…The economy and stock market have been built on massive stimulus and liquidity from a rapidly expanding money supply. With M2 growth decelerating last month, the stock market looked in trouble. Now that it has become a contraction, the effect could be very profound. Words: 1034

This version of the original article from SchiffGold.com has been edited [ ] and abridged (…) to provide you with a faster and easier read. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

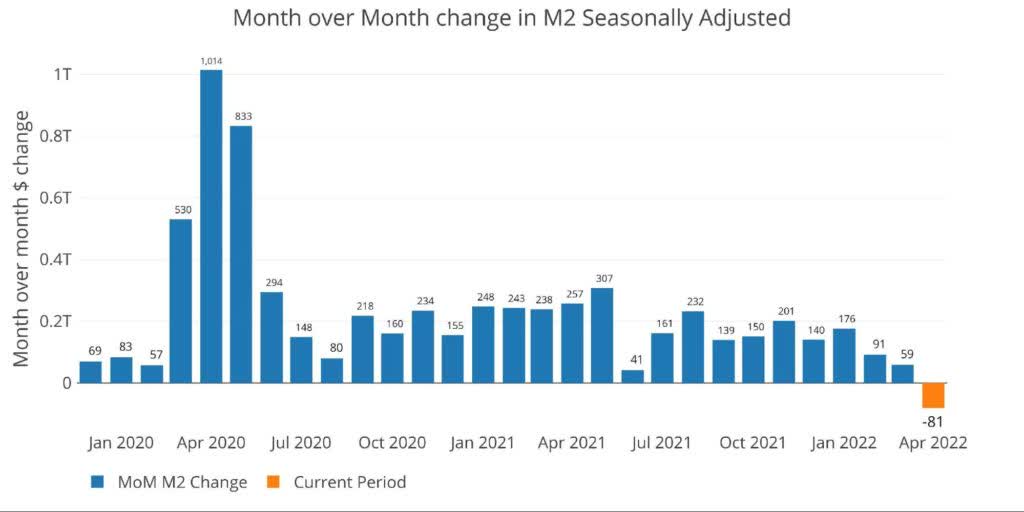

Month-over-month Change In Seasonally Adjusted M2

Figure: 1 MoM M2 Change (Seasonally Adjusted) (Author)

…The Fed must shrink the money supply to get inflation under control but even the small contraction illustrated above has resulted in a bear market for the Nasdaq, Russel 2000, and almost the S&P…[and were] the Fed to undo all the M2 growth it would be catastrophic.

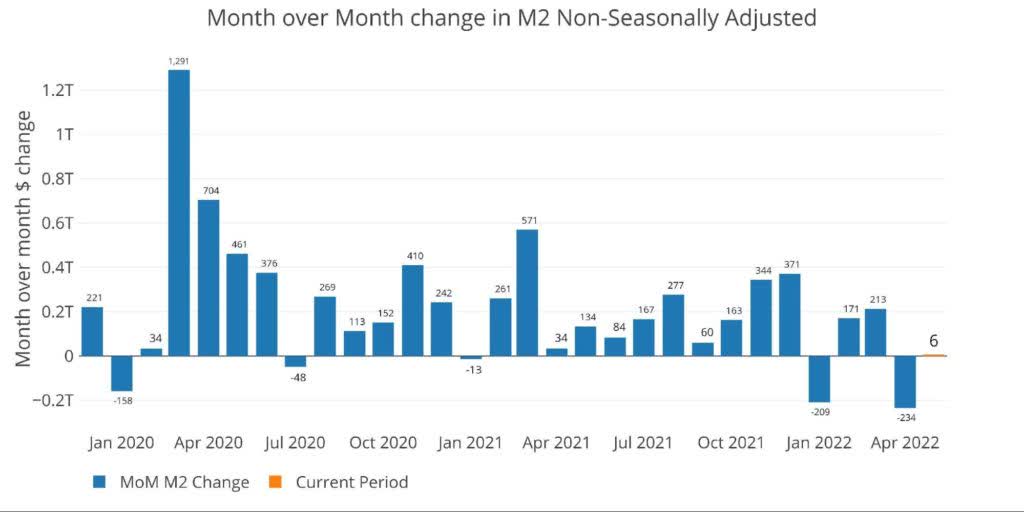

Non-seasonally Adjusted Money Supply

The chart below shows the non-seasonally adjusted money supply. The current slowdown can be seen very clearly when compared to the growth since COVID-19. The market is not used to this and hence everything is slowing.

