A report by Oxford Economics has concluded that silver’s return characteristics are sufficiently different from gold to make it a valuable diversification tool that deserves its own portfolio commitment.

Read More »Prepare & Prosper – Gold Equities Could Experience +1000% Returns Once Again! (+4K Views)

We are in the eye of the storm and when the other side of the vortex engulfs us gold and silver will increase considerably, their associated stocks will go up substantially and their warrants, where available, will escalate dramatically. With what has happened in the world of late and what will be unfolding in the next 5 years or so those few investors who fully understand the impact the current economic situation is going to have on future inflation, the USD, interest rates, the stock market, physical gold and silver and gold and silver stocks and warrants in particular are going to be in the unique position of being the benefactors of currently unimaginable returns and wealth. All they need do, as I like to say, is “Just prepare and prosper!” Words: 918

Read More »The Largest Buyers & Sellers Of Gold In Past 20 Years

Today's infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Read More »Is A New Commodity Supercycle Already Up and Running?

A “commodity supercycle” is commonly described as a period of consistent and sustained price increases lasting more than five years, and in some cases, decades...Supercycles occur because of the long lag between commodity price signals and changes in supply. While each commodity is different, the following is a rundown of a typical boom-bust cycle:

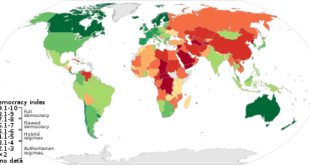

Read More »Shift From U.S. Dollar As World Reserve Currency Underway (+93K Views)

Today, more than 60% of all foreign currency reserves in the world are in U.S. dollars - but there are big changes on the horizon...Some of the biggest economies on earth have been making agreements with each other to move away from using the U.S. dollar in international trade...[and this shift] is going to have massive implications for the U.S. economy. [Let me explain what is underway.] Words: 1583

Read More »Pros & Cons of Buying Gold Bars vs. Ingots vs. Coins (35K Views)

It is now easier for you to convert your savings into gold than ever before and this article outlines the reason for buying physical gold and the advantages and disadvantages of buying gold bars, ingots and/or coins. Read on!

Read More »International Comparison of Retirement Ages

At what age does the average person retire in high-income countries? How long is the average period of retirement? The OECD collects this information. Here's a trimmed down table with a selection of countries.

Read More »A Ranking Of America’s Trading Partners

Given that the U.S. has trade relations with more than 200 countries, regions, and territories, the infographic in this article makes trade relationships easier to understand, ranking the biggest trading partners of the U.S. in terms of goods trade alongside the value of exports and imports.

Read More »A Comparison of Living Costs By City Worldwide

This article presents the Cost of Living Index by City Worldwide for 2023. These indices are historical and they are published periodically. It's a snapshot of the current indices at a specific point in time.

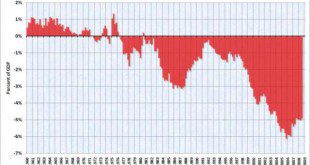

Read More »How Does Silver Perform During (and after) A Recession? You’ll Be VERY Surprised! (+23K Views)

If you are buying silver because you expect a recession will take its price higher, you are skating on thin ice. The expectation is fundamentally flawed and there is nothing historically to support the expectation for higher silver prices during recessions.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money