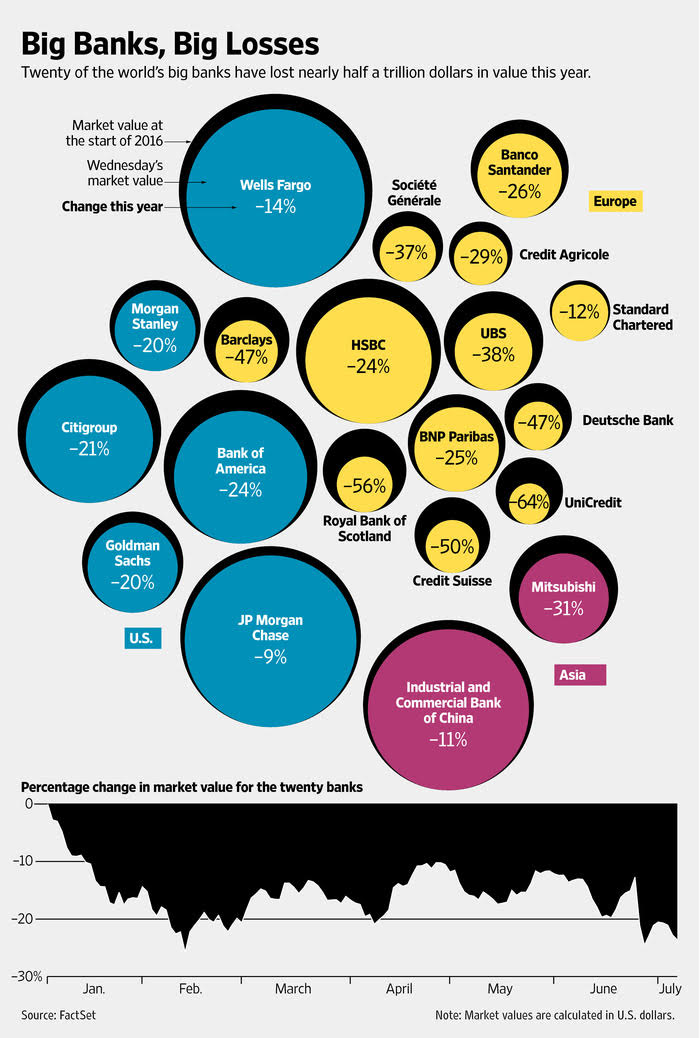

Well-capitalized banks are supposed to have double-digit capital levels while making low risk  investments. Deutsche Bank, on the other hand, has a capital level of less that 3% (just like Lehman), and an incredibly risky asset base that boasts notional derivatives exposure of more than $70 trillion, roughly the size of world GDP. Even the IMF has stated unequivocally that Deutsche Bank poses the greatest risk to global financial stability and the IMF would be right – except that most of the other banks major banks in the world are no better off – see chart below.

investments. Deutsche Bank, on the other hand, has a capital level of less that 3% (just like Lehman), and an incredibly risky asset base that boasts notional derivatives exposure of more than $70 trillion, roughly the size of world GDP. Even the IMF has stated unequivocally that Deutsche Bank poses the greatest risk to global financial stability and the IMF would be right – except that most of the other banks major banks in the world are no better off – see chart below.

The comments above and below are excerpts from an article by Simon Black (SovereignMan.com which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

Deutsche Bank, currently one of the largest banks in the world, has seen a lot in its years [since being established in 1870]; multiple world wars, the devastation of Europe, hyperinflation in the Weimar Republic, Nazi Germany…but, as the world learned in 2008, when the 158-year old investment bank Lehman Brothers went bust, even giant, centuries-old financial institutions can collapse…

One of the major issues in the 2008 crisis was that banks were over-leveraged and had very thin levels of capital. In other words, the banks’ rainy-day reserve funds as a percentage of their overall balance sheets were extremely low, so even a small loss in their investment portfolios would cause financial Armageddon. That’s precisely what happened. Lehman Brothers famously had a capital ratio of less than 3% of its assets so, when the value of its assets fell by more than 3%, the bank was finished.

Well-capitalized banks are supposed to have double-digit capital levels while making low risk investments. Deutsche Bank, on the other hand, has a capital level of less that 3% (just like Lehman), and an incredibly risky asset base that boasts notional derivatives exposure of more than $70 trillion, roughly the size of world GDP. Even the IMF has stated unequivocally that Deutsche Bank poses the greatest risk to global financial stability and the IMF would be right – except for all the other banks.

- In Italy, nearly the entire Italian banking system is rapidly sliding into insolvency. Italian banks are sitting on over 360 billion euros in bad loans right now and are in desperate need of a massive bailout. IMF calculations show that Italian banks’ capital levels are among the lowest in the world, just ahead of Bangladesh, and this doesn’t even scratch the surface of problems in other banking jurisdictions.

- Spanish banks have been scrambling to raise billions in capital to cover persistent losses that still haven’t healed from the last crisis.

- In Greece, over 35% of all loans in the banking system are classified as “non-performing”. This is astounding. But what’s even more incredible is that the ratio of non-performing loans has actually been increasing for several years since the country’s supposed bailout.

- Banks in Cyprus and Portugal are hemorrhaging cash and reporting widespread losses.

Banks’ stock prices across the region have practically collapsed in recent weeks as investors have started to realize that Bancopalypse 2.0 may be upon us. (Oh, and lest anyone think that the United States is a banking safe haven, it’s worth noting that the non-performing commercial loan ratio in the US banking system has tripled in 18-months… but we’ll save that for another time.)

Source: WSJ

Here’s the bottom line: the banking crisis of 2008 never fully healed. It just got shuffled under the carpet while the public was fed a phony narrative that everything was fantastic…[which] turned out to be a gigantic farce; many of the world’s banking systems are just as risky as they were back in 2008.

Do yourself a favor: don’t keep 100% of your savings trapped in a risky banking system. What’s the point? They’re only paying you 0.1% anyhow. Why take on so much risk?

If you have savings of even more than $10,000 (and definitely if you’re in the six to seven figure range), move some funds to a stronger, better capitalized banking system abroad, and definitely consider owning precious metals, plus holding at least a month’s worth of expenses in physical cash in a safe at your home. Given how low interest rates are, you won’t be any worse off but should Bancopalypse 2.0 be upon us, cash and gold could end up being a phenomenal insurance policy.

Until tomorrow,

Simon Black, Founder, SovereignMan.com

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

Related Articles from the munKNEE Vault:

1. Decline & Fall of Deutsche Bank Becoming Fast & Furious

It’s been almost 10 years in the making, but the fate of one of Europe’s most important financial institutions appears to be sealed. After a hard-hitting sequence of scandals, poor decisions, and unfortunate events, Frankfurt-based Deutsche Bank shares are now down -48% on the year to $12.60, which is a record-setting low. Even more stunning is the long-term view of the German institution’s downward spiral. With a modest $15.8 billion in market capitalization, shares of the 147-year-old company now trade for a paltry 8% of its peak price in May 2007. Today’s infographic illustrates the timeline of the fall of one of Europe’s most iconic financial institutions.

2. Central Bank Bubble Will Burst and Result In A Recession & Bear Market

The unwinding of the “Central Bank Bubble” will be worse than either the Dot.Com Bubble or the Housing Bubble. It seems like most investors continue to show apathy even with the warnings by us and quite a few others of the “unintended consequences” of the central banks doing things that have never been done before. Those investors are in good company because it appears to us that the leaders of the major central banks of the world do not have any idea of the “unintended consequences” either.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money