Figure: 2 MoM M2 Change (Non-Seasonally Adjusted) (Author)

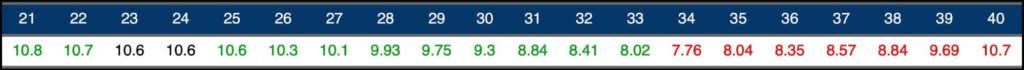

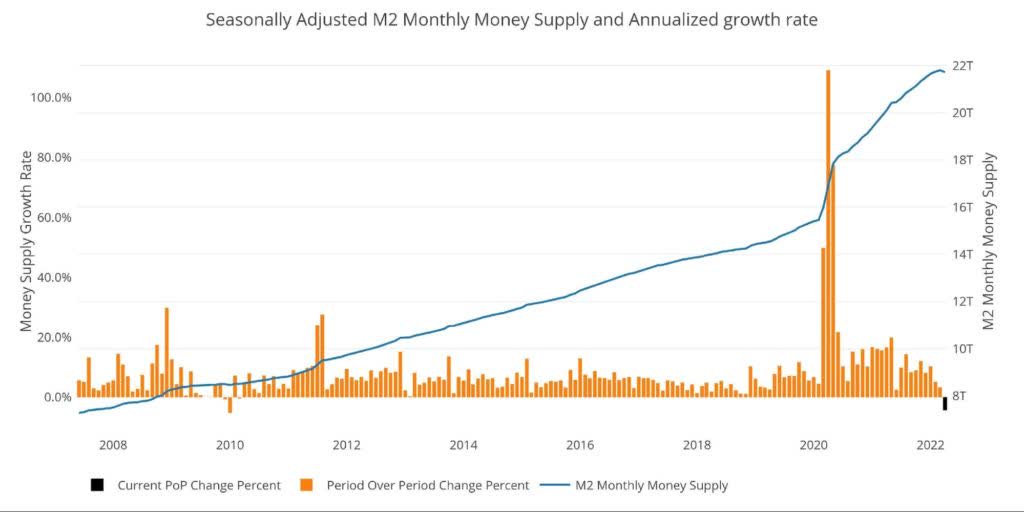

Growth of M2 Monthly Money Supply

The table below shows this slowdown more clearly. Over the past three years, M2 growth has averaged 14.3% annualized. In the past year, that has fallen to 8%, dipping to 5.6% over the last 6 months, and turning negative in the most recent month. This is a dramatic slowdown.

Figure: 3 M2 Growth Rates (Author)

M2 Monthly Money Supply Growth rate By Month

When looking at the average monthly growth rate by month before COVID-19, April historically expands at an annualized 5.4%. This compares to -4.4% for the current month.

Figure: 4 Average Monthly Growth Rates (Author)

