Historically, junior mining stocks tend to fluctuate between extreme boom and bust cycles and, given that we just completed a major bust cycle, the setup for a major rally in gold stocks is right in front of us. Those with the courage to buy low, and the discipline to sell during a frenzy, could quite possibly realize 10-bagger or even 100-bagger returns that could be worth a million dollars or more. Hold on to your hat!

Read More »U.S. National Debt At New High; The Consequences Will Be Severe

Debt isn’t without consequences - and the consequences will be severe when the chickens come home to roost.

Read More »History Says: “Rising Interest Rates Might Trigger A Depression!”

The Fed’s current raising of interest rates could trigger a credit collapse, ushering in deflation and a New Great Depression.

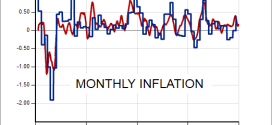

Read More »Inflation: What Exactly Is It? What Causes It? How is It Measured? (+3K Views)

Exactly what is inflation, and how do we measure it? It is very important to investors, savers, and people in general, that we understand.

Read More »12 Tips to Effectively Manage Your Credit Card Debt

If you're like most people, you probably have a credit card and, if you're like most people, you also have some amount of credit card debt. Below, debt relief experts Creditfix have shared some of their top tips on how you can tackle your credit card debt more effectively.

Read More »Assessments of Powell’s Favorite Indicators Say…

Powell has three jobs at the Federal Reserve: Ensure the US Treasury market functions; Price stability and Employment. [Below is my assessment of how each is evolving and what we can expect from the Fed over the next 3 to 6 months and the effect on the U.S. economy.]

Read More »Top 10 Videos For Week (+2K Views)

Lyn Alden: The economy is crashing into stagflation... Edward Dowd: CV19 vax deadliest fraud in history … Jim Rickards : New kind of globalization is coming … Stanley Druckenmiller: The bubble has burst with a vengeance … and more.

Read More »Debt Clocks of U.S., U.K., Canada, Australia & Rest of World (+5K Views)

A BIS study warns that budgets of most advanced economies, excluding interest payments, "would need 20 consecutive years of surpluses exceeding 2 per cent of gross domestic product – starting now – just to bring the debt-to-GDP ratio back to its pre-crisis level".

Read More »The Collapse of the U.S. Dollar is Unavoidable! Here’s Why (+6K Views)

The mother of all collapses is still in front of us. Below are my reasons why that is the case and how to protect yourself financially from such an eventuality.

Read More »Coming Currency Superstorm Will Be Absolutely Catastrophic for U.S. Economy (+5K Views)

What would happen if someday the rest of the world decides to reject the U.S. dollar and that process suddenly reversed and a tsunami of U.S. dollars come flooding back to this country? It is frightening to think about. Just take a moment and think of the worst superstorm that you can possibly imagine, and then replace every drop of rain with a dollar bill. The giant currency superstorm that will eventually hit this nation will be far worse than that.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money