*http://srsroccoreport.com/physical-gold-investment-the-united-states-ranks-worst-in-the-world/physical-gold-investment-the-united-states-ranks-worst-in-the-world/ (© 2014 SRSrocco Report. All rights reserved.)

What would the optimal portfolio allocation in gold have been according to Modern Portfolio Theory over several different periods of time? This article has a look at how an investor could have combined gold and equities to enhance risk-adjusted returns. Read More »

2. The Merits of Using Gold as a Portfolio Diversifier

Although not perfect (nothing is), gold has a tendency to go up in the face of external shocks…[and] tends to have a low and sometimes negative correlation to US equities. As such, with stocks up, gold being down is not a terrible outcome for the investor using gold as a diversifier. Let me explain further below. Read More »

3. Physical Gold and Gold Stocks Should be in Your Portfolio – Here’s Why

Do you own enough gold and silver for what lies ahead? If 10% of your total investable assets (i.e., excluding equity in your primary residence) aren’t held in various forms of gold and silver, we…think your portfolio is at risk. Here’s why. Words: 625

4. Don’t Laugh – Invest At Least 65% of Your Portfolio In Precious Metals!

There is such a “fear of gold” amongst most people that it must be due to statist indoctrination and propaganda because it makes no rational sense to have such a fear of such a time tested and true store of wealth. After all, we are talking about time tested and true money – the only money that has lasted for thousands of years and is still fully accepted worldwide as a store of wealth….What would you rather hold “for eternity” gold [or] US dollars [which are nothing more than] a paper debt obligation of a bankrupt nation state? Words: 450

5. Your Portfolio Isn’t Adequately Diversified Without 7-15% in Precious Metals – Here’s Why

The traditional view of portfolio management is that three asset classes, stocks, bonds and cash, are sufficient to achieve diversification. This view is, quite simply, wrong because over the past 10 years gold, silver and platinum have singularly outperformed virtually all major widely accepted investment indexes. Precious metals should be considered an independent asset class and an allocation to precious metals, as the most uncorrelated asset group, is essential for proper portfolio diversification. [Let me explain.] Words: 2137

6. Protect Your Portfolio By Including 15% Gold Bullion – Here’s Why

We are reading a lot of hype these days about gold and the necessity to own it but only about 2% of ‘investors’ actually have gold in their portfolios and those that have done so have insufficient quantities to offset the future impact of inflation and to maximize their portfolio returns. New research, however, has determined a specific percentage to accomplish such objectives. Words: 1063

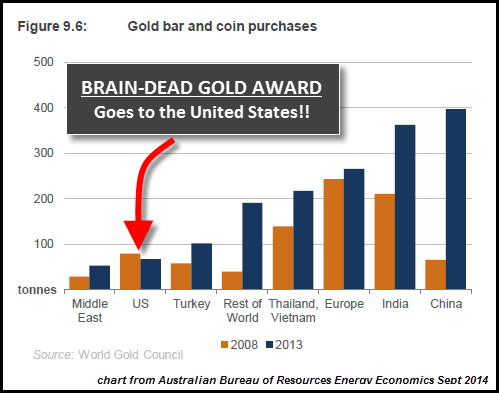

investors throughout the world have purchased physical gold in increasing volume. Everywhere, that is, except if you lived in the United States where the opposite was the case. Here’s why.

investors throughout the world have purchased physical gold in increasing volume. Everywhere, that is, except if you lived in the United States where the opposite was the case. Here’s why. munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money