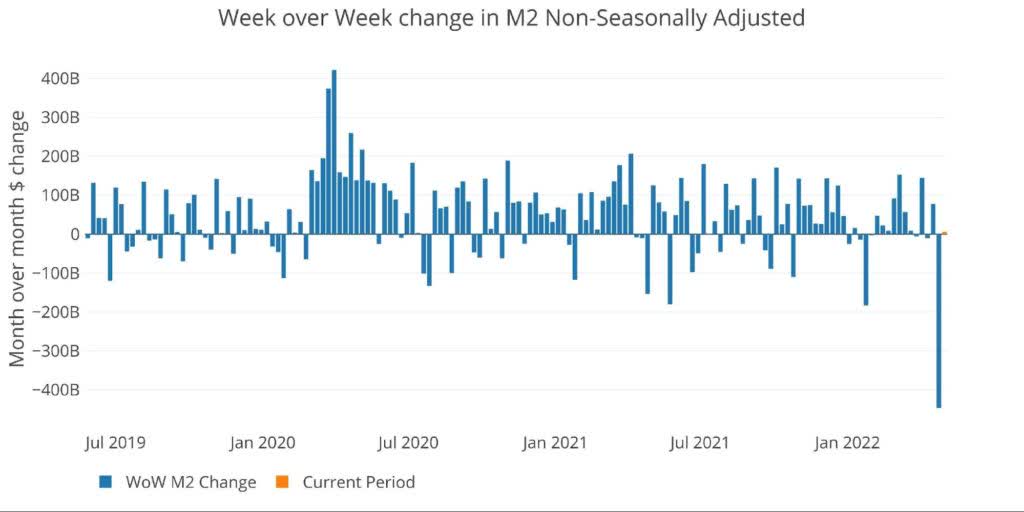

Week-over-Week Change in M2 (non-seasonally adjusted)

The Fed only offers weekly data that is not seasonally adjusted. The chart below shows how the week ending April 25th saw M2 drop by $446B! This is greater than the largest increase which occurred on March 30, 2020, when Money Supply grew by $421.7B.

Figure: 5 WoW M2 Change (Author)

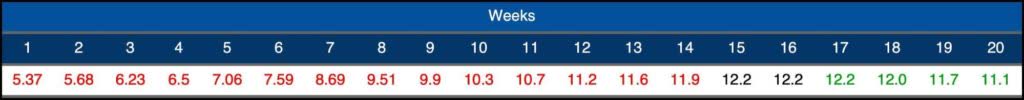

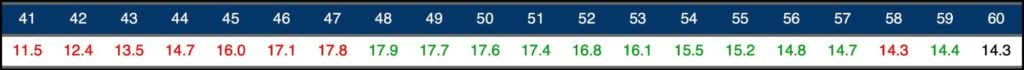

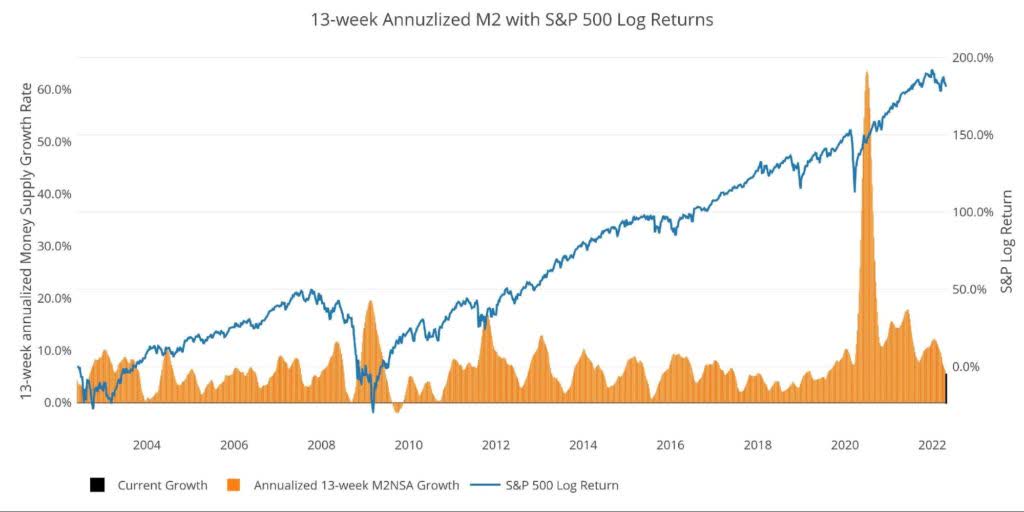

Trailing 13-week Money Supply Growth Rate

…The objective of the 13-week average is to smooth some of the choppy data without bringing in too much history that could blind someone from seeing what’s in front of them.

- The 13-week average growth rate can be seen in the table below. Decelerating trends are in red and accelerating trends in green.

- Money Supply growth on a 13-week annualized basis was mostly accelerating for 16 weeks in a row. It has now been flat or down for 16 weeks in a row.

- Growth has now reached 5.37% which is the lowest reading in more than 60 weeks.

