Automatically receive the internet’s most informative articles bi-weekly via our free bi-weekly Market Intelligence Report newsletter (sample here). Register in the top right hand corner of this page.

The Dow:Gold ratio is defined as how many troy ounces of gold it takes to buy the Dow Jones Industrial Average and is arrived at by dividing the price of the Dow by the price of gold/ozt. It is a powerful tool in order to determine major turnarounds in the DJIA and/or gold so, if you are heavily into equities, this article should make you very nervous.

Written by Lorimer Wilson, editor of munKNEE.com

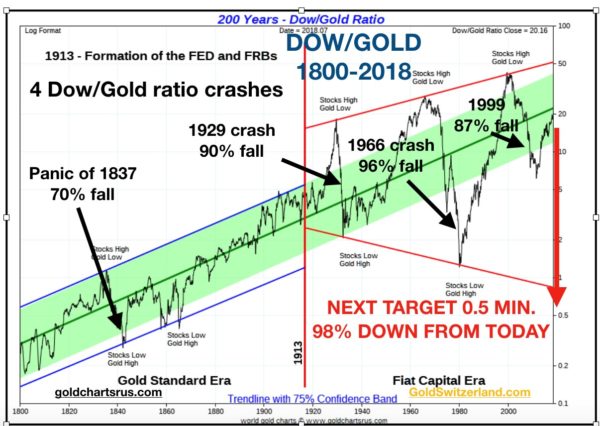

The following chart is a long-term look at the Dow:Gold ratio since 1800 highlighting the 4 major crashes in said ratio:

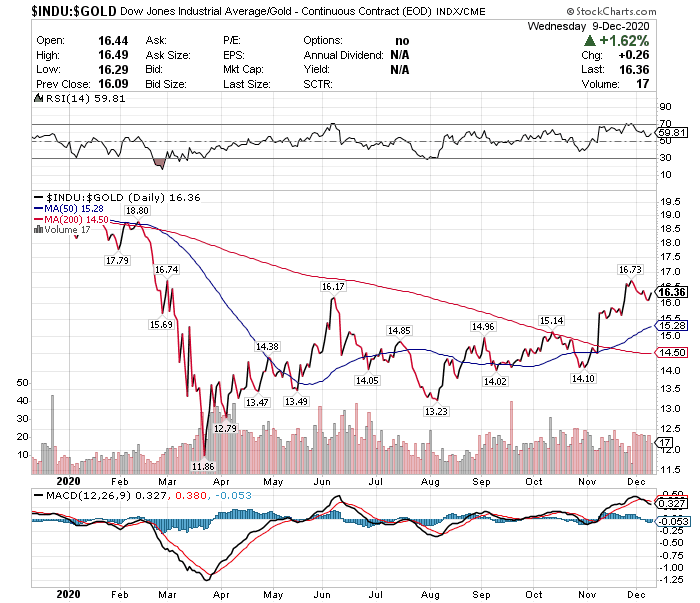

As can be seen in the charts above:

- over the past 200 years:

- the Dow:Gold ratio has encountered 4 crashes of

- 70% in 1837,

- 90% in 1929,

- 96% in 1966, and

- 87% in 1999;

- the Dow:Gold ratio has encountered 4 crashes of

- over the last 40 years:

- the Dow:Gold ratio has ranged from

- a low of 1.05 in January, 1980 to

- a high of 44.56 in August, 1999;

- the Dow:Gold ratio has ranged from

- there has been a big Megaphone pattern in the Dow/Gold ratio since 1913 and

- the next big move will at least reach the bottom of the Megaphone at 1.0 (last seen in 1980)

- and, even more likely, will see .05 or lower (see chart above)

- representing a stock market crash from here of 98% against gold.

Most people cannot see what is clearly unfolding…Little do they understand that the gyrations in the Dow/Gold ratio will continue until the megaphone pattern is completed on the downside.

The above being said raises the question of just where the Dow and gold would meet if the 1:1 ratio was achieved.

- We expect that the Dow would fall faster than gold could climb to meet it. If we had to put a number to it we would guess that the number could end up at about 5,000 (1-to-1).

- That would equate to approx. a 200% increase in the price of gold

- and a 80% decrease in the value of the DJIA.

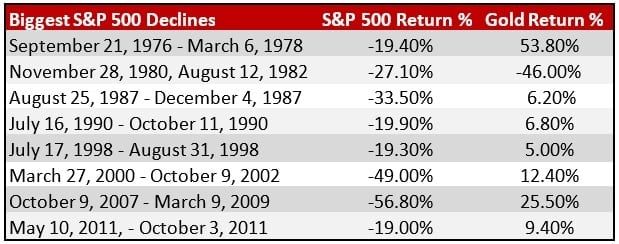

Is a move to 1-to-1 or lower likely? That’s for you to determine but it is quite possible that the reason behind many of the Central Banks acquiring large quantities of additional gold bullion for their financial reserves of late is that:

- they expect a powerful thrust downward in the ratio going forward and

- they understand that physical gold does extremely well during any stock market crash as the table below illustrates:

Conclusion

- If you believe the odds of the stock market halving from here are zero,

- then you probably want to own zero gold. That seems the view of the vast majority of private investors.

- On the other hand, if you believe what this article is conveying,

- then you will want to add physical gold to your portfolio to offset the severe equity losses that are…[upon us]…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money