Jim Sinclair stated in a video that, with so many U.S. Dollars being printed to uphold the economy as a result of COVID-19, that Gold will:

- rise to $50,000 (i.e. go “straight up” in Sinclair’s words) at the end of the 45-year gold cycle which is coming up in 2025 and

- and rise up to $87,000/ozt. by the end of 2032.

WOW! That is a massive rise from where Gold sits, today.

Jim didn’t comment much on Silver, but my fractal analysis chart work on Silver clearly points to:

- Silver going up to $800 to $1,200/ozt a bit later than 2025.

A rise in Gold to $87,000 would blow the Silver Price vastly higher than that.

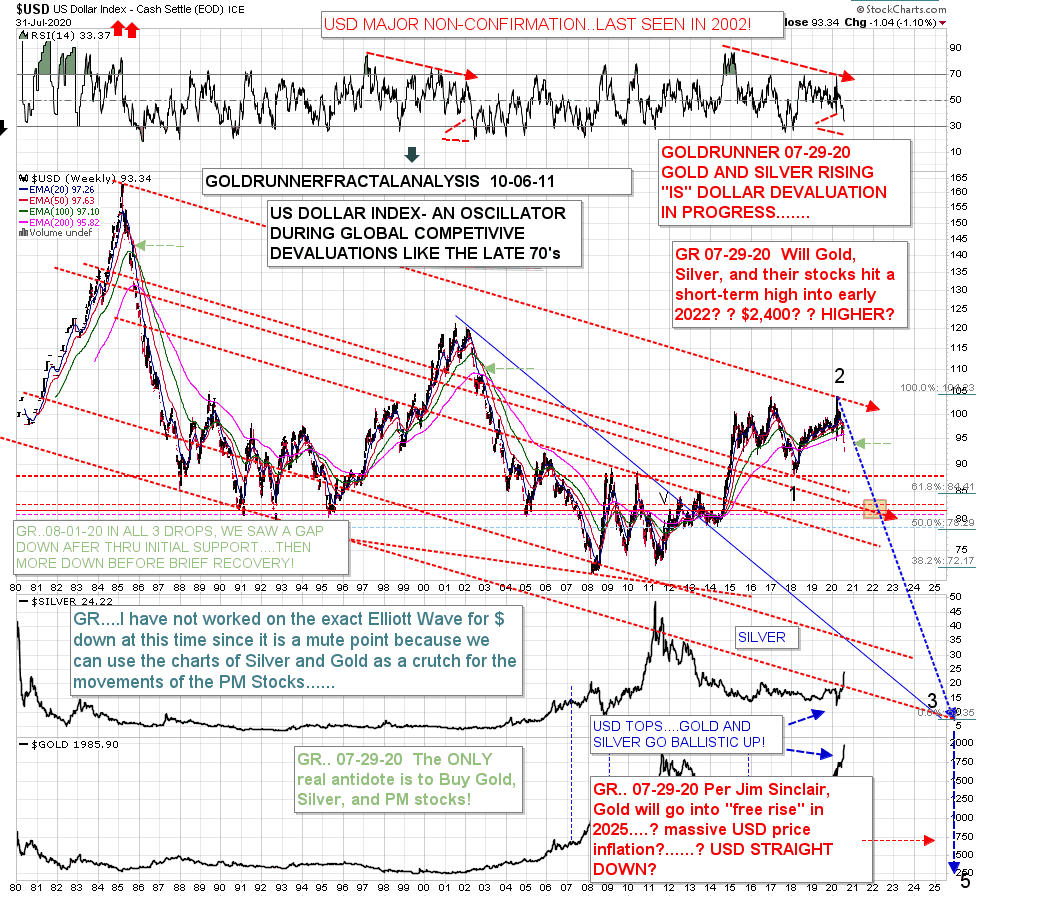

U.S. Dollar Price Going Forward to 2025

As Mr. Sinclair has always claimed, “GOLD IS THE INVERSE OF THE US DOLLAR” so I have put together a chart of what the U.S. Dollar might look like in 5 or 6 years.

As mentioned in the chart above,

- there will be massive inflation going forward causing

- gold to go into a “free ride” (Sinclair’s words) in 2025

- and the USD to go straight down.

Indeed, if Mr. Sinclair is correct then we can expect to do a “Zimbabwe” in ONE FELL SWOOP in a just a few years. The ONLY real antidote for all this is to buy gold, silver and precious metals stocks.

The above article is an edited version of the original article by Goldrunner as submitted to munKNEE.com.

Editor’s Note:

Please donate what you can towards the costs involved in providing this article and those to come. Contribute by Paypal or credit card.

Thank you Dom for your recent $50 donation!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

One comment

Pingback: Goldrunner: Gold Could Jump To $1,900-$2,100 In Next 30 days - Here's Why (7K Views) - munKNEE.com