Figure: 6 WoW Trailing 13-week Average Money Supply Growth (Author)

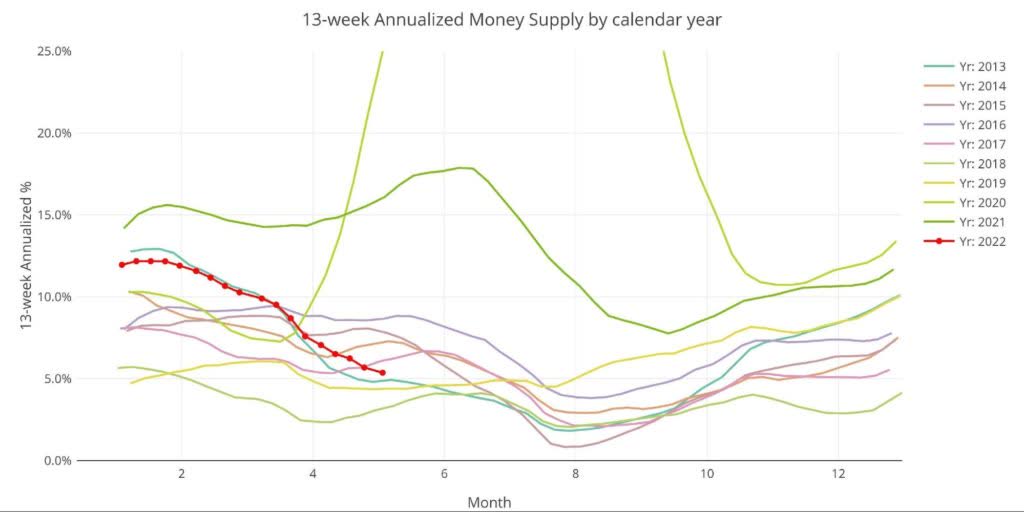

13-week Money Supply Growth Rate By Calendar Year

The plot below helps show the seasonality of the Money Supply and compares the current year to previous years. It shows the current trajectory moving down quite steeply. In the last two years, this has rebounded in April with stimulus, but the Fed is now tightening conditions which are pushing the growth rate even lower…

Figure: 7 Yearly 13-week Overlay (Author)

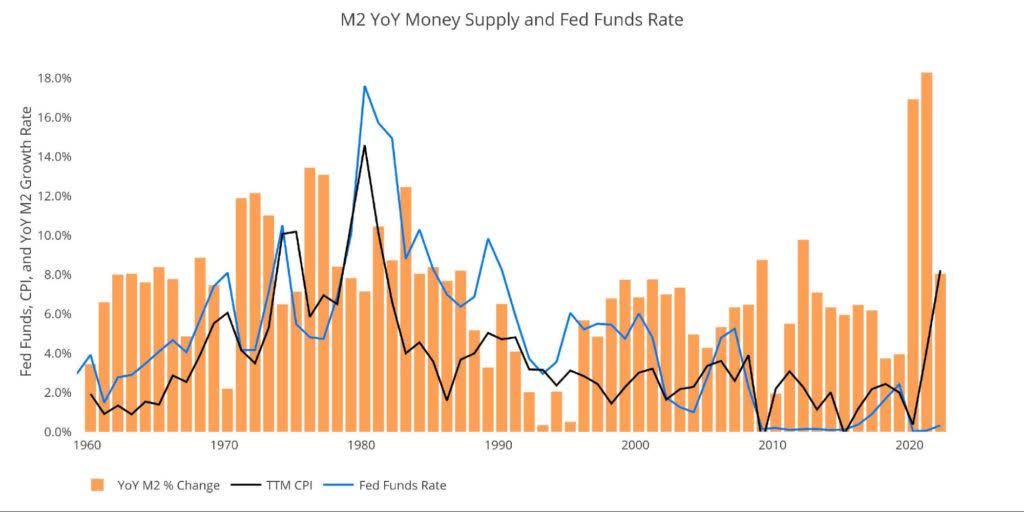

M2 YoY Money Supply and Fed Funds Rate

The problem is that this deceleration will not do enough to slow inflation but it will certainly be enough to crash the bubble. To combat rising prices, the Fed would need to undo all the money it has created over the last several years. This would require bringing interest rates above the rate of inflation. Unfortunately, the chart below shows that the Fed has never been further behind the inflation curve.

