Today, institutional participation…in the gold market is minimal but, with interest rates near zero globally, we’re seeing signs that this is changing rapidly – and one you want to make sure you’re in front of.

The latest such news:…the Ohio Police and Fire Pension Fund, has announced it will allocate 5% of its (+$750M) assets to gold…and it’s the first major pension fund this year to publicly announce it has entered the gold market. That’s roughly 2.5% of ALL the new gold brought into circulation last year for investment – from one fund.

A couple things make this very interesting…

- This fund is only one of eight similar public pensions in that state alone so there’s a great deal of cash from these kinds of entities that could look at entering the gold market.

- This fund is a very traditional “money” manager so for them to enter the gold market signals a major shift.

- Pension funds are typically among the most conservative, long-term oriented investors, and don’t jump in and out of positions so this public move from a large mainstream fund is likely to spur other institutional investors to consider making an allocation to gold, too.

- This is a trend we expect will pick up steam, particularly in a ZIRP (Zero Interest Rate Policy) world.

One of the most supportive conditions for gold is a negative “real” interest rate (10-year Treasury rate minus the CPI). When real rates are zero or negative, like they are now, gold has historically performed very well. The Fed and other central bankers have essentially signaled that they don’t plan to change this policy anytime soon.

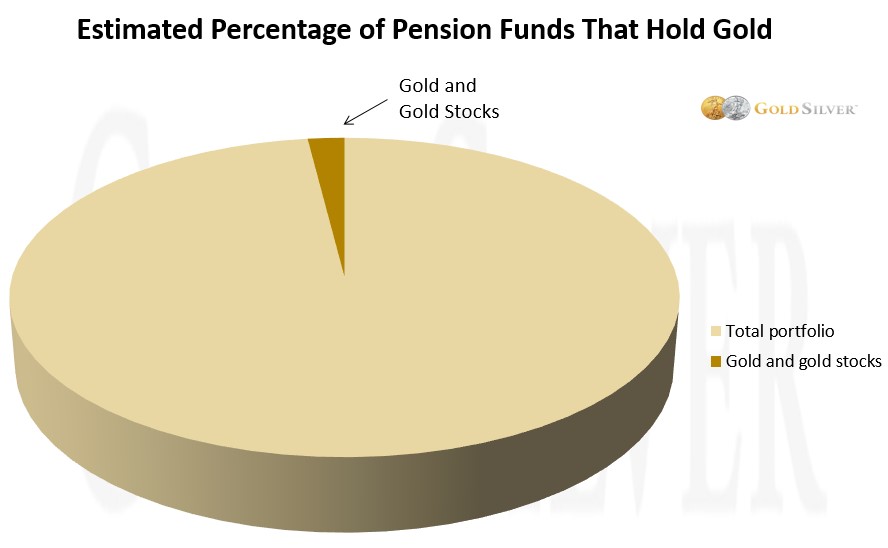

The compelling angle to all this is that most pension funds currently have zero direct exposure to gold. Estimates vary, but we’ve seen percentages from less than 1% to as high as 2%. That 2% figure looks like this.

In other words, the vast majority of pension funds have not yet bought any gold. We’re not implying that they all will, but clearly a lot more could – and likely will.

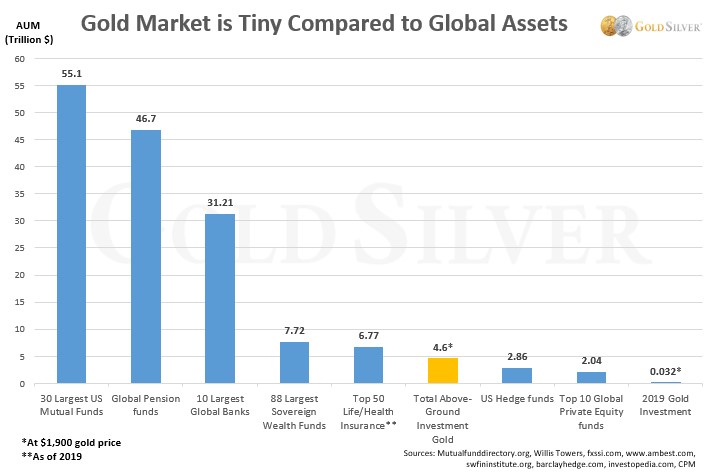

On a global basis, pension funds currently have assets…exceeding $46 trillion (second bar from left), which completely dwarfs the gold industry (middle gold bar).

Even the total value of all known above-ground gold (at $1900) is puny compared to the amount of…capital the wide array of institutional investors have at their disposal.

It appears clear that institutional investors are now starting to enter the gold market. This is a new trend in motion, one that could easily last years. It’s a catalyst in and of itself, and one you want to make sure you’re in front of.

Editor’s Note: The original article by Jeff Clark has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

Related Articles from the munKNEE Vault:

1. Pension Funds: Why $5,000 Gold May Be Too Low! (+2K Views)

You already know the basic reasons for owning gold — currency protection, inflation hedge, store of value, calamity insurance — many of which are becoming clichés even in mainstream articles. Throw in the supply and demand imbalance, and you’ve got the basic arguments for why one should hold gold for the foreseeable future. There is another driver of the price, however, that escapes many gold watchers and certainly the mainstream media and I’m convinced that once this sleeping giant wakes, it could ignite the gold market like nothing we’ve ever seen. [Let me explain.] Words: 788

2. Most Pension Fund Managers Shy Away From Gold – Guess Why (+2K Views)

As the unbacked Federal Reserve Note continues to be abused and devalued, it becomes clearer every day that pension funds should increase their precious metals holdings.

munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

If you want more articles like the one above sign up in the top right hand corner of this page and receive our FREE bi-weekly newsletter (see sample here).

munKNEE.com – ” The internet’s most unique site for financial articles! Here’s why“

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money