Some Background

…Bitcoin euphorically surged past all resistances, reaching a new all-time high of USD 73,794 on March 4th. a staggering +91% increase from the low on January 23rd in just seven weeks and an even more sensational increase of +376.7% within just thirteen and a half months from the low of USD 15,479 on November 22nd, 2022!

This version of the original article by Florian Grummes has been edited and abridged by the Managing Editor of munKNEE.com to ensure clarity and brevity for a fast and easy read.

Only since the new all-time high at USD 73,793 did we witness a significant pullback of -17.66% a week ago, reaching an initial low point at USD 60,760. While the rally has been slightly shaken as witnessed by a significant pullback of -17.66% a week ago, overarching sell-signals have not yet emerged. Rather, Bitcoin quickly recovered to around USD 68,250 and has recently been fluctuating around the USD 65,000 levels.

Bitcoin Halving

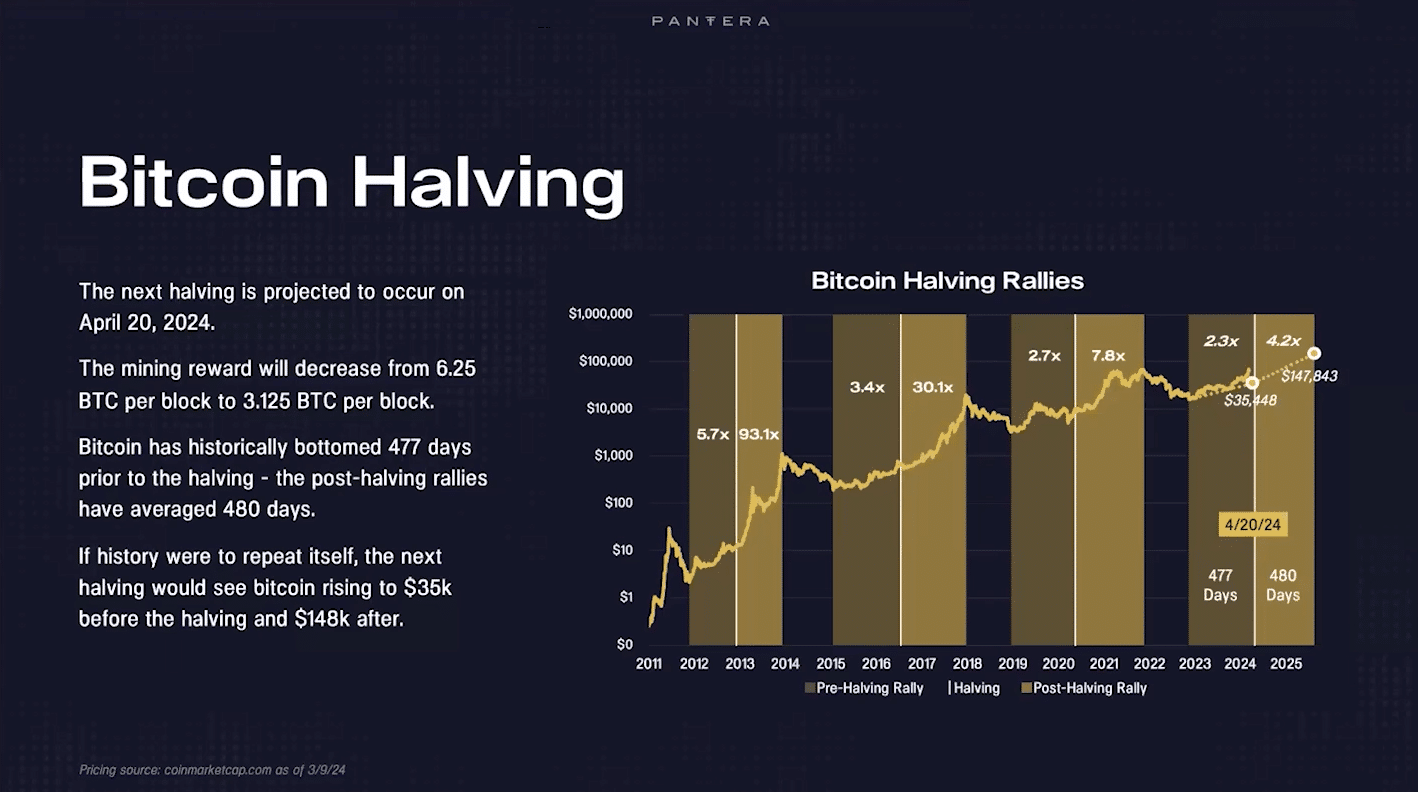

The next “halving,” expected to occur on April 15th, 2024, could potentially intensify buying pressure in the coming weeks. With mining reward automatically decreasing from 6.25 Bitcoin per block to only 3.125 Bitcoin per block, this reduction in supply is likely to have a medium-term impact on price discovery.

Immediately before and after the halving, however, Bitcoin tends to weaken for approximately 15 to 45 days. Considering that major financial institutions, with combined USD 36 trillion of assets under management, are just beginning to invest in digital assets and build Bitcoin allocations in client portfolios, the supply/demand balance may increasingly shift. Higher Bitcoin prices thus seem inevitable in the further course of the year.

However, in the short term, Bitcoin is approaching the “pre-halving danger zone,” during which, historically, pullbacks ranging from 20% to 40% have been observed 14 to 28 days before the halving. It is noteworthy that ETFs, likely due to consistent liquidations of positions in the Grayscale Bitcoin ETF, recently recorded a cumulative weekly outflow of approximately USD 94 million.

Summary

Overall, the daily chart is currently bearish, indicating the continuation of the correction or consolidation in the short term. However, new lows below USD 60,760 are not yet foreseeable…. A volatile back-and-forth between approximately USD 61,000 and USD 67,000 could be sufficient to build a base and to then generate a new contrarian buying signal within a few days.

…We suspect that Bitcoin will likely oscillate in a pretty volatile manner within the upper half of its uptrend channel between USD 57,000 and USD 77,000 throughout spring and early summer.

Conclusion

After the extreme rally of the past two months, Bitcoin has reached a short-term top at USD 73,793. There are increasing signs that this could be an important medium-term peak.

While the first test of support around USD 60,000 held up solidly, a second attempt is likely to break through to the downside. After all, the USD 60,000 mark represents only to the absolute minimum Fibonacci retracement (23.6%) of the entire rally from the lows of USD 15,479 in November 2022! Therefore, the bulls must avoid any approach to this round psychological level.

A more likely scenario would be a typical retracement to the 38.2% retracement level, which awaits around USD 51,500 USD and a still entirely normal pullback towards the 61.8% retracement could even lead Bitcoin back to approximately USD 38,000.

Of course, we must first wait to see how demand from ETFs will develop in conjunction with the “halving”. Furthermore, rapid spikes towards and above USD 70,000 are still possible at any time. However, we doubt whether the forces will be sufficient for significant new all-time highs above USD 75,000 to USD 77,000 by summer.

Bitcoin in USD, potential cup & handle-scenario, as of March 23rd, 2024. Source: Tradingview

If the correction or consolidation would unfold as a “cup & handle pattern”, the entire correction/consolidation process could take about three to nine months. This would result in a potential time projection towards September or October 2024 with a potential price target of USD 51,500 for the final low. Of course, this would be an outstanding buying opportunity before Bitcoin should head towards USD 100,000 and higher.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money