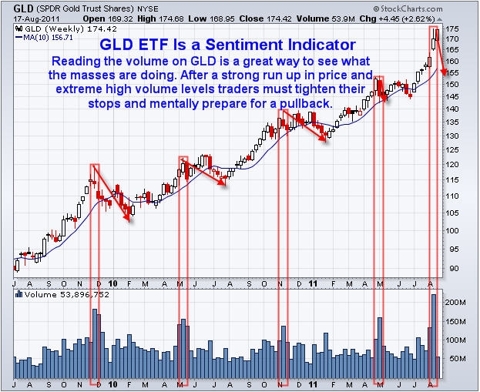

The past few weeks traders and investors have been completely spooked by the surge of negative news and collapsing stock prices and reading the volume on the GLD exchange traded fund chart gives us a good sense of what the masses are feeling emotionally – fear….Fear is the strongest force in the financial market for moving prices and there are a number of ways to [ascertain the extent of] fear in the market and the more they line up at the same time, the higher the probability of trend reversal in the near future. [Let’s take a look at a few such indicators and what they are currently suggesting.] Words: 700

I look for:

- a rising volatility index (VIX) [see article 1 below]. This index rises when investors become fearful of stock prices falling by hedging positions or flat out buying put options to profit from a falling market.

- a high selling volume ratio meaning [that] at least [three times the] shares traded are from individuals hitting the sell button in a panic thinking that the market is about to collapse [see article 2 below].

- a surge in the GLD etf volume after a strong move up which means everyone is scared and dumping their money into a safe haven.

Let’s take a look at some charts to get a better feel.

GLD Weekly Gold Chart

As you can see [in the chart below] there were sizable price movements which ended with strong volume surges. Those volume surges mean that the majority of investors have reached the same emotional level and bought GLD for safety [See article 3 below]. Keep in mind that the big money players and market makers can see this taking place and that is when they start selling into that surge of buying volume – locking in maximum gains before there are no more buyers left to hold the price up. Tops generally take a few weeks to form so don’t expect a one-day collapse [See article 4 below].

SPY Weekly Chart

The recent rally in gold has taken place when stocks have fallen sharply. Money has been pulled out of stocks and pushed into gold but I think that is about to change.

Who in the world is currently reading this article along with you? Click here to find out.

The past month has been a bloodbath for stocks but from looking at the charts, volume and fear in the market, I can’t help but think we are going to see higher stock prices. As investors see stocks moving higher, they will pull money out of gold and dump it back into stocks and likely high-dividend paying stocks [See article 5 below].

Conclusion

In short, everyone piled into gold sending it rocketing higher and I feel it has moved too far too fast and is ready for a pullback (pause lasting 2-12 weeks). In association with gold’s pullback I feel investors are now realizing they sold their stocks at the bottom of this correction because fear took hold of their investing decisions. Now they are starting to think about getting long stocks but it still may be a bumpy ride for a few weeks yet.

*http://www.thegoldandoilguy.com/articles/gold-stocks-are-about-to-move-in-opposite-directions-get-ready/

Titles and Links to Articles Referenced Above:

- The Investor Fear Gauge: What Everyone Should Know About the VIX

- Relax! World’s Stock Markets in Panic Mode but Its Not the End of the World – Yet

- Why It’s Not Too Late to Jump on the Goldwagon

- Gold: It’s Time to Sell – Not Buy! Here’s Why

- Now’s the Time to Buy Quality Dividend Stocks – Consider These 11

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

nope your wrong, every time gold goes up , oh no its gonna go down don’t buy look here, please stop BS