A recession on its own will not cure this inflation problem because of the lagged effects. Looking at the period of 1970, inflation always moved higher on a delay after significant expansion in the money supply. Price increases are still waiting to feel the full effects of all the M2 growth. Furthermore, history shows it required rates higher than inflation to bring prices back down.

Figure: 8 YoY M2 Change with CPI and Fed Funds (Author)

Historical Perspective

The chart below shows how the current contraction compares against more than 12 years of non-stop expansion. If one month of M2 contraction can cause this much pain, how much carnage would unfold in a prolonged fight against inflation where M2 had to shrink consistently for months?

Figure: 9 M2 with Growth Rate (Author)

Taking a historical look at the 13-week annualized average also shows the current predicament. This chart overlays the log return of the S&P…Large drops in Money Supply could be a sign of stock market pullbacks and the current value of 5.4% is the lowest value since July 2019…While not a perfect predictive tool, many of the dips in Money Supply precede market dips. Specifically, the major dips in 2002 and 2008 from 10% down to 0%.

The latest stock market pullback is further evidence of this relationship. Based on the chart below, history would indicate that the market pullback is just getting started…

Figure: 10 13-week M2 Annualized and S&P 500 (Author)

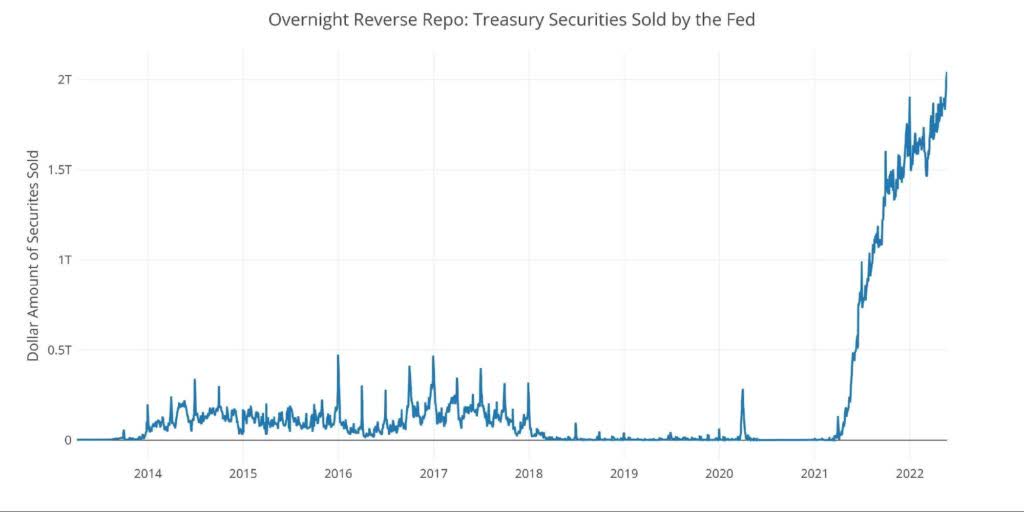

One other consideration is the massive liquidity buildup in the system. The Fed offers Reverse Repurchase Agreements (reverse repos). Essentially this is a tool that allows financial institutions to swap cash for instruments on the Fed balance sheet.

- Current Reverse Repo exceeded $2T on May 23 for the first time in history. This dwarfs the old records of ~$500B in 2016-2017 and quarter-end is still more than a month away when Repos tend to peak.

- This shows that even though M2 has contracted there are still trillions of dollars in liquidity sloshing around. How will prices drop with this much excess liquidity in the system?

Figure: 11 Fed Reverse Repurchase Agreements (Author)

What Does It Mean for Gold and Silver?

…The market has experienced a single month of contraction and it has ripped through financial markets but Money Supply growth rates do not typically bottom until August so, if the contraction in M2 continues for another 3 months, then it will bring nearly everything into a vicious bear market. The Fed cannot allow this to happen. The recent surge in tax revenues would most likely reverse, putting extraordinary strain on the Federal budget. Not to mention the massacre that would unfold in the stock and real estate market.

Expect the Fed to see 1-2 months of slightly lower inflation (though well above 2%), proclaim victory prematurely, and “rescue” the economy with more stimulus. This could be the moment where gold and silver take off and put $2000 and $30 well in the rearview mirror.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money