Our capital market assumptions for returns over the next 5 years forecast lower returns ahead,  given moderate economic growth and stretched valuations. Take a look.

given moderate economic growth and stretched valuations. Take a look.

Written by: Richard Turnill (BlackRock.com)

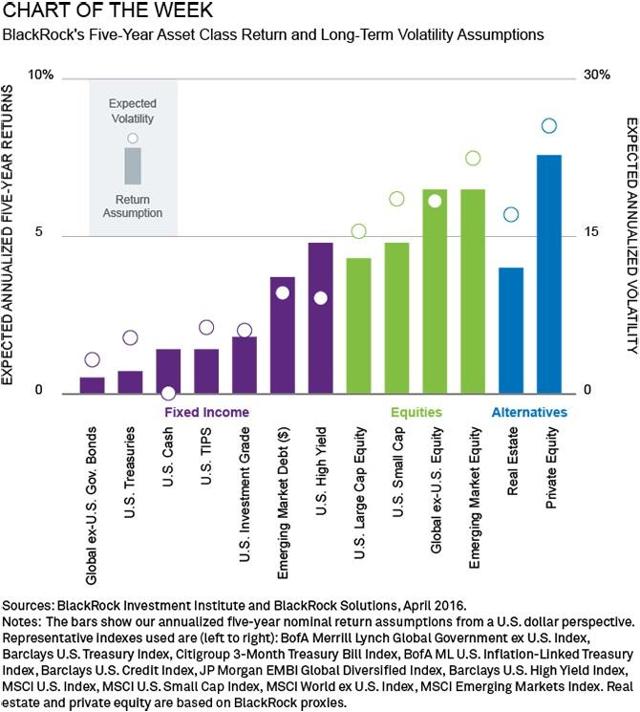

The bars in the chart below show our return assumptions for selected asset classes, while the dots show expected volatility. Higher returns generally come with more volatility.

Many of our return assumptions are now at or near post-crisis lows, with many expected returns below historical averages. These assumptions reflect high current valuations and lower global growth over the next five years, in line with a long, flat U.S. recovery.

No free lunch

We see portfolios made up of 60% equities and 40% fixed income producing annual returns:

- for a global portfolio of just 3.3% in U.S. dollars, before inflation, over the next 5 years and…

- for a U.S. portfolio of less than 3% – and less than 1% after inflation.

Negative returns may also be more widespread, given that many benchmark rates hover around 0%. We now anticipate:

- negative returns over the next 5 years from assets such as long-dated Treasuries and euro zone bonds. These assets are still important portfolio diversifiers, but the price of that diversification is rising.

We see a wider gap between the prospective returns for safe-haven and risk assets, reflected in higher expected returns for equities versus bonds and for non-U.S. equities versus U.S. equities. Our international equity return estimates are now above the long-term average, thanks to improved valuations outside the U.S.

Alternatives come with higher volatility and illiquidity, but we believe real assets can offer portfolio diversification benefits.

The bottom line:

Generating higher returns over the longer term involves more volatility.

Disclosure: The original article, by Richard Turnill (BlackRock.com) was edited ( [ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money