After falling out of favor for so long gold stocks are overdue to soar this year. The smart contrarians buying in early before the rest of the herd starts understanding gold stocks’ vast upside potential are going to earn fortunes. This article looks at the performance of the HUI, XAU, GDX & GDXJ over the last few months of decline to their lows and their most recent ascent.

Below is:

- the recent price activity of the HUI index from its low in mid-August

- commentary on the HUI by Jordan Roy-Byrne

- commentary on the GDX by Adam Hamilton and Jordan Roy-Byrne (with chart)

- commentary on the GDXJ by Jordan Roy-Byrne (with chart) and Rick Mills and

- commentary on the XAU by Justin Smyth and

- commentary by Katchum on the affect of the falling price of oil on mining profits.

1. HUI Price Activity

- At week ending Friday, Aug. 15th, the HUI closed at 251.83

- By month ending Friday, Oct. 31st the HUI had CRASHED through 10-year support of 168 to 156.22!!! (1st bottom?)

- By month ending Friday, Nov. 28th the HUI gave up ALL its November gains once again closing below its 10-year support of 168 at 162.79!!!

- By month ending Friday, Jan.2nd the HUI, after dropping down to 158.34 earlier in the week (2nd bottom?), had closed UP to 167.81!

- By week ending Friday, Jan. 9th the HUI had closed UP dramatically to 186.30!!! The bottom seems to be definitely in – finally!

- By week ending Friday, Jan. 16th the HUI had closed UP even more to 200.87!!! The bottom IS in – definitely!

- By week ending Friday, Jan. 23rd the HUI had settled back to 196.37

- By week ending Jan. 30th the HUI had closed UP to 201.82 – an increase of 27.5% from the 2nd bottom low of just 4 weeks ago!

- By week ending Feb. 6th the HUI had given up more than 4 weeks of gains closing DOWN at 192.86 (albeit UP by 21.8% from the second bottom close)!!

2. HUI Commentary (For current chart go here, enter $HUI and click on GO) Interestingly, as noted by Jordan Roy-Byrne, CMT (TheDailyGold.com) in a recent article*:

- the HUI rebounded at least 125% within 12 months from its previous lows in 2000 & 2008 – and 300% & 200%, respectively, within 18 months following those lows.

- A 125% increase from the Oct. 31st low of 156.22 would equate to in excess of 350 in 1 year’s time & anywhere between 468 and 624 before the end of April, 2015!

3. GDX Commentary (For current chart go here, enter GDX and click on GO)

a) According to Adam Hamilton (zealllc.com) in an article** entitled Gold Stocks Turning Up:

“Major market changes are afoot that should catapult gold much higher and, with gold stocks trading at fundamentally-absurd price levels relative to prevailing gold prices, this sector’s upside potential is vast and unequalled... All financial markets are forever cyclical, with periods of out-performance always following periods of under-performance and vice versa so smart contrarian investors are well aware the stock markets are overdue to reverse lower while gold mean reverts higher. Thus they are starting to buy the dirt-cheap gold stocks in anticipation of these inevitable major reversals – and that’s why gold stocks are turning up this year…

The gold stocks are probably the only super-cheap sector left in these lofty Fed-inflated stock markets. They are the only one that has the potential to at least quadruple again in the coming years no matter what the stock markets do. Their mean reversion higher relative to gold is way overdue, and it’s going to be massive…

The contrarian investors now returning to gold stocks…realize that the Fed-levitated stock markets are on the verge of rolling over decisively, which will rekindle gold investment demand and, as gold itself recovers, the radically-undervalued and wildly-oversold gold stocks are going to rocket higher. They will very likely be this year’s best-performing sector in all the stock markets…

Another major bullish factor coming into play is the utter collapse in energy prices. Gold mining is an incredibly energy-intensive industry. It takes vast amounts of energy to dig up heavy rock, haul it, crush it, and extract the relatively tiny quantities of gold out of that ore. Energy is often the largest variable cost for gold miners so the brutal collapse in energy prices in recent months is also going to really boost profits and that will make gold stocks look even more ludicrously undervalued than they already do, which is hard to believe.

