The munKNEE Conservative "Cannabis" Stocks Portfolio was UP 0.7% last week but was DOWN 3.1% in April (as of April 26th) and is now UP 4.1% YTD. In addition, the stocks in the Index now have an average dividend yield of 3.3%.

Read More »Should You “Sell In May & Go Away?”

As the end of April approaches, will 2023 be another year where the “Sell In May” strategy works? While no one knows the answer, historical statistics, current economic indicators, and technical measures suggest some caution is warranted.

Read More »Bitcoin Likely To Oscillate From $57-$77,000 Throughout Spring and Early Summer

the daily chart is currently bearish, indicating the continuation of the correction or consolidation in the short term. However, new lows below USD 60,760 are not yet foreseeable.... A volatile back-and-forth between approximately USD 61,000 and USD 67,000 could be sufficient to build a base and to then generate a new contrarian buying signal within a few days.

Read More »Invest In Gold the Easy Way – Here’s How

This user-friendly platform offers a seamless experience, allowing you to invest in gold as easily as you would any other digital asset.

Read More »Get Over It! Don’t Expect Gold Stocks to Outperform Gold

With the expectations by some that gold is on the verge of a big breakout on the upside, one might be lulled into thinking that such a move would boost mining shares out of their doldrums. That could happen; but, it is not something that is likely. Nor, is it something with historical precedent.

Read More »Bitcoin Significantly Outperforming Gold Assets

Whether the excitement surrounding Bitcoin is siphoning flows away from gold is unclear, but there does appear to be some disconnect between gold’s price action and investment levels. Historically, the gold price and holdings in gold-backed ETFs have traded in tandem, but starting in 2023, the two began to decouple,

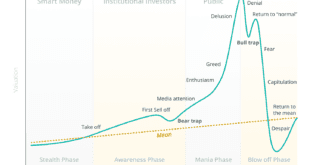

Read More »Bull Trend Continues: Are We In A Stock Market Bubble?

The bullish trend has remained firmly intact again this week, as the market tested the 20-DMA, the bottom of the trend channel, early in the week, which sparked buyers to push the index to all-time highs by the week’s end.

Read More »Bubble or Not Here’s How To Trade It

Whether you think the market is in a bubble or just forming a short-term top is mainly irrelevant but if you’re nearing retirement, or are a retiree, your investment horizon is shorter than that of much younger people it may be wise to consider the possibility.

Read More »Can the Super Bowl Winner Predict How Stocks Will Do This Year?

Some investors believe... the outcome of the Super Bowl could determine which direction the stock market will head. The thesis behind the Super Bowl stock indicator is this: If an AFC team [this year its the Kansas City Chiefs] wins the Super Bowl, a stock market decline or bear market can be expected by year-end. Conversely, if an NFC team [this year its the San Francisco 49ers] wins, it’s all roses ahead.

Read More »The Baltic Dry Index: Why You Should Use It and How to Do So (+3K Views)

The Baltic Dry Index is, in my opinion, the best leading economic indicator to follow when the media is telling us the economy is looking great one week and then predicting a double dip recession the next. Let me explain. Words: 933

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money