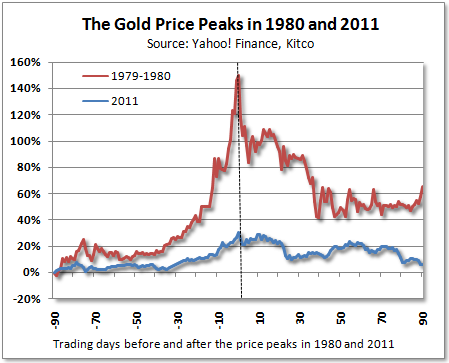

[Here is a summary of my]…thoughts on the 2011 gold price peak relative to the last time a long term bull market ended (back in 1980): Long-term bull markets almost always end with a bang, not a whimper, and last year’s price peak was clearly the latter. A 25% rise over a period of about two months last year [does not an] end-of-cycle, blow-off top [make]. No, I think there’s still some room to run for gold if for no other reason than that we haven’t even come close to the “mania” stage that characterizes the end of long-term market moves…[Let me explain further.] Words: 359; Charts: 1

the last time a long term bull market ended (back in 1980): Long-term bull markets almost always end with a bang, not a whimper, and last year’s price peak was clearly the latter. A 25% rise over a period of about two months last year [does not an] end-of-cycle, blow-off top [make]. No, I think there’s still some room to run for gold if for no other reason than that we haven’t even come close to the “mania” stage that characterizes the end of long-term market moves…[Let me explain further.] Words: 359; Charts: 1

So writes Tim Iacono (http://iaconoresearch.com) in edited excerpts from his original article* entitled That’s Not What The End Of The Gold Bull Market Would Look Like. (Original post)

This article is presented compliments of www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Iacono goes on to say, in part:

If the late-2011 peak of just over $1,920 a [troy] ounce [for gold] proves to… [have been] the highest the price of [that] the yellow metal will go for another 30 years or so, it certainly looks nothing like the prior secular peak. Long-term bull markets almost always end with a bang, not a whimper, and last year’s price peak was clearly the latter as shown below.

A 25% rise over a period of about two months last year [does not an] end-of-cycle, blow-off top [make]. No, I think there’s still some room to run for gold if for no other reason than that we haven’t even come close to the “mania” stage that characterizes the end of long-term market moves…

Holders of [gold, gold ETFs and gold stocks] should probably hang…[in there as]:

- Real interest rates remain in negative territory,

- Central banks continue to buy the metal in large quantities, and

- Investors around the world continue to lose confidence in both paper money and the policymakers that control it.

There [may well] have…been 12- or 13-year bull markets before that have ended like the blue curve in the graphic above, but I don’t know of any. That’s all the more reason to think that gold is still just getting warmed up for its main performance to come sometime in the next few years.

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- FREE

- The “best of the best” financial, economic and investment articles to be found on the internet

- An “edited excerpts” format to provide brevity & clarity to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you!

- Sign up HERE and begin receiving your newsletter starting tomorrow

- You can also “follow the munKNEE” on twitter & Facebook

*http://iaconoresearch.com/2012/12/18/thats-not-how-the-end-of-the-gold-bull-would-look/

Related Articles:

1. Gold’s Flirting With Its 200-day Moving Average: Now’s the Right Time to Buy Some – or More

While I know many of you are concerned about the recent sell offs in gold and silver – especially gold and silver stocks – I must strongly caution you not to join in the crowd of sellers. Instead, if you’ve been waiting for a time to add to, or to initiate, a precious metals position, this is exactly what you’ve been waiting for. [Let me explain why that is the case.] Words: 311; Charts: 1

3. BullionVault Has 43,000 Customers: Now They’ve Cut Their Fee By 37.5% So You Will Buy From Them Too!

7. What, Me Worry? Not When You Look at These Monthly Gold & Silver Charts

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money