After falling out of favor for so long, after suffering an unbelievably anomalous year (2013) and its aftermath (2014), gold stocks are overdue to soar this year. The smart contrarians buying in early before the rest of the herd starts understanding gold stocks’ vast upside potential are going to earn fortunes…”

b) The chart below from an article*** by Jordan Roy-Byrne, CMT (TheDailyGold.com) entitled Gold & Gold Stocks Consolidate at Resistance shows that the GDX has consolidated below a confluence of major resistance for several weeks and has held in well. The 400-day moving average has marked each important top since 2012 while the trendline dates back almost as far. A confirmed break above the trendline would bring targets of $27.50 (21% upside) and $30.00 (25% upside) into play. A break above an RSI of 70 would signal sustained positive momentum and offer strong confirmation of the breakout. GDX has strong support at $20.50.

4. GDXJ Commentary (For current chart go here, enter GDXJ and click on GO)

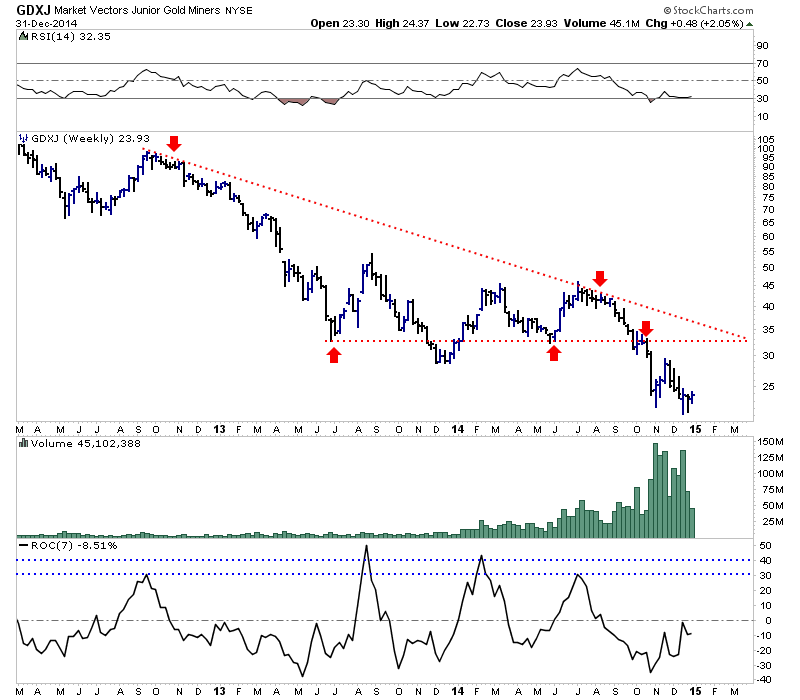

a) As noted by Jordan Roy-Byrne, CMT (TheDailyGold.com) in a recent article**** entitled Potential Upside Target for GDXJ:

Note in the weekly bar chart below of the GDXJ the confluence of trendline and lateral resistance just below $33. The 50% retracement of the recent 53% decline (June to December) is $33. Clearly $33 figures to be important overhead resistance.

At the bottom of the chart above we plot a rolling 7-week rate of change for GDXJ. Over the past two years GDXJ has gained at least 30% within 7 weeks on four different occasions and twice at least 40%. [A 40% advance from the second bottom of $21.59 on December 23rd would have taken the GDXJ to $30.23 by Feb. 6th on that time line but it fell short of that level closing at only $26.86 which, however, still represents an increase of 23.4%.]

b) Rick Mills (aheadoftheherd.com) comments in an article***** entitled What’s Your Edge? that: “…[if] you want to own the cheapest gold and silver you can find to reap the maximum coming rewards…buy it while it’s still in the ground….[while the] junior resource companies – the owners of the worlds future precious metal mines – are on sale. If you like their management team, their projects and their plans for 2015, perhaps now is the time to be slowly acquiring a position. Why? Well,

- besides the fact that I believe that precious metal focused junior resource companies offer the greatest leverage to increased demand and rising prices for precious metals,

- there’s obviously going to be a very real and increasing trend for Mergers and Acquisitions (M&A).

