With the right batch of investments, you could still count on income from dividends no matter what the markets are doing. Here's how you can do that.

Read More »Social Security Alone Will NOT Be Enough To Live Comfortably In Retirement – Not By A Long Shot!

401(k)s, IRAs, and Social Security aren’t giving the average person enough to retire on anything close to a comfortable lifestyle as 80% of households have less than $100,000 in savings. That is not enough for even a minimal retirement.

Read More »Take This Retirement Income Literacy Quiz (only 26% scored 60% or more) and Learn How Knowledgeable You Are

Most people don’t have a clue about money, finance, economics, you name it. We are a nation of financial illiterates. Take this financial literacy quiz and see how knowledgeable you are.

Read More »The Right Asset Allocation Accounts For 100% Of Investment Performance

…Asset allocation…explains 100% of investment performance – yes, all of it. Accordingly, most of your time, energy and money should be spent on asset allocation…and a plan for asset allocation is called an investment policy. …Asset allocation are risk decisions designed to achieve objectives with an acceptable likelihood…This risk decision is called “risk willingness” or “risk necessity” and needs to be …

Read More »Your Retirement: What Happens If the Gov’t Doesn’t Get Its Act Together?

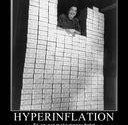

I recently discovered a video entitled 10 Myths About Government Debt that lays out several reasons why we are in real trouble. I encourage you to watch this 21 minute video. The most troubling assertion in the video is that our nation’s usual sources of loans are tapped out…[and that] the only source we have left is the Federal Reserve, which means …

Read More »Keep On Track: 3 Steps To Retirement

Saving for retirement is one of the smartest decisions you can make. Here are three steps you can take today that can keep you on track.

Read More »Average American Can’t Afford To Own A House – Here’s Why (+3K Views)

Regular home buyers are wondering why they are unable to partake in the American Dream of owning a home now that they actually have to document their income and put some skin in the game. The reason is that the current median selling price of $201,000 puts real estate out of reach for most Americans earning the typical $50,000 a year unless they go into massive levels of debt. They are too broke to own a home!

Read More »Understanding the Arithmetic of Wealth Is Critical to Increasing Your Wealth

The power of compounding: Use this knowledge to plot your road map to wealth.

Read More »The Noah Rule: Build An Ark For A Rainy Day

An alarming number of Americans aren’t saving for retirement. They may have “predicted the rain,” but for whatever reason they haven’t gotten around to “building the ark.”

Read More »Following “the 4% Rule” In Retirement Is Mostly Unnecessary – Here’s Why

If you’re planning for retirement, it won’t take long before you come across the 4% safe withdrawal rate which goes something like this:

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money