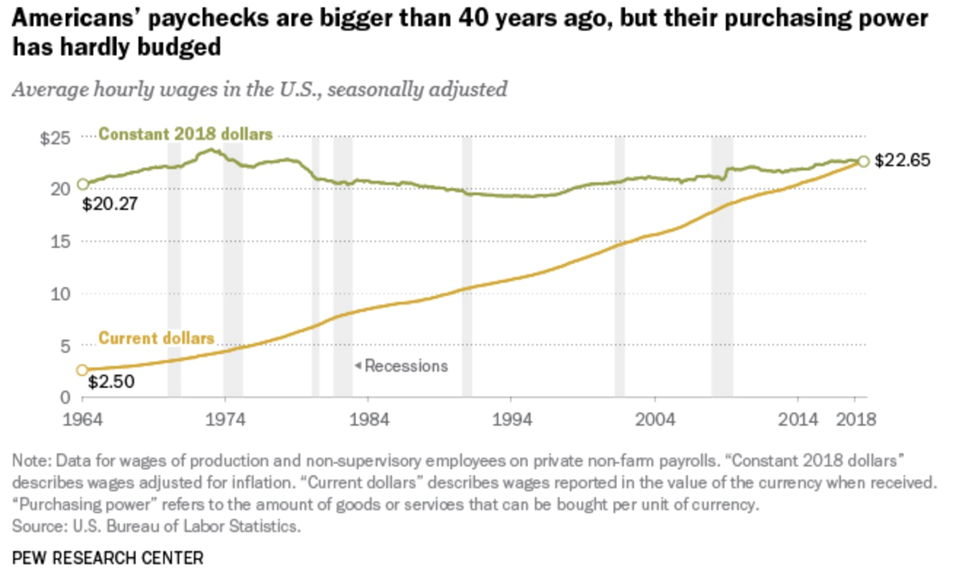

@$$4$According to the Pew Research Center, despite some ups and downs over the past several decades, the real average wage in 2018 had the same purchasing power it did in 1978 as a result of inflation and the inability of fiat currencies to protect against it.

…According to Pew, from 1973 to 2018 the compensation of the typical American worker only grew about 12% BUT, after inflation, the hourly median wage went up less than 10% in real (after inflation) dollars, or an average annual raise of barely 4 cents during the same period.

@$Real wages among the lowest-paid workers have fared even worse, increasing just 4.3% between 1979 and 2018.

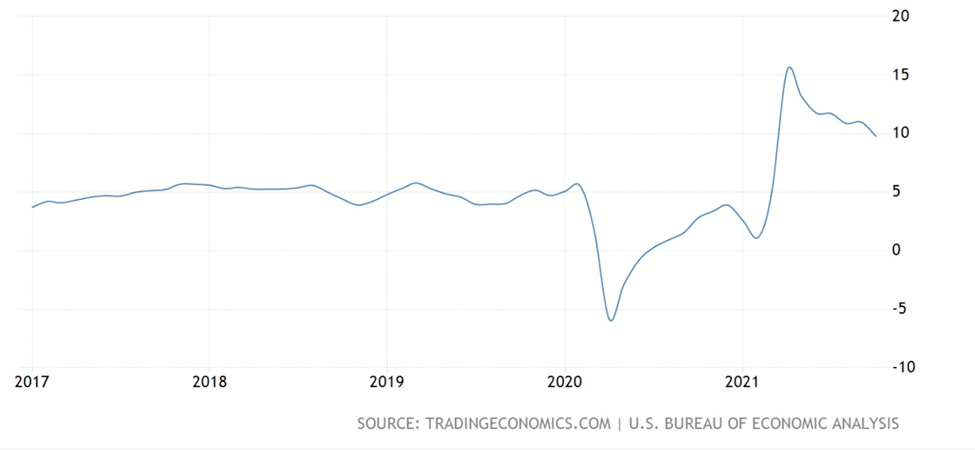

The chart below by Trading Economics shows American wage and salaries growth holding steady at about 5% since 2017, decreasing in the early part of 2020, then climbing sharply in 2021, as the U.S. economy experienced a shortage of workers.