Juniors, not majors, own the worlds future mines and juniors are the ones most adept at finding these future mines. They already own, and find more of, what the world’s larger mining companies need to replace reserves and grow their asset base. Gold’s bull market is not over…”

5. XAU Commentary (For current chart go here, enter $XAU and click on GO)

In yet another post****** entitled Life Changing Opportunity In Gold Stocks, Justin Smyth (nextbigtrade.com) has analyzed the XAU and notes that:

- Due to the cyclical nature of markets in general, and of the gold market in particular, we should expect a bull market next…[which] should offer big gains.

6. A post******* by Katchum (katchum.blogspot.ca) reports that “For 1 ounce, miners use 26 gallons of diesel or about 100 liters. We know that diesel costs around 3 dollars a gallon. So we have 3 dollars/gallon x 26 gallons = 78 dollars. 1 ounce = 1300 dollars. This means that energy is 6% of the cost to produce gold.

To repeat what Hamilton says: “After falling out of favor for so long, after suffering an unbelievably anomalous year (2013) and its aftermath (2014), gold stocks are overdue to soar this year. The smart contrarians buying in early before the rest of the herd starts understanding gold stocks’ vast upside potential are going to earn fortunes.”

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

- *http://thedailygold.com/precious-metals-face-body-blows/ (© 2014 The Daily Gold. All Rights Reserved.)

- **http://www.zealllc.com/2015/gsturnup.htm (Copyright 2000 – 2015 Zeal LLC)

- ***http://thedailygold.com/gold-gold-stocks-consolidate-resistance/ (© 2014 The Daily Gold. All Rights Reserved.)

- ****http://thedailygold.com/potential-upside-target-gdxj/ (© 2014 The Daily Gold. All Rights Reserved.)

- *****http://aheadoftheherd.com/Newsletter/2015/Whats-Your-Edge.htm

- ******http://www.nextbigtrade.com/2014/11/18/life-changing-opportunity-in-gold-stocks/ (Copyright © 2014 Next Big Trade)

- *******http://katchum.blogspot.ca/2015/01/oil-versus-gold.html

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Now’s the Time To Buy the Better Mining Stocks – Here Are 3 Major Reasons Why

3. Are the Benefits Of Including Gold/Silver Stocks In Your Portfolio Really Worthwhile?

4. Gold Shares Have Bottomed & Will Now Outperform Physical Gold Over Next 5.5 Years

6. It’s Time To “Swap” Your PM Stocks For Physical Gold & Silver – Here’s Why

7. Get on Board – NOW! We’re On the Verge of a Major Bull Market Advance Across the PM Sector.

8. Incredible Bounce Coming Soon In Gold & Silver – Here Are 5 Reasons Why

9. The Most Explosive Turnaround to the Upside — EVER — Is Coming In the Precious Metals Sector

10. Gold Stocks Could Jump 100% in the Coming Year – Here’s Why

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Want to copy articles from other pages rewrite them in seconds and post on your

site, or use for contextual backlinks? You can save a lot of writing work,

just type in gogle:

Daradess’s Rewriter

Great post. I was checking constantly this weblog and I’m inspired!

Very useful information specifically the final phase :

) I deal with such information much. I used to be looking for this particular info for a long time.

Thanks and best of luck.

I expect those with physical Silver to keep it, while those trading “paper” Silver will find that they are getting squeezed by demand for the physical Silver; when that happens we will see the price of Silver rebound, which will cause big problems with those trying to make money by trading using what I call naked shorting of Silver.