Italy is facing its greatest crisis in the postwar era. The country’s banking system is bankrupt, and no one in Europe is willing to fix it. As a result the euro could start to drift toward dollar parity as the situation in Europe goes from bad to worse.

Read More »“Crexit” Is Upon Us – Caution is Warranted

“Crexit:” a credit crunch brought about by plunging bond prices, soaring losses, an implosion in China’s high-risk debt markets, and a reversal of all the “yield chase” trades investors have flocked to in the last couple of years. That's what S&P's debt analysis team fears is about to unfold with the acceleration in corporate debt and That tells me there’s more going on beneath the surface – and that caution is still warranted when it comes to your investing strategy.

Read More »Bancopalypse 2.0 May Be Upon Us – Soon

The banking crisis of 2008 never fully healed. It just got shuffled under the carpet while the public was fed a phony narrative that everything was fantastic which turned out to be a gigantic farce; many of the world’s banking systems are just as risky as they were back in 2008.

Read More »Decline & Fall of Deutsche Bank Becoming Fast & Furious (2K Views)

It’s been almost 10 years in the making, but the fate of one of Europe’s most important financial institutions appears to be sealed. After a hard-hitting sequence of scandals, poor decisions, and unfortunate events, Frankfurt-based Deutsche Bank shares are now down -48% on the year to $12.60, which is a record-setting low. Even more stunning is the long-term view of the German institution’s downward spiral. With a modest $15.8 billion in market capitalization, shares of the 147-year-old company now trade for a paltry 8% of its peak price in May 2007. Today's infographic illustrates the timeline of the fall of one of Europe’s most iconic financial institutions.

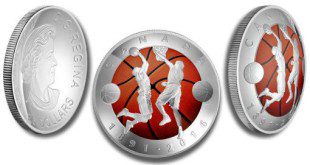

Read More »Basketball Fans Should Own This Uniquely Shaped 125 Year Anniversary Coin (+2K Views)

James Naismith of Almonte, Ontario invented basketball in 1891...to keep athletes active during the cold winter months while teaching physical education at the International Young Men’s Christian Training School in Springfield, Massachusetts. To celebrate that occasion, the Royal Canadian Mint is now selling a colourized coin with a convex reverse side to depict the likeness of a basketball.

Read More »Top Financial News Blogs (+4K Views)

Welcome to Wise Bread's rankings of the top financial news blogs.

Read More »Gallop Poll: Confidence In U.S. Banks Has Plunged Dramatically

According to a new Gallup poll, of all the major institutions that Americans come into contact with throughout their daily lives, the percent of people who say they have a "great deal" of confidence in banks has plunged more than any other institution since June 2006.

Read More »The Reality on Main Street Is As Clear As the Nose On Your Face!

The only reason that I can come up with that would have the Fed raise rates is that it wants to crash the markets. Why? Because Main Street is not doing well as the Price to Sales ratio chart below clearly shows. The Fed, and the markets, are stuck and those who are fully invested now will probably get creamed if a negative catalyst like Donald Trump becoming President happens, as he would surly cause instability and rock the government institutions.

Read More »The U.S. Dollar vs. Gold: Which Is the Best Store of Value? (+2K Views)

Have you ever heard the statement, perspective is everything? Well with money, it’s no different. Looking through the foggy lens of dollar money you will get a distorted and unclear vision of the world and its affairs. Walking through life with foggy dollar lenses could lead to a very bumpy ride. Looking through the lens of gold, however, will bring precision and clarity...

Read More »Going Cashless Is Snowballing Around the World

Love it or hate it, cash is playing an increasingly less important role in society. In some ways this is great news for consumers. The rise of mobile and electronic payments means faster, convenient, and more efficient purchases in most instances...However, there is also a darker side in the shift to a cashless society. Governments and central banks have a different rationale behind the elimination of cash transactions, and as a result, the so-called “war on cash” is on.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money