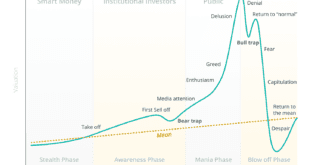

Ben Bernanke has created the mother of all bubbles. Today, the S&P 500 is sitting a full 30% above its 200-weekly moving average. We all know how bubbles end: BADLY, and this time will be no different. This is not doom and gloom, this is a fact. The Fed has created an even bigger bubble than the 2007 one!

full 30% above its 200-weekly moving average. We all know how bubbles end: BADLY, and this time will be no different. This is not doom and gloom, this is a fact. The Fed has created an even bigger bubble than the 2007 one!

So writes Graham Summers (http://gainspainscapital.com/) in edited excerpts from his latest free daily market commentary newsletter entitled An Epic Market Meltdown is Coming… Are You Prepared?

[The following article is presented by Lorimer Wilson, editor of www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Summers goes on to say in further edited excerpts:

Conclusion

The time to prepare for this is not once the collapse begins, but NOW, while stocks are still rallying. Stocks take their time moving up, but when they crash it happens VERY quickly.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*For a more extended version go to: http://gainspainscapital.com/2013/07/12/bernanks-bluff-and-the-coming-crash/ (Sign up to receive our daily market commentary. Send an email to: publishing@gainspainscapital.com)

Related Articles:

1. A Stock Market Crash Followed This Occurrence In 1929, 2000 & 2007 – It’s Happening Again!

What do 1929, 2000 and 2007 all have in common? Those were all years in which we saw a dramatic spike in margin debt. In all three instances, investors became highly leveraged in order to “take advantage” of a soaring stock market but, of course, we all know what happened each time. The spike in margin debt was rapidly followed by a horrifying stock market crash. Well guess what? It is happening again. Read More »

Over the past 6 years, when the yield on high yield bonds (junk bonds) broke above resistance of bullish falling wedges, the S&P 500 ended up declining between 17% & 50%. Will it be different this time? Read More »

There are many, many different takes on why the stock market has been ripe for a fall and why it has finally happened. Below are 30 of the best-of-the-best such analyses to help you come to some sort of resolution. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money