Brexit is a return to inefficiency and trade wars and will spike inflation throughout the whole world. It will trigger a rise in unemployment mainly in Europe, but will also hurt the rest of the world through contagion. [Let me explain further.]

throughout the whole world. It will trigger a rise in unemployment mainly in Europe, but will also hurt the rest of the world through contagion. [Let me explain further.]

The comments above and below are excerpts from an article by Albert Sung (katchum.blogspot.ca) which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

1. Inflation to Rise

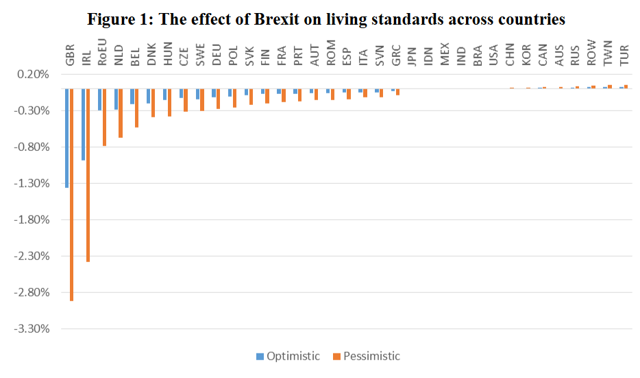

Incomes could drop 2.3% according to a report issued by the Centre for Economic Performance at the London School of Economics. Here is a graph on the effect of Brexit on the living standards of EU countries.

2. U.K. Real Estate Market to Tank

On top of that, the U.K. real estate market dropped 20% in one day. You will see a lot of money leaving this country and its real estate market. There are many reasons for this. Among one of those reasons is that a lot of people working in the U.K. are foreigners without a valid passport. For example, there are 850,000 Poles in the U.K., if they all were to leave the country, that would have a lot of implications. The economy would slow down, a lower population will inherently lower real estate prices.

a) Financial Sector

The U.K. could also witness a lot of job losses, especially in the banking sector. There is a so called passporting system which allows financial services operators, legally established in one Member State, to establish/provide their services in other Member States without further authorisation requirements. This was all part of the Financial Services Action Plan which was designed to open up a single market for financial services in the EU. Begun in 1999, it comprises 42 measures designed to harmonise the member states’ rules on securities, banking, insurance, mortgages, pensions and all other forms of financial transaction. It allowed Britain (as part of the EU) to export financial services worth more than £20bn, or 1.1% of GDP, to the EU. Now that the U.K. leaves the EU, banks like Goldman Sachs, Morgan Stanley, HSBC need to move their operations outside the EU…we are seeing huge consequences just in the financial sector alone already.

b) Auto Industry

Exports from EU countries to the U.K. will be affected, especially in the auto industry, due to the lower British pound (e.g. Peugeot, Renault dropped more than 20%).

4. Stock Prices to Continue Falling

The IMF predicts that the U.K. could lose 5.5% in GDP and this will trigger a recession. A lower GDP will lead to lower stock prices, so investors should pull their money out of the stock markets while they still can. This is not only about the U.K., we are living in a globalized economy and stock markets go up and down in tandem.

5. Brexit To Have Global Implications

Not only the U.S. and Europe will react to this referendum, but also Asia will be affected due to contagion. According to Nomura, the Asian countries that are highest correlated with the U.K. and Europe are: Australia, Hong Kong, Taiwan, Singapore, Japan, China, Korea and India. What is desirable in a low growth economy are bonds, so investors will be safer in those assets.

6. Increase in Calls for Referendums By Other EU Countries

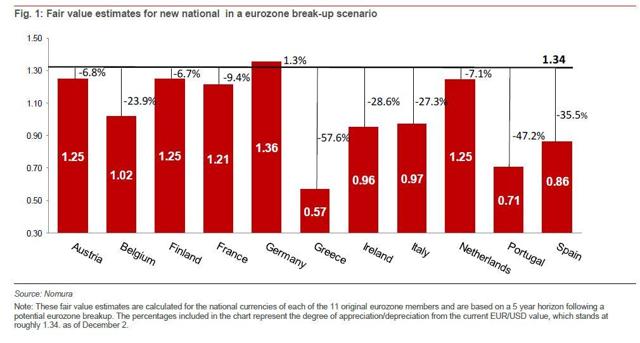

To make matters worse, some other countries like the Netherlands, Italy, France and Denmark all call for a referendum now. Nomura estimated the fair value of several currencies in the Eurozone a few years ago. What we see here is that a break-up of the Eurozone is ultimately bad for the currency of most of the countries in the Eurozone. Especially Greece, Italy, Spain, Ireland and Belgium are affected.

Conclusion

To make it short, Brexit is a return to inefficiency, trade wars and will spike inflation throughout the whole world. It will trigger a rise in unemployment mainly in Europe, but will also hurt the rest of the world through contagion. Stocks, real estate, currencies in the Eurozone are undesirable investments, while precious metals and bonds will do well.

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money