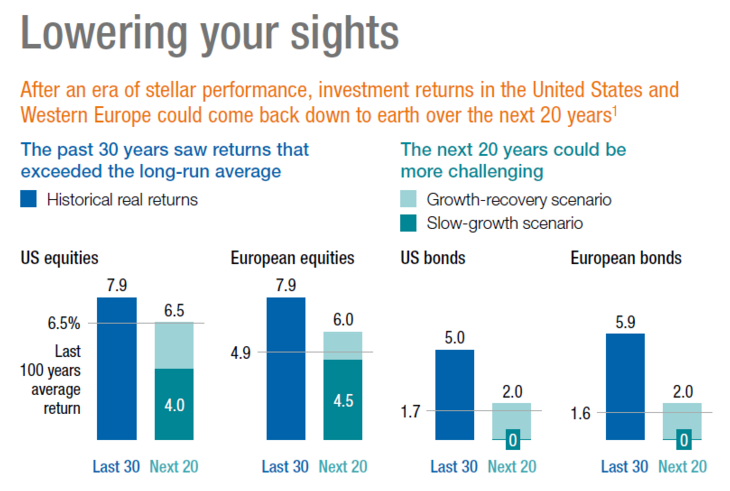

the next 30 years than we’ve experienced over the past 30. [Does that] automatically spell doom for Millennials who are investing their money? Not necessarily. Here’s why.

the next 30 years than we’ve experienced over the past 30. [Does that] automatically spell doom for Millennials who are investing their money? Not necessarily. Here’s why. …Source: Bloomberg

…Source: BloombergBoth scenarios saw the exact same amount saved over the exact same time frame and earned the exact same annual returns but the sequence of those returns caused a huge difference in their ending balances. The second scenario was more than 30% higher than the first one.

The thing that most young investors can’t seem to wrap their heads around is the fact that you want lower returns during your early years when you are a net saver. It allows you to buy more shares in the stock market at a lower price. A decade or even two decades of poor returns would be an amazing opportunity for Millennials. Throw in a couple of market crashes in there and that’s even better.

This example illustrates the fact that luck can have a lot to do with how much money you end up with. Some people are simply born into a perfect market cycle while others have more of an uphill battle. Whatever future market returns we end up seeing, one thing is for sure — they will not exist in a steady state like you see in a simple retirement calculator. Averages never tell the entire story.

This report did have one piece of great advice for young people — it makes sense to increase their savings rates and plan for the worst. Not only does this mindset allow compound interest to do most of the heavy lifting for you, but a higher savings rates, and thus slower lifestyle creep, is a great way to give yourself a margin of safety in case things don’t go as planned in life (and they never do).

The biggest problem is that it can be difficult for young people with little financial or market experience to have the guts to continue buying when things don’t look so good and markets are falling or going nowhere. That’s probably why one of the best financial decisions you can make early in your working life is to automate your investing contributions, increase the amount you save every year and then don’t look at your statements very often…

Disclosure: The original article, by Ben Carlson, was edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money