As an investment, gold is not for the faint of heart. You can make or lose a fortune, depending on your entry and exit points so, that being the case, is now a good time to buy gold?

The above edited excerpts, and those below, are from an article* by Scott Grannis (scottgrannis.blogspot.ca) originally entitled What’s the right price for gold?.

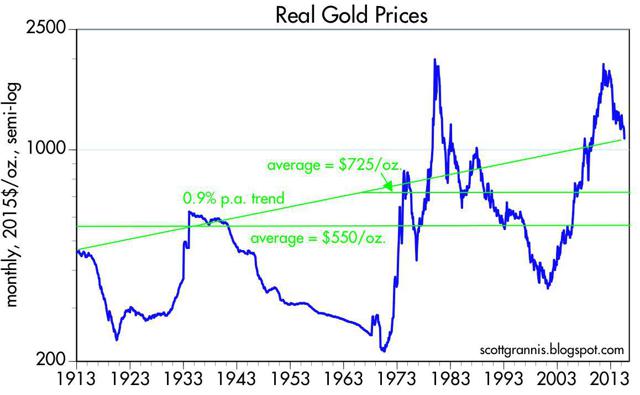

To help answer that question, I put together the chart below which shows the real price of gold (using the CPI) over the past century.

- For the entire period, the average real price of gold was about $550/oz.

- For the period beginning 1965 (when the Fed began cheating on the gold standard by not raising interest rates to counter gold outflows) through today, the average real price of gold was about $725/oz.

- The inflation-adjusted, compound annual rate of return to holding gold over the past 100 years is about 0.9%.

Yes, gold is a store of value, but just barely, and only over very long periods.

As a partial answer to my question, I think gold still looks expensive right now, because:

- relative to the prices of other things, gold today is still significantly above its long-term average and,

- if history is any guide, it could well drop to $700 or maybe even $500 before embarking on another long rally and, in the meantime, an investment in gold yields nothing.

Conclusion

For gold to pay off, I think it would take another huge scare:

- another big recession,

- a big and unexpected rise in inflation,

- another crisis of confidence in the world’s central banks,

- or something that would make people think that The End of the World As We Know It is just around the corner.

Barring another major scare of some sort, gold prices are likely to drift lower, possibly for years to come.

*http://scottgrannis.blogspot.ca/2015/07/whats-right-price-for-gold.html

Related Articles from the munKNEE Vault:

1. Analysts: Gold Will Bottom Somewhere Between $725 & $1,000/ozt.

Much has been written over the past few months as to just where gold (and silver) is headed. In light of the recent significant drop in price below is substantiation for such a decline and several projections as to where the price correction will bottom out and the timeframe for such price action.

2. What Is Gold’s Role In An Investment Portfolio – If Any?

There is a plethora of information available in all sorts of media that is negative about gold – gold is risky, volatile, a barbarous relic, and so on – but these arguments miss the point entirely, because they treat gold as an investment. To fully understand gold’s role in an investment portfolio, we need a new mindset—a gold mindset – [and HERE it is].

3. The 6 Most Commonly Held Anti-Gold Beliefs That Don’t Hold Water

…Many in the investment community swear by the old myths about gold, but is there any truth in them? If investors examined the facts, they would find that the most commonly held anti-gold beliefs do not hold water and, once the general public realizes that these beliefs are not valid, the price of gold will be much higher.

4. Look No Further! Here Are the Best Articles on Gold & Silver

Hundreds of articles seem to be posted every day on why the prices of gold and silver are going north of $5,000 & $100 ozt. respectively, or conversely to below $1,000 and $15, respectively. Unfortunately most of what is written is self-serving and/or wishful thinking. Some is what I call nothing more than financial entertainment devoid of substance. Occasionally a thought provoking article is posted and when that happens munKNEE.com is there with it. Below are some such articles that are currently in the munKNEE.com vault.

5. Noonan: Why Buy Gold & Silver? Here’s Why

Here’s the best reason to buy and hold gold and silver, at any price, and especially at these artificially suppressed prices.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money