provide a summary of these scenarios and give a brief glimpse into the respective investments/asset classes that we consider most suitable in each scenario. Words: 1331

So says Frank Suess (www.mountainvision.com) in two articles* which Lorimer Wilson, editor of www.munKNEE.com, has amalgamated and further edited ([ ]), abridged (…) and reformatted below into one article for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Suess goes on to say:

The scenarios depicted above are ‘guesstimates´ [but] the conclusions we draw from our analysis [of the various] scenarios are that:

- The western world is still subject to a good degree of deflationary risks which are fervently fought by governments via loose monetary policies. This will not change any time soon. In particular, the U.S. is hell bound for more quantitative easing.

- A certain degree of hope and counter-balance is exuded by the higher growth of emerging markets (EM). The opening up to international trade and pursuit of more market-oriented economic policies by emerging market economies from the 1980´s onwards raised their GDP growth and kicked off a catch-up process with advanced economies. The giants among the emerging economies, China and India, according to Deutsche Bank Research, could be the second and third largest economies of the world by the middle of this decade.

We think that EM growth, along with the continued heavy use of the printing machine in the U.S., will lead to hope and some positive signals that could carry financial markets higher in the coming months.

That being said, an acceleration of inflationary tendencies can evolve quickly and we feel that all of the abovementioned scenarios – and in particular Scenario 1 and 2 which we consider the more probable scenarios – will play an important role.

**UPDATE: Inflation Rising Much More Quickly Than ‘Intended´

Today, partially due to the geo-political unrest in the Middle East and higher commodity prices — particularly those of oil and food — the danger is mounting that we are slipping into Scenario 2, the stagflationary scenario, one that might stifle growth under the weight of rising inflation… and interest rates.

According to a Bloomberg article, inflation is particularly concerning for emerging markets: “A jump of more than 20% in the price of crude oil over the past two weeks has increased the threat of inflation in Asia, where central banks are already grappling with consumer price pressures fueled by job and spending gains.”

In emerging countries, the acceleration of consumer price indices is worrying for central banks due to the high weighting in food prices (close to 40%). The recent rise in oil prices comes on top. For central bankers in these regions, it means that tightening is the only way to go. The Bank of Thailand and Bank of Korea are expected to both raise key interest rates by a quarter percentage point shortly. Malaysia may also be approaching the end of its pause in boosting borrowing costs.

The objective, of course, is slower economic growth and lower inflation. However, all this occurs in a world full of US dollar liquidity (courtesy of the Fed). It occurs in a world where US interest rates are at rock bottom and where international capital is thirsting for any available yield. Therefore, it is questionable whether an increase in interest rates in emerging markets will in fact avoid further ‘overheating´.

As interest rates are increased, more international capital will flow into these. Thus, one might well expect Asian currencies in particular to further rise against the US dollar, where at this point, nothing indicates that the Fed will increase rates.

This is not what the American economy needs at this point. While a depreciating dollar, to some degree, is the chosen scheme to also depreciate foreign debt, the U.S. is still very much dependent on selling its Treasury paper in order to finance rampant deficits.

Bill Gross, manager of Pimco, the world´s largest mutual [bond] fund, announced that he is dumping all Treasuries. He is not the only one. Some of the biggest private investors in the bond market, from fund managers to insurers and pensions, are preparing for an end to the three-decade Treasury rally, as interest rates near zero and unprecedented spending by the U.S. government and the central bank threaten to fuel inflation.

In this scenario you may well again see more US rating agency shenanigans headed for Europe. In defense of an all too rapid devaluation of the dollar, the main contender, the Euro, will need to be held down – especially since Mr. Trichet, who heads up the European Central Bank, has just announced Europe´s intention to raise their interest rates…

Slipping Into the Stagflationary ‘Debt Trap´?

All this, unfortunately, creates problems in several dimensions. On the one hand, countries with high growth may find it difficult to contain inflation without more drastic measures, including a variety of capital control policies. On the other hand, if they do succeed at slowing down their growth it may endanger the global economy that is currently very much dependent on the much discussed divergence.

Furthermore, higher interest rates can be expected to raise these countries´ currencies; particularly Asian currencies can be expected to appreciate. With the Federal Reserve not giving any indications that it may be ready to raise its benchmark rate from close to zero, currencies from South Korea´s won to Malaysia´s ringgit are set to gain versus the dollar.

The end result of all this is that we appear to be slipping into Scenario 2, the Stagflationary ‘Debt Trap´ sooner than we had expected only a few months ago… This of course has implications for our investment decisions and strategic allocation as follows:

- Stock markets can, from now on, be expected to be characterized primarily by sideways volatility. The upturn that we´ve been able to nicely benefit from in the past few months, may have ended.

- Gold and silver have performed well in the current environment and can be expected to continue their upward trend, although a healthy, temporary correction after the late run cannot be ruled out.

- Bonds with maturities of more than 2 years should be avoided, weeded out.

Ignore Wall Street’s Refrain: “Don´t Worry About it!”

While it is often difficult and sometimes simply impossible to predict the future, failing to prepare for looming dangers and potential threats can be far worse than ignoring, denying or hiding the threats.

It is important to remember that Wall Street always operates with blinders on and they will never directly confront or publicize potential market threats or prepare the investing public for the inevitable market problems and pullbacks that, time-after-time, decimate profits, financial security and stability. Their message is always to accent the positives and [cite the mantra] “don´t worry about the negatives”. This message is not a prudent course of action for the same investors who suffered through the dot.com and technology debacle, or who have lost money due to the continued and long-term depreciation of the U.S. dollar.

[It is time to ignore Wall Street research, recommendations and advice and think for yourselves and take action accordingly. Hopefully this article has helped in that regard.] |

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I admit to being attracted by this article because it largely conforms with my own thinking in the contexts of both the economic scenarios presented and the expectation/probability time frames suggested.

I found it interesting that in the Global ‘Debt Crisis’ Scenario physical silver is no longer recommended as a suitable investment, whereas it is in the first two economic scenarios. Physical gold is recommended in all three. I speculate that the author focused on physical silver’s primary use as an industrial metal when removing it as a suitable investment in his third scenario.

Ian R. Campbell

http://www.StockResearchPortal.com