Many lessons can be gleaned from history and, while no two periods are identically alike, there are often many similarities to learn from. The current period, for example, is often compared to the Great Depression in regards to unprecedented government action as well as with the 1970s in regards to trends in commodities and inflation. [Let's take a closer look.] Words: 1165

Read More »Why Hyperinflation is Not Likely – Let Alone Imminent (+2K Views)

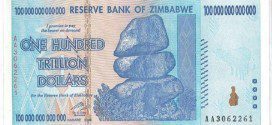

The National Inflation Association (NIA) has just posted an article* which makes a number of interesting arguments for the advent of hyperinflation and, while I agree with the conclusion that we could potentially face such an event, I see it as just one of a few possible outcomes. Let me comment on the specific points in the NIA article. Words: 1666

Read More »Pew Research: Support for bin Laden Had Declined but Remains Constant for al Qaeda

In the months leading up to Osama bin Laden’s death a survey of Muslim publics around the world found little support for the al Qaeda leader. [That being said, over 20% of Muslims in several of the countries surveyed still had favorable views of al Qaeda itself. Let's take a closer look at what the survet results conveyed.] Words: 502

Read More »GOLDRUNNER: Gold on Track to Reach $1860 – $1920 by Mid-year (+8K Views)

The Golden Parabola is continuing to follow the cycle of the 70’s Gold Bull as the U.S. Dollar is further devalued against Gold to balance the budget of the United States at this point in the “paper currency cycle” where Global Competitive Currency Devaluations rule. As discussed in a recent editorial this point in the cycle suggests that Gold will soon enter into a more aggressive higher rise in price to $1,860 - $1,920 per ozt. as it starts to project the higher Vth Wave characteristics of this new Golden Parabola. Let me explain. Words: 1403

Read More »How to "Play" a Parabolic Move in Silver (+2K Views)

In order to successfully identify bubbles and profit from them, one needs to know the tipping point at which a bubble [in this case a silver bubble] is unsustainable and begins to breakdown...This article focuses on just one of a myriad of factors that determine when a bubble may pop - momentum - and addresses what trading strategies may be suited to the situation. [Let me go on.] Words: 1475

Read More »Goldrunner: “$52 to $56 Silver by Mid-year” Update

Back on February 18th I wrote an editorial showing that Silver could rocket up to $52 to $56 by mid-year. At the time of the writing Silver was sitting a little above $32 on the price chart. The original chart work was based off of the fractal chart work I do with Silver from previous fractal time periods. So far the rise in Silver appears to be right on track for our expected targets to be approached into mid-year. [Let me review the details with you.] Words: 1069

Read More »$300 Silver is Beginning to Look Conservative! Here's Why

The price ratio of gold versus silver has been dropping in the last couple of years in favor of the white precious metal. At the moment, the gold/silver ratio is trading below the ”crucial” bandwidth of 40-to-50, currently hovering around 38x... [which] marks the beginning of a new phase in the bull cycle. The gold/silver ratio could finally be on its way to our target of 16x, the historical bottom in the last century. [Let me explain why I think that may well be the case.] Words: 580

Read More »We Have Fallen Head First Into An Economic Abyss! Here's Why

While the [financial] events of the past few months have not been a surprise [to many I can just imagine how shocking they must be,] however, for those just waking up to the ongoing implosion of our fiscal infrastructure, the bubbling inflationary meltdown just over the horizon, the nightmare unfolding around our national debt... With gasoline nearing $5 a gallon, grain prices doubling, and shelf prices beginning to skyrocket, it’s hard for even the most ignorant suburban schlep to remain oblivious to the problem anymore. We are no longer on the edge of the abyss; we have fallen into it head first… [Let me explain.] Words: 2311

Read More »How Best to Invest Based on 3 Potential Economic Scenarios (+2K Views)

Inflation is the big ‘sword of Damocles´ hanging over our heads and the higher interest rates that may arrive with it over time. We believe that one of three scenarios is probable in the months and years ahead and in this article we provide a summary of these scenarios and give a brief glimpse into the respective investments/asset classes that we consider most suitable in each scenario. Words: 1331

Read More »A Hyperinflationary Great Depression Is Coming to America! Here’s Why (+7K Views)

As the advance squalls from this great financial tempest come ashore, the government could be expected to launch a variety of efforts at forestalling the hyperinflation’s landfall, but such efforts will buy little time and ultimately will fail in preventing the dollar’s collapse.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money