@$$In fact in the three months ending in September, pay jumped 1.5%, the most in 20 years. Why?

- Employees have been quitting their jobs in droves, with many preferring to stay home and collect “stimmy checks”.

- According to Axios, there are about 2 million fewer immigrants in the U.S. because of COVID-19 immigration restrictions.

- About 1.5 million fewer mothers of school-aged children are working, compared to pre-pandemic times.

- There were 3.3 million more retirees in October 2021 versus January 2020.

The dearth of workers has hiked wages and salaries, but significant and persistent inflation has done away with the gains in most cases.

- In October 2021 average hourly earnings increased by 0.4%, but inflation for the month increased 0.9%, meaning a -0.5% decrease in real average hourly earnings.

- According to the Labor Department, wages swelled from April 2020 to April 2021, with average hourly earnings up 4.9% in October, but compared with inflation, real hourly wages actually declined more than 1.2% during the same period…

- A survey of 5,365 adults done for the New York Times, found only 17% of workers received wage increases that kept up with inflation.

- While the Consumer Price Index (CPI) rose 6.8% in November, a nearly four-decade high, average hourly earnings increased just 4.8%. Other measures show pay gains lagging price increases, the NYT states.

U.S. wages have failed to keep up with the rate of inflation. The wage and salary earner is literally getting screwed every day because the value of the dollar is being devalued by a fractionally small amount. Over time, however, the diminished value is huge.

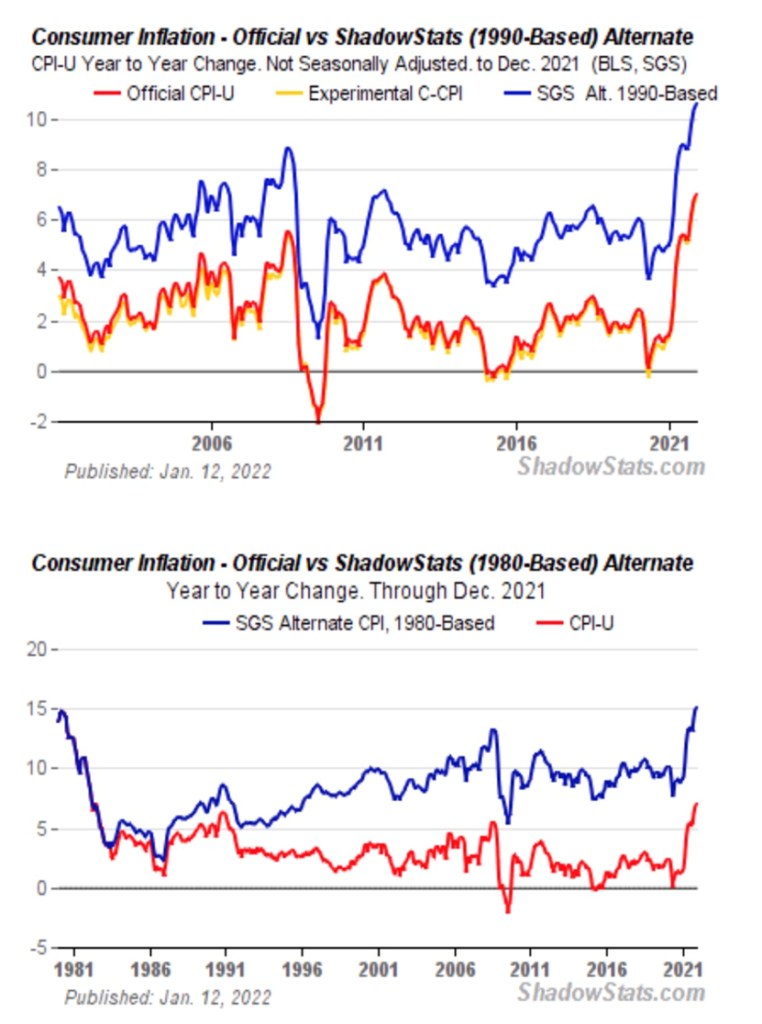

@$$$It’s important to understand that the U.S. Federal Reserve’s concept of inflation is different from both the official statistic and the reality in the economy.

- The Consumer Price Index (CPI) is currently 7%, which is the highest since 1982 — a 40-year high. This is the number most quoted in the financial press; it is the official inflation rate but when the Fed talks about inflation, as it has since 2012, it refers to the “Personal Consumption Expenditures” (PCE) price index. Core PCE inflation excludes food and fuel, supposedly because they’re too volatile, but the fact that the two most essential price categories are left out, means the Fed is deliberately underestimating true inflation.

- Real “on the ground” inflation is much higher. CPI’s less known but more accurate cousin is the Producer Prices Index (PPI). Unlike CPI, which is crafted by bean counters, the PPI is based on information from actual producers of goods and services. The numbers don’t lie. The latest PPI data point clocked in at 9.7% for 2021 — close to double-digit inflation.

- It must also be pointed out that the government does not calculate inflation like it used to. John Williams’ Shadow Government Statistics published two charts, one showing inflation today if it was calculated the same way it was in 1990, the second showing inflation today using 1980’s methodology. The latter reveals the actual inflation rate today is 15%, not 7%.

According to Williams, over the decades, the Bureau of Labor Statistics has altered the meaning of the CPI from being a measure of the cost of living needed to maintain a constant standard of living, to something that neither reflects the constant-standard-of-living concept nor measures adequately most of what consumers view as out-of-pocket expenditures. For example:

- of the current consumer price index (CPI), 24% represents the category “homeowners’ equivalent rent of residences” instead of reflecting a measure of home prices, as was the case before 1983. The BLS bases this figure on surveys that ask what homeowners think their home might rent for.

Williams says the aggregate impact of inflation reporting changes since 1980 have reduced the level of annual CPI by roughly seven percentage points. The effect has been a significant under-reporting of official inflation, so as to cut annual cost of living adjustment to Social Security, etc.

A comparison between using gold versus dollars to buy a basket of breakfast groceries — milk, eggs, bread and bacon, and the gas to go get them — is illustrative:

1970

Milk: $1.32 per gallon

Eggs: 60¢ per dozen

Bread: 70¢

Bacon: 85¢ – 95¢ per pound

Gasoline: 36¢ a gallon

December 2021 (US Bureau of Labor Statistics latest numbers)

Milk: $3.74 per gallon

Eggs: $1.78 per dozen

Bread: $1.53

Bacon: $7.21 per pound

Gasoline: $3.40 a gallon

Selling an ounce of gold in 2022 would give you about $1,813 — a 51X increase over the $35/oz gold in 1970. Obviously $1,813 buys a hell of a lot more breakfast groceries than $35 — you could probably feed an entire football team, including coaches and trainers, with everybody coming up for seconds.

The point is a grocery shopper:

- using gold as a currency rather than dollars in 2022 would see a 51-fold increase in their purchasing power while

- using dollars by contrast loses about 40% of their purchasing power because the prices of their grocery items have at least doubled or in the case of bacon increased by a factor of seven.

@$$4$Which has been the better store of value, dollars, or gold? Obviously, it is gold — the only safe haven that protects the holder against rampant inflation caused by money-printing…

(There is another way that governments and the mainstream financial system keeps average Joes and Janes in check, and that is the purchase of government bonds, which in the United States, are known as Treasury bills – or notes – and you can read much more on bonds by visiting the original article.)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Gold’s purchasing power being 51 times that of dollars should open some eyes, Lorimer